- Introduction to Index Funds

- How Do Funds Work?

- Major Indian and Global Indices

- Passive Investing Strategy

- Advantages of Index Funds

- Risks and Limitations

- Cost Efficiency (Expense Ratio)

- Performance vs Active Funds

- Conclusion

Introduction to Index Funds

In the world of investing, index funds have emerged as a popular and effective tool for building long-term wealth. Their simplicity, low costs, and broad market exposure make them an attractive choice for both beginners and seasoned investors. This article provides an in-depth look at index funds, how they work, their advantages, limitations, tax implications, and practical considerations for investors.Index funds are a type of mutual fund or index funds in stock market exchange-traded fund (ETF) designed to replicate the performance of a specific market index account. Instead of relying on active management, index funds invest in the same securities that constitute a benchmark index, Advantages of Index Funds, Global Indices in the same proportion.For example, an index fund tracking the Nifty 50 will hold shares of the 50 companies in the Nifty 50 index, aiming to match its returns rather than beat them.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

How Do Index Funds Work?

The core principle behind index funds is passive investing. Instead of fund managers actively selecting index funds in the stock market to outperform the market, index funds follow a “buy and hold” strategy aligned with the index account composition.

Key Features:

- Replication: The fund buys securities in the exact proportion as the index.

- Rebalancing: Periodically, the fund adjusts holdings to reflect changes in the index (e.g., when companies enter or leave the index).

- Tracking Error: The slight difference between the index return and the fund’s actual return, usually minimal in well-managed funds.

This passive approach removes the guesswork and reduces trading costs, contributing to consistent performance aligned with the broader market.

Major Indian and Global Indices

Understanding the Global Indices that index funds track is crucial.

Indian Indices:

- Nifty 50: Represents the top 50 large-cap companies on the National Stock Exchange (NSE).

- Sensex: The benchmark index of the Bombay Stock Exchange (BSE), tracking 30 large-cap companies.

- Nifty Next 50: Represents the next 50 companies after Nifty 50, considered mid-cap.

- Nifty Midcap 150 and Smallcap 250: Track mid and small-cap companies respectively.

Global Indices:

Investors can choose index funds that track domestic or international indices, diversifying geographically.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Passive Investing Strategy

Index funds embody thePassive Investing Strategy philosophy, which is based on the belief that consistently outperforming the market is extremely difficult and costly over the long term.

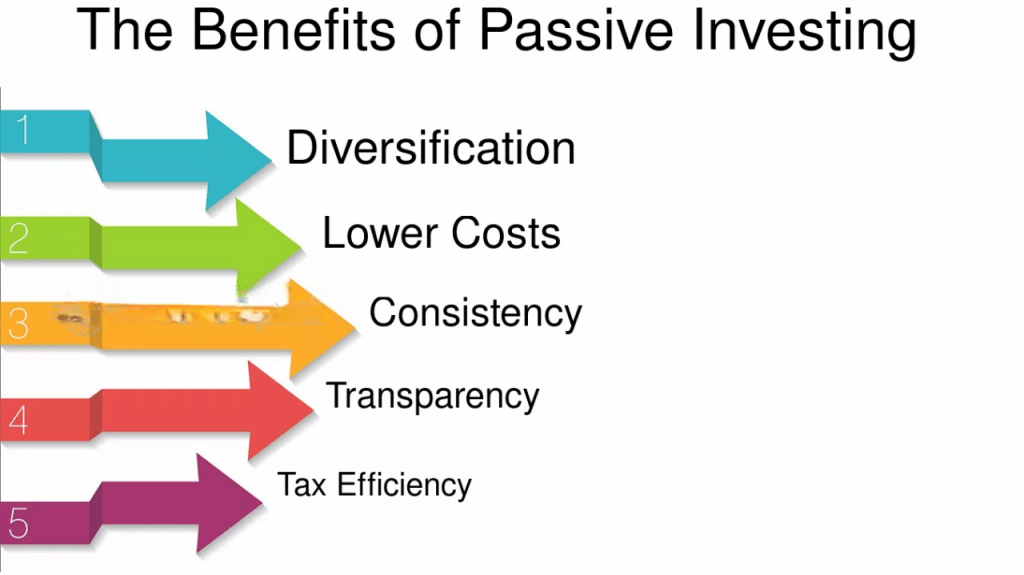

Benefits of Passive Investing Strategy:

- Market Efficiency: Financial markets are largely efficient, so actively trying to beat them often fails.

- Lower Costs: Passive funds have lower management fees compared to active funds.

- Diversification: Index funds automatically provide broad exposure to many stocks.

- Consistency: Long-term returns closely track the overall market, avoiding the risks of poor active decisions.

Passive Investing Strategy gained popularity after studies showed that most active managers fail to outperform benchmarks after fees.

