- Assessing Financial Goals

- Risk Appetite Evaluation

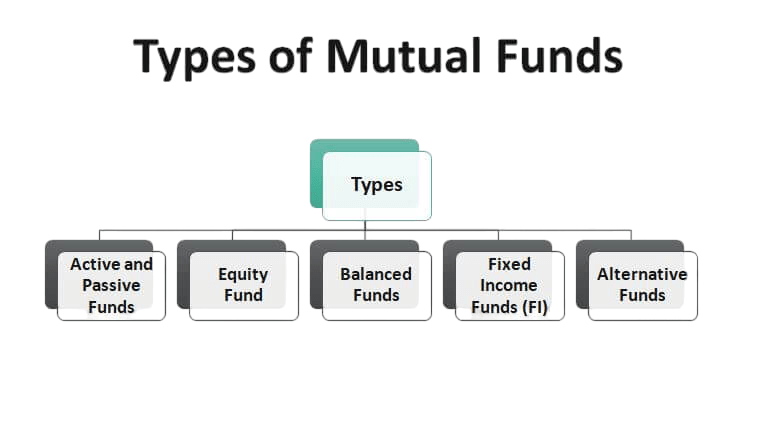

- Types of Mutual Funds

- Expense Ratio Importance

- Fund Manager Track Record

- Fund House Reputation

- Asset Allocation Strategy

- Past Performance and Ratings

- SIP or Lump Sum?

- Exit Load and Liquidity

- Online Tools and Platforms

- Conclusion

Assessing Financial Goals

Investing in mutual funds is one of the most popular ways to grow wealth over time, offering diversification, professional management, and accessibility to investors of all levels. However, successful mutual fund investing requires more than just picking a fund at random. Investors need to assess their financial goals, risk appetite, and various fund characteristics before making an investment decision. In this guide, we’ll walk through crucial considerations such as assessing financial goals, evaluating risk appetite, understanding types of mutual funds, importance of expense ratios, fund manager track record, fund house reputation, asset allocation strategy, reviewing past performance, deciding between SIP and lump sum, understanding exit load and liquidity, online tools, and the importance of periodic review. The first and foremost step before investing in any mutual fund is to clearly define your financial goals. This forms the foundation of your investment strategy.

- Short-Term Goals (under 3 years): These might include saving for a vacation, buying a gadget, or building an emergency fund. Such goals require investments that are low risk and highly liquid.

- Medium-Term Goals (3 to 7 years): Examples include buying a car, funding education, or home renovation. Moderate risk investments with potential for growth but some level of capital protection suit these goals.

- Long-Term Goals (7+ years): Retirement planning, wealth creation, or children’s higher education funds are long-term objectives. You can afford higher risk and volatility in return for potentially higher returns.

By understanding your timeline and the amount of money you aim to accumulate, you can choose the Mutual Funds to Invest that align best with your goals. For instance, equity Mutual Funds to Invest are ideal for long-term wealth creation, while debt funds are preferred for short-term goals requiring capital protection.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Risk Appetite Evaluation

Risk appetite is an important personal finance idea. It shapes an individual’s investment strategy based on factors like age, income stability, financial commitments, and personal temperament. Investors usually fit into three main risk categories: conservative, moderate, and aggressive. Conservative investors focus on preserving their capital. They often choose low-risk options such as debt funds or balanced funds with little equity. Moderate investors feel comfortable with some risk. They tend to select hybrid funds that provide a balanced approach to possible returns. In contrast, aggressive investors are willing to take on high risks. They mainly invest in equity Mutual Funds to Invest or sector-specific assets to maximize growth potential. Investment platforms now provide detailed risk profiling questionnaires. These tools help individuals evaluate their risk profile, leading to more informed investment choices. By aligning mutual fund selections with personal risk appetite, investors can lower the chances of making emotional, panic-driven sales during market ups and downs. This approach encourages a more disciplined and potentially successful long-term investment strategy.

Types of Mutual Funds

Mutual funds can be classified based on asset class, structure, and investment objective. Understanding these categories is essential for building a diversified portfolio:

- Equity Funds: Invest primarily in stocks. Suitable for long-term growth with high volatility.

- Debt Funds: Invest in fixed income instruments like bonds, government securities, and money market instruments. Offer lower risk and returns compared to equity.

