- M&A Overview and Terminologies

- Types of Mergers and Acquisitions

