- What is an Exchange Traded Funds?

- How Exchange Traded Funds Work

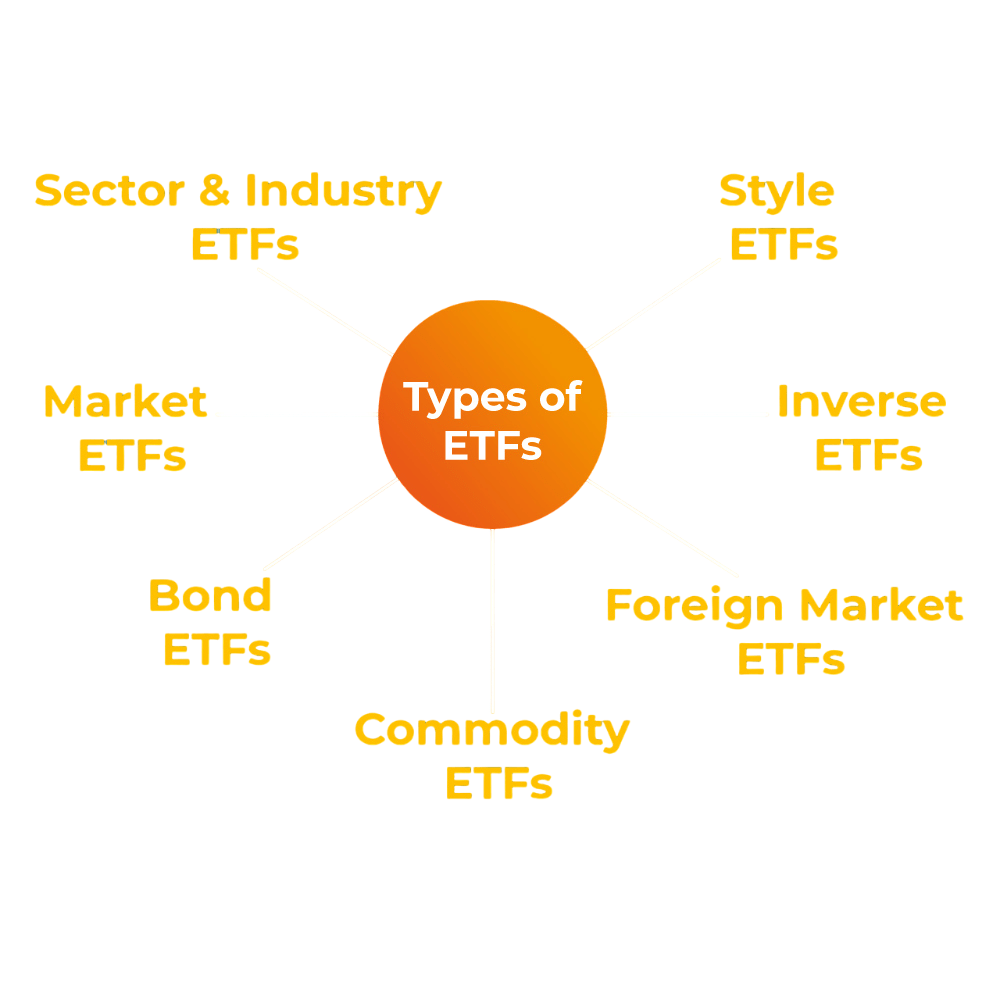

- Types of ETFs

- Liquidity and Pricing

- Cost Structure and Taxation

- How to Invest in ETFs

- ETF Trading Strategies

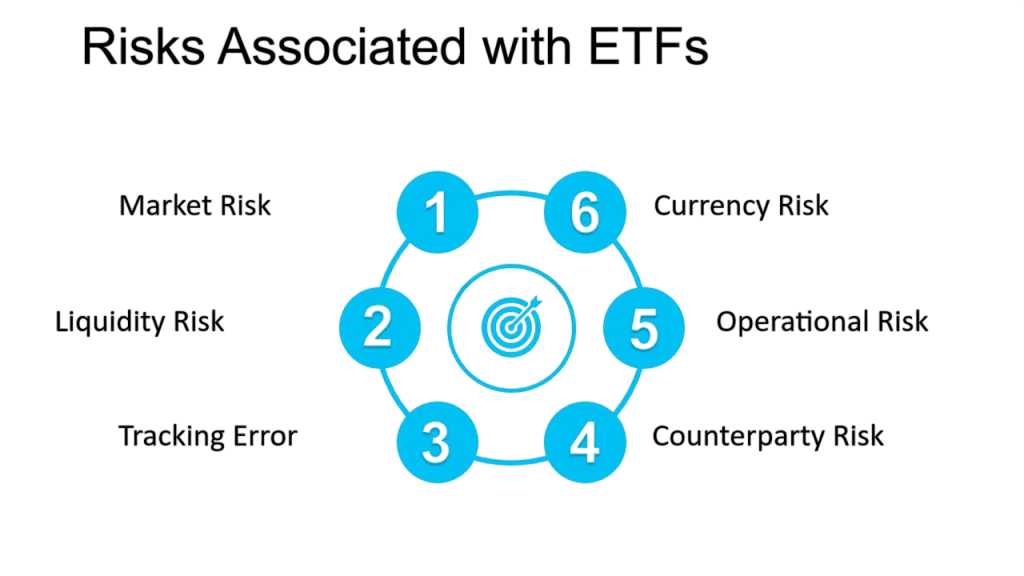

- Risks Involved

- Global Exchange Traded Funds Market

- Popular ETFs in India

- Conclusion

What is an ETF?

