- Introduction to Derivatives

- What is an Option?

- Types of Options

- Key Concepts: Strike, Premium, Expiry

- Intrinsic and Time Value

- Black-Scholes Model Explained

- Binomial Pricing Model

- Factors Influencing Option Prices

- Greeks: Delta, Gamma, Theta, Vega

- Conclusion

Introduction to Derivatives

A derivative is a financial contract whose value is derived from the performance of an underlying asset, index, or benchmark. Common underlying assets include stocks, bonds, commodities, interest rates, currencies, and market indices.Derivatives can be used for hedging (risk management), speculation, or arbitrage. They help market participants transfer risk or gain exposure without owning the underlying asset directly.Derivatives are powerful financial instruments used globally by investors, types of options, traders, and institutions to manage risk, speculate, or enhance portfolio returns. Among derivatives, option pricing models stand out for their versatility and strategic applications. This essay introduces the basics of derivatives and options, explains their key pricing models, Binomial pricing model and explores their practical significance and limitations.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

What is an Option?

An option pricing models is a derivative contract that grants its buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, called the strike price, within a specified time period.

Options come in two main forms:

- Call Option: Gives the holder the right to buy the underlying asset.

- Put Option: Gives the holder the right to sell the underlying asset.

Options provide leverage, allowing investors to control a large amount of the underlying asset with a smaller capital outlay (premium). They can be used to hedge downside risk, generate income, market price or speculate on price movements.

Types of Options

Options are categorized based on various features:

Based on Exercise Style

- European Options: Can only be exercised on the expiration date.

- American Options: Can be exercised anytime before or on the expiration date.

- Bermudan Options: Can be exercised on specific dates before expiration.

Based on Underlying Asset

- Stock Options: Based on shares of companies.

- Index Options: Based on market indices like the S&P 500 or Nifty 50.

- Currency Options: Based on foreign exchange rates.

- Commodity Options: Based on commodities such as gold, oil, or agricultural products.

Based on Settlement

- Physical Delivery: Underlying assets are delivered upon exercise.

- Cash Settlement: Cash equivalent of the option’s intrinsic value is paid.

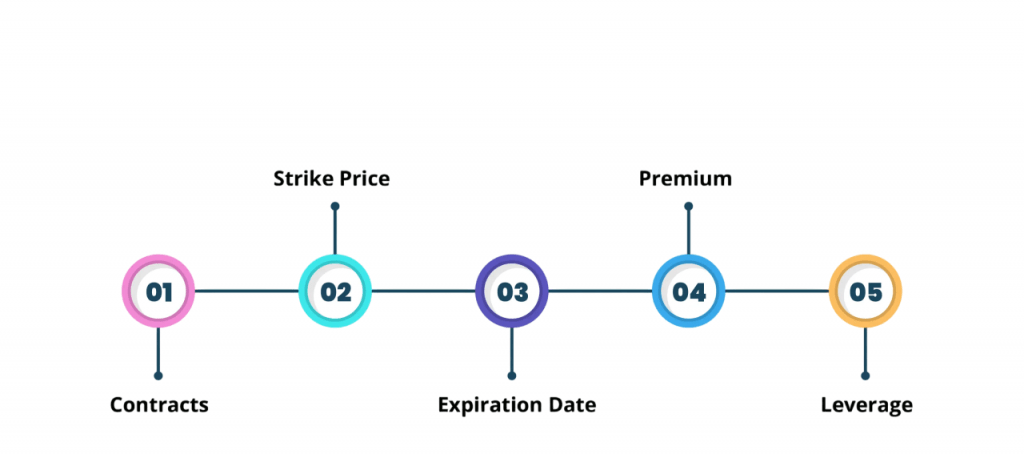

- Strike Price (Exercise Price): The strike price, also known as the exercise price, is a key concept in c. It refers to the fixed price at which the holder of an options contract can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset during a specified period or on a specific expiration date. The strike price is set at the time the option contract is created and does not change throughout the life of the option pricing models.The relationship between the strike price and the current market price of the underlying asset determines the option’s value and whether it is “in the money,” “at the money,” or “out of the money.” For example, if a stock is trading at $100 and a call option has a strike price of $90, the option is considered in the money because the holder can buy the stock for less than the market value. Conversely, if the strike price is higher than the market price, the call option is out of the money.

- Premium: In the context of options trading, the premium is the price paid by the buyer to the seller (also known as the writer) for acquiring the rights granted by an options contract. It represents the cost of the option and is determined by various factors, including the current market price of the underlying asset, the strike price, the time remaining until expiration, financial , volatility, interest rates, investors and market demand.For a call option, the premium gives the buyer the right, but not the obligation, to purchase the underlying asset at the strike price before or on the expiration date. For a put option, it gives the buyer the right to sell the asset at the strike price. In both cases, the buyer pays the premium upfront and does not get it back, regardless of whether they choose to exercise the option.