- Hybrid Funds: Invest in a mix of equity and debt instruments. Designed to balance risk and return.

- Liquid Funds: Invest in very short-term money market instruments. Typically used for parking funds temporarily.

- Commodity Funds: Invest in commodities like gold, oil, etc.

Based on Investment Objective:

- Growth Funds: Aim for capital appreciation by investing in growth-oriented stocks. Ideal for long-term wealth creation.

- Income Funds: Focus on generating regular income through dividends or interest. Suitable for conservative investors seeking steady cash flow.

- Index Funds: Replicate the performance of a specific stock market index, offering low-cost exposure to broad market movements.

- Sector or Thematic Funds: Invest in specific sectors (e.g., technology, pharmaceuticals) or themes (e.g., ESG). Best suited for informed investors willing to take targeted exposure.

Knowing these types helps you pick funds that fit your financial goals and risk profile.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Expense Ratio Importance

The expense ratio is the annual fee charged by the mutual fund for managing your investment, expressed as a percentage of assets under management (AUM).

- It covers fund management fees, administrative costs, marketing, and distribution expenses.

- Expense ratios vary widely. For example, index funds generally have lower expense ratios (0.05% to 0.5%) compared to actively managed equity funds (1% to 2.5%).

- Over time, a high expense ratio can significantly reduce your net returns. For instance, a 1% expense ratio may seem small but can erode substantial returns over a decade.

- Always compare expense ratios of similar funds before investing. Lower cost funds with comparable performance are often better choices.

Fund Manager Track Record

When looking at a mutual fund, the fund manager is key to investment success. This person chooses the securities for the portfolio and can greatly influence the fund’s performance through their asset choices and timing in the market. Investors should examine the fund manager’s qualifications, including how long they have been with the fund and their past performance with other portfolios. It’s important to focus on consistency rather than short-term market changes. A history of steady returns during different market conditions is essential. Additionally, understanding the fund manager’s investment approach and decision-making is vital. This helps ensure that their style aligns with your investment goals and risk level. By thoroughly researching the fund manager’s background, methods, and past results, investors can make better choices about mutual fund investments.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Fund House Reputation

When choosing a mutual fund, the Asset Management Company (AMC) is key to investment success. Investors should focus on larger, well-established fund houses with strong compliance and governance. These companies usually provide more reliability and stability. While newer or smaller AMCs may offer fresh opportunities, they often come with higher operational risks. Evaluating the fund house should involve a thorough look at its market reputation, historical performance, and total number of investment options. Importantly, potential investors need to review the AMC’s track record for consistent fund performance. They should also investigate any past regulatory problems or legal issues, as these can be serious warning signs. By doing careful research into the fund house’s background and operational integrity, investors can make better choices that fit their financial goals and risk tolerance.

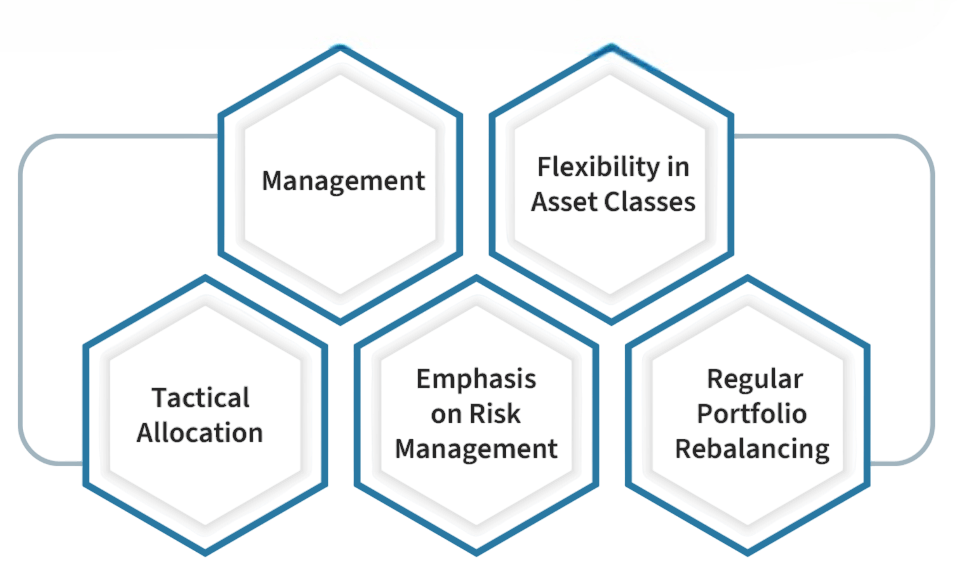

Asset Allocation Strategy

Asset allocation refers to how the mutual fund distributes its investments across different asset classes.