Exchange-Traded Funds (ETFs) have revolutionized the investment landscape by offering an accessible, flexible, and cost-effective way for investors to gain exposure to a diversified portfolio. This guide will walk you through what Exchange Traded Funds are, how they work, their types, costs, etf trading strategies, risks, and much more, with a special focus on India and the global market. An Exchange-Traded Fund (ETF) is a type of investment fund that holds a basket of assets such as stocks, bonds, commodities, or a mix and trades on stock exchanges, similar to individual stocks. Exchange Traded Funds provide investors with diversification, liquidity, and the ability to buy and sell shares throughout the trading day at market prices. Unlike mutual funds that price once a day after market close, ETFs offer real-time pricing and intraday trading. They combine the diversification benefits of mutual funds with the flexibility of stock trading.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

How ETFs Work

ETFs are structured as open-ended funds or unit investment trusts. Here’s a simplified look at how they operate:

- Creation and Redemption Mechanism: Authorized Participants (APs), usually large financial institutions, create ETF shares by delivering the underlying assets to the fund in exchange for ETF shares (creation). Conversely, they can redeem ETF shares by returning them to the fund and receiving the underlying assets (redemption). This mechanism keeps the ETF’s market price close to its Net Asset Value (NAV).

- Basket of Securities: The ETF holds a portfolio that tracks an underlying index, sector, or commodity. For example, a Nifty 50 ETF holds the 50 stocks comprising the Nifty 50 index in the same proportions.

- Trading on Exchange: Investors can buy or sell ETF shares on stock exchanges throughout the trading day at prevailing market prices.

- Market Makers: They provide liquidity by continuously quoting buy and sell prices, ensuring smooth trading of ETF shares.

Role of Financial Markets in Economic Development

Financial markets play a pivotal role in fostering economic development by:

- Efficient Capital Allocation: By channeling funds from savers to productive uses, markets ensure that capital is deployed where it generates the highest returns.

- Liquidity Provision: Markets provide liquidity, allowing investors to convert assets into cash easily, increasing the attractiveness of investment.

- Price Discovery: Through the forces of supply and demand, financial markets determine the fair prices of securities, reflecting all available information.

- Risk Management: Derivatives and insurance markets enable individuals and firms to hedge against various risks.

- Promoting Savings and Investment: Attractive financial markets incentivize savings and investment, vital for long-term economic growth.

- Facilitating Corporate Governance: Listed companies in stock exchanges are subject to regulatory oversight, promoting transparency and accountability.

- Equity ETFs: Track stock indices such as the Nifty 50, Sensex, or S&P 500. They provide exposure to equity markets.

- Bond ETFs: Invest in government or corporate bonds. Provide fixed income exposure with liquidity benefits.

- Commodity ETFs: Track commodities like gold, silver, oil. Example: Gold ETFs backed by physical gold.

- Sectoral ETFs: Focus on specific sectors such as banking, IT, healthcare.

- Thematic ETFs: Invest in specific themes like clean energy, technology innovation, or ESG (Environmental, Social, Governance).

- International ETFs: Offer exposure to foreign markets, e.g., US, Europe, emerging markets.

- Inverse and Leveraged ETFs: Designed for sophisticated investors; inverse ETFs aim to profit from market declines, leveraged ETFs amplify returns using derivatives.

- Actively Managed ETFs: Unlike traditional ETFs tracking indices, these are managed by fund managers aiming to outperform benchmarks.

- Primary Market Liquidity: Created and redeemed by authorized participants in large blocks (creation units).

- Secondary Market Liquidity: Investors buying/selling ETF shares on exchanges.

- Buy and Hold: Long-term investors often buy ETFs that track broad indices or sectors and hold them to capture market growth with diversification.

- Dollar-Cost Averaging: Investing fixed amounts regularly regardless of market conditions to reduce timing risk.

- Tactical Asset Allocation: Adjust ETF holdings based on market outlook or economic cycles to capitalize on opportunities.

- Sector Rotation: Shifting investments between sector ETFs to benefit from sector-specific growth.

- Hedging and Short-Term Trading: Using inverse or leveraged ETFs for hedging or speculative trading in volatile markets.

- Market Risk: ETF value fluctuates with market prices of underlying assets.

- Tracking Error: ETF may not perfectly replicate the benchmark’s performance.