- Expiry (Expiration Date): The expiry or expiration date in options trading refers to the specific date on which an options contract becomes invalid and can no longer be exercised. After this date, the option ceases to exist, and the holder loses the right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at the strike price.Options contracts are time-sensitive financial instruments, and their value typically declines as the expiration date approaches a phenomenon known as time decay. The expiration date is clearly defined when the option is created and varies depending on the type of option. It can be daily, weekly, monthly, or even long-term (such as LEAPS—Long-Term Equity Anticipation Securities).

- For call options: max(0,Underlying Price−Strike Price)\max(0, \text{Underlying Price} – \text{Strike Price})

- For put options: max(0,Strike Price−Underlying Price)\max(0, \text{Strike Price} – \text{Underlying Price})

- Time Value=Option Premium−Intrinsic Value\text{Time Value} = \text{Option Premium} – \text{Intrinsic Value}

- Time value depends on factors such as volatility, time to expiration, and interest rates.

- Markets are frictionless (no transaction costs or taxes).

- The underlying asset price follows a lognormal distribution with constant volatility.

- No dividends are paid during the option’s life.

- Risk-free interest rate and volatility are constant.

- The option can only be exercised at expiration (European style).

- The underlying asset price can move up or down by specific factors at each time step.

- The model creates a binomial tree depicting possible price paths until expiration. Option values at terminal nodes are calculated based on payoffs.

- Using backward induction, the present value of the option is computed by discounting expected payoffs under a risk-neutral measure.

- Can price American options allowing early exercise.

- Flexible to incorporate dividends and varying volatility.

- Intuitive and adaptable for complex derivatives.

- Computationally intensive for long maturities or fine time steps.

- Requires estimation of up/down factors and probabilities.

- Underlying Asset Price: The closer the asset price is to the strike, the higher the option’s time value and premium.

- Strike Price: Option Prices with strikes closer to the current asset price (at-the-money) generally have higher premiums.

- Time to Expiration: Longer time horizons increase the likelihood of profitable price movements, raising the premium.

- Volatility: Higher volatility increases potential price swings, boosting option premiums.

- Interest Rates: Higher risk-free rates tend to increase call premiums and decrease put premiums due to opportunity cost effects.

- Dividends: Expected dividends reduce call option premiums (as stock price drops on dividend dates) and increase put premiums.

- Measures the rate of change of option price relative to changes in the underlying asset price.

- Call delta ranges from 0 to 1; put delta ranges from -1 to 0.

- Helps in hedging (e.g., delta-neutral portfolios).

- Measures the rate of change of delta with respect to the underlying asset price.

- Indicates the curvature of the option’s value relative to the asset price.

- High gamma means delta is sensitive to price changes.

- Measures the sensitivity of option price to the passage of time (time decay).

- Usually negative for long option holders, reflecting premium erosion as expiration nears.

- Measures sensitivity to changes in implied volatility.

- Higher volatility increases option premiums; vega quantifies this effect.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Key Concepts: Strike, Premium, Expiry

Understanding options requires familiarity with several fundamental terms:

Intrinsic and Time Value

The premium of an option consists of two components:

Intrinsic Value

The immediate, realizable value of an option if exercised now.

If the Types of Options is “in-the-money” (ITM), intrinsic value is positive; otherwise, it is zero.

Time Value

The additional premium reflects the probability that the option will gain intrinsic value before expiry. Time value declines as expiration approaches, a phenomenon called time decay.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Black-Scholes Model Explained

The Black-Scholes model is the foundational mathematical framework for pricing European-style options. Developed by Fischer Black, Myron Scholes, and Robert Merton in 1973, it revolutionized derivatives trading by providing a formula to estimate option prices theoretically.

Assumptions

Binomial Pricing Model

TheBinomial Pricing Model, developed by Cox, Ross, and Rubinstein in 1979, offers a discrete-time approach to option pricing.

How it Works

Advantages

Limitations

Factors Influencing Option Prices

Option premiums depend on several key variables:

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Greeks: Delta, Gamma, Theta, Vega

The Greeks are sensitivity measures that quantify how option prices respond to changes in underlying factors.

Delta (Δ)

Gamma (Γ)

Theta (Θ)

Vega (ν)

Conclusion

option pricing models are sophisticated derivatives providing investors with strategic flexibility to manage risk and capitalize on market movements. Understanding their mechanics types, investors, market price, pricing components, and influencing factors is essential for effective utilization. Pricing models like Black-Scholes and the Binomial Pricing Model offer theoretical frameworks to estimate fair types of options values, guiding trading and risk management decisions. The Greeks help monitor sensitivities and maintain hedged portfolios. While these models simplify the complex realities of financial markets, awareness of their assumptions and limitations ensures prudent application. With evolving markets and technologies, derivatives and options will continue to be indispensable tools in global finance, offering opportunities and challenges for all market participants.