Advantages of Index Funds

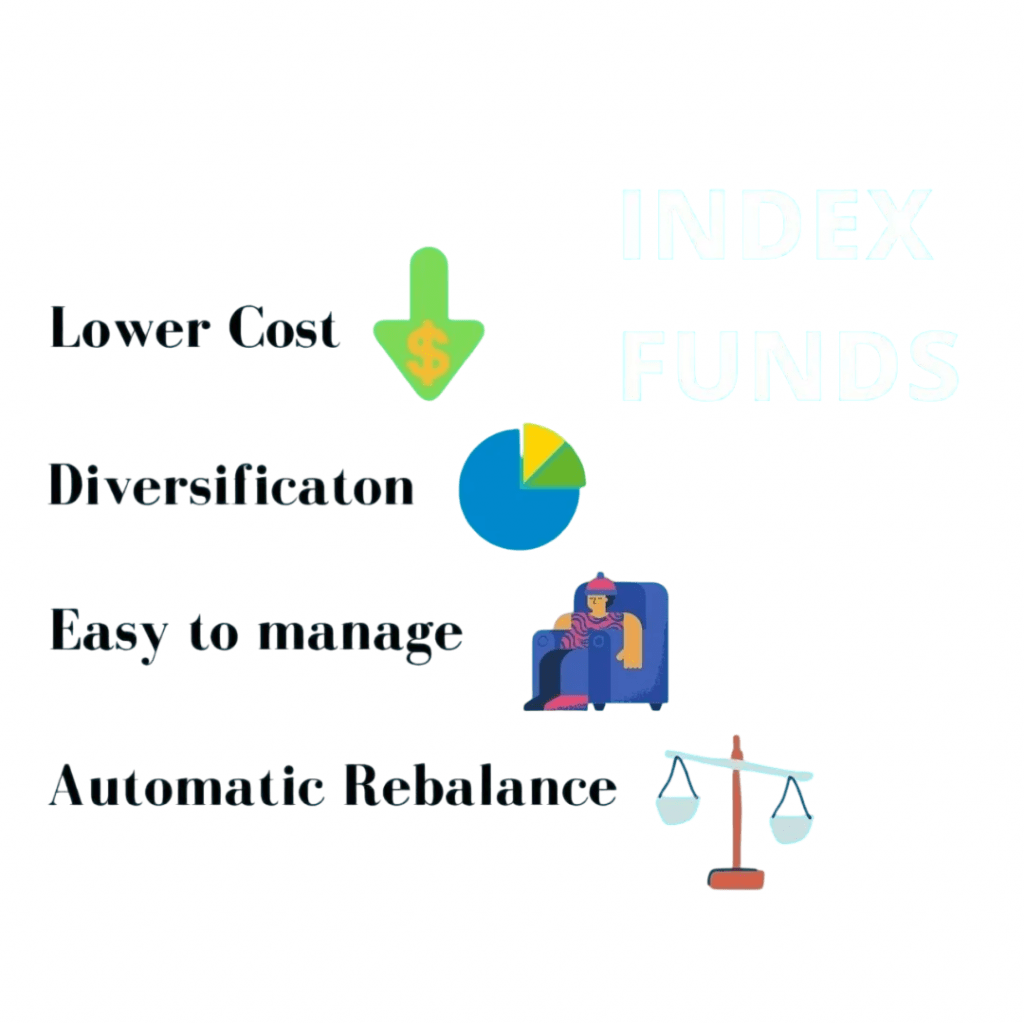

- Cost Efficiency: Since index funds do not require expensive research or frequent trading, their expense ratios are significantly lower than actively managed funds.

- Diversification: By investing in an entire index, index funds provide exposure to a broad basket of stocks, index account reducing company-specific risk

- Simplicity: Investors don’t need to analyze individual stocks or time the market.

- Tax Efficiency: Lower turnover reduces capital gains distributions, which can defer tax liabilities.

- Consistency and Predictability: The fund’s performance closely mirrors the underlying index, making outcomes more predictable.

- Accessibility: Most index funds have low minimum investment requirements, making them accessible for retail investors.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Risks and Limitations

While index funds offer many benefits, they are not without risks.

- Market Risk: Since index funds mirror market indices, they will fall when the market declines. There is no protection against systemic downturns.

- No Outperformance: Index funds cannot beat the market by design; they only aim to match it.

- Tracking Error: Though usually small, differences can arise due to fund expenses, cash holdings, or sampling methods.

- Limited Flexibility: Index funds cannot avoid poorly performing stocks within the index.

- Concentration Risk: Some indices may have heavy weighting in certain sectors, leading to sector concentration risk.

Cost Efficiency: Understanding Expense Ratio

The expense ratio is a critical measure of cost efficiency in the world of investing, particularly when evaluating mutual funds and exchange-traded funds (ETFs). It represents the percentage of a fund’s assets that go toward annual operating expenses, including management fees, index account administrative costs, and other associated expenses. For example, if a fund has an expense ratio of 0.75%, it means that $7.50 is taken out annually for every $1,000 invested to cover the fund’s costs. A lower expense ratio is generally more favorable, as it means a smaller portion of an investor’s returns is eroded by fees. This is especially important in long-term investing, index funds in the stock market where even small differences in expense ratios can significantly impact the total return due to compounding effects. Investors often compare the expense ratios of similar funds to ensure they are not overpaying for fund management, Advantages of Index Funds particularly when passively managed index funds typically offer much lower expense ratios than actively managed funds. Understanding the expense ratio is essential for making cost-effective investment decisions and maximizing overall portfolio performance.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Performance: Index Funds vs Active Funds

Over the long term, studies globally have found that a majority of active funds underperform their benchmark indices, especially after fees.

Reasons:

- Costs: Active funds incur higher fees and trading costs.

- Market Efficiency: It is difficult to consistently pick winners.

- Behavioral Biases: Managers’ decisions can be affected by emotions or market noise.

That said, some active funds do outperform, but identifying them in advance is challenging.

Conclusion

Index funds are a simple, cost-effective, and diversified way to invest in the stock market. By passively tracking well-established indices, they offer predictable returns that reflect the overall market performance. While they do have risks, their advantages in terms of low cost, transparency, and ease of investment make them an ideal choice for long-term wealth creation. Systematic investing through SIPs, coupled with proper fund selection and tax planning, Advantages of Index Funds can help investors harness the power of compounding and build substantial wealth over time. For those seeking consistent market returns without the hassle of active management, index funds in stock market index funds present a compelling investment avenue.