- Liquidity Risk: Some niche or thinly traded ETFs may have limited liquidity.

- Counterparty Risk: In synthetic ETFs that use derivatives, risk arises from counterparties.

- Sector/Theme Risk: Concentrated ETFs expose investors to sector-specific downturns.

- Regulatory Risk: Changes in regulations can impact ETF structure or taxation.

- Currency Risk: For international ETFs, fluctuations in currency can affect returns.

- Nifty 50 ETFs: Track Nifty 50 index, e.g., Nippon India ETF Nifty BeES, SBI ETF Nifty 50.

- Sensex ETFs: Track BSE Sensex, e.g., HDFC Sensex ETF.

- Gold ETFs: Backed by physical gold, e.g., Nippon India Gold ETF.

- Banking Sector ETFs: Track banking stocks, e.g., Kotak Banking ETF.

- International ETFs: Some Indian platforms offer ETFs tracking foreign indices.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Types of ETFs

ETFs come in various forms depending on the asset class and investment strategy:

Liquidity and Pricing

Liquidity

ETF liquidity and pricing has two layers:

Even if ETF shares have low trading volume, the underlying asset liquidity ensures investors can buy/sell without large price deviations.

Pricing

ETF price typically trades close to its Net Asset Value (NAV). Minor premiums or discounts may occur due to market supply-demand imbalances, but creation/redemption helps correct these deviations.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Cost Structure and Taxation

ETF investors need to carefully look at the detailed cost structure that can affect overall investment performance. The expense ratio usually ranges from 0.05% to 0.5%. This ratio shows the ongoing fees that ETF providers charge to cover management and administrative costs. It is notably lower than the costs associated with traditional mutual funds. When trading these investment vehicles, investors face extra costs like brokerage commissions for buying and selling shares. There are also bid-ask spreads, which show the price difference between buying and selling points. Although tracking error is usually small, it is another important factor when assessing an ETF’s financial efficiency. It measures the minor differences between the fund’s returns and its underlying benchmark index. Understanding these connected cost factors helps investors make better decisions and improve their investment strategies. In Indian taxation, Equity ETFs with over 65% equity exposure are treated like equity mutual funds. This creates specific tax implications for investors. Short-Term Capital Gains (STCG) are taxed at 15% for holdings of less than one year. Long-Term Capital Gains (LTCG) face a 10% tax on gains that exceed ₹1 lakh when held for more than a year; there are no indexation benefits. On the other hand, non-equity ETFs have a different tax structure. Short-Term Capital Gains are taxed based on the individual’s income tax slab for holdings under three years. Long-Term Capital Gains on these non-equity ETFs are taxed at a rate of 20% with indexation benefits for holdings over three years. This offers investors a detailed way to handle their investment tax liabilities.

How to Invest in ETFs

Investing in ETFs provides a simple and easy way to diversify your investment portfolio. First, you’ll need to open a Demat and Trading Account. This account is necessary for buying and selling on Indian stock exchanges like NSE and BSE. After setting up your account, choosing an ETF should align with your personal investment goals and risk tolerance. Placing an order is much like buying stocks. You can specify the amount and select between market or limit order types. To invest successfully in ETFs, you need to check your portfolio often and may need to rebalance it to improve performance. Many brokers and platforms now offer more options through Systematic Investment Plans (SIPs) in ETFs. Investors can also buy ETF units through mutual fund platforms, which makes the investment process more convenient and suited to individual financial plans.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

ETF Trading Strategies

Risks Involved

Though ETFs offer diversification and liquidity, they carry risks:

Global ETF Market

The global ETF market has become a vibrant and growing financial system. The United States is at the forefront, offering an unmatched variety of investment products that span nearly every asset class and investment strategy. In Europe and the Asia-Pacific regions, ETFs have also seen significant growth, sparking new ideas in various sectors. These financial tools have moved beyond traditional market areas. They now include thematic ETFs that focus on modern topics like technology, sustainability, and new innovations. Additionally, ETFs have broadened their scope to include alternative assets such as real estate investment trusts (REITs), fixed income securities, and commodities, giving investors more options for diversification. Most importantly, these investment vehicles have made global investing more accessible. They provide easy access to emerging and frontier markets, allowing investors to strategically distribute their capital across complex international landscapes.

Popular ETFs in India

India’s ETF market has grown significantly, with several popular offerings:

These ETFs offer investors low-cost exposure to India’s equity and commodity markets.

Conclusion

Exchange Traded Funds represent a versatile and efficient investment vehicle suitable for beginners and experienced investors alike. With benefits like low cost, liquidity, transparency, and diversification, ETFs have democratized investing and allowed broad market access. However, investors must understand the types, cost structures, trading mechanics, and associated risks before investing. In India, ETFs have gained tremendous traction and offer an excellent option for wealth creation over the long term. Globally, Exchange Traded Funds continue to innovate, making them indispensable tools in modern portfolio management.