- Equity funds may focus on large-cap, mid-cap, or small-cap stocks.

- Debt funds invest in varying credit qualities and durations (short-term, long-term bonds).

- Hybrid funds adjust the equity-debt mix depending on market conditions or fund mandate.

- Evaluate the fund’s portfolio to ensure it aligns with your risk tolerance and financial goals.

- Look for diversification within the portfolio to reduce risk from any single sector or stock.

- The asset allocation strategy is often detailed in the fund’s offer document or fact sheet.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Past Performance and Ratings

Although past performance does not guarantee future results, it remains a useful indicator when evaluated alongside other metrics:

- Analyze returns over 1, 3, 5, and 10-year periods.

- Compare the fund’s performance against its benchmark index and peer funds.

- Use performance consistency as a metric. Funds with stable performance during market ups and downs are preferable.

- Ratings by independent agencies like Morningstar, CRISIL, or Value Research offer a consolidated view of fund quality.

- Don’t rely solely on star ratings; always read the detailed report.

SIP or Lump Sum?

Systematic Investment Plan (SIP) and a lump sum approach depends on personal financial goals, risk tolerance, and market conditions. SIP offers a disciplined way to invest by letting people contribute a fixed amount regularly. This method lowers timing risk through cost averaging. It is especially helpful for beginners and those who are cautious about risk and want to build consistent investing habits with steady income. On the other hand, lump sum investing means putting a large amount of money in at once. This can lead to higher returns if done wisely during market downturns. While lump sum investments have a greater timing risk, they may work for investors with significant capital, a good grasp of market trends, or long-term investment plans, especially when markets seem undervalued. In the end, the decision between SIP and lump sum investing should reflect personal financial goals, risk tolerance, and current market conditions.

Exit Load and Liquidity

Exit load is a fee charged when you redeem units of a mutual fund within a specific period.

- Exit Load: A fee charged when you redeem mutual fund units within a specified holding period. Its purpose is to deter short-term trading and protect long-term investors.

- Typical Rate: Commonly around 1% if units are redeemed within one year, though some funds may not charge any exit load.

- Investment Check: Always review the exit load and lock-in period in the fund’s offer document before investing.

- Liquidity: Refers to how quickly you can redeem your mutual fund units and get your money.

- Open-Ended Funds: Offer high liquidity, usually allowing redemption within 1 5 to 3 business days.

- Close-Ended or ELSS Funds: Have lock-in periods and limited liquidity; redemptions are restricted until maturity or completion of the lock-in.

- Suitability: Match a fund’s liquidity profile to your investment horizon and emergency cash requirements.

Online Tools and Platforms

In today’s digital era, various online tools help investors research and invest in mutual funds efficiently.

- Research Portals: Platforms like Moneycontrol, Value Research Online, and Morningstar provide comprehensive fund data, performance charts, peer comparisons, and ratings.

- Return Simulators: Most brokerage and AMC websites offer SIP and lump sum calculators to help forecast investment outcomes over specific horizons.

- Mobile Apps: Enable easy tracking of your portfolio, setting up automated SIPs, and aligning investments with predefined financial goals.

- Robo-Advisors: Provide algorithm-driven fund recommendations tailored to your risk profile, investment horizon, and objectives.

- Smart Usage: Leverage these tools to compare funds, monitor performance, and make informed, goal-aligned investment decisions.

Conclusion

Mutual funds provide an accessible and effective avenue for wealth creation, but success requires a thoughtful approach. Start by clearly defining your financial goals and understanding your risk appetite. Choose the right type of mutual funds with consideration to expense ratios, fund manager expertise, fund house reputation, and asset allocation strategy. Evaluate past performance critically and decide between SIP or lump sum based on your comfort with market volatility. Be mindful of exit loads and liquidity terms. Leverage online tools for research and portfolio management, and don’t forget to review your investments periodically. By following these principles, you can build a diversified and balanced mutual fund portfolio that grows steadily and suits your unique financial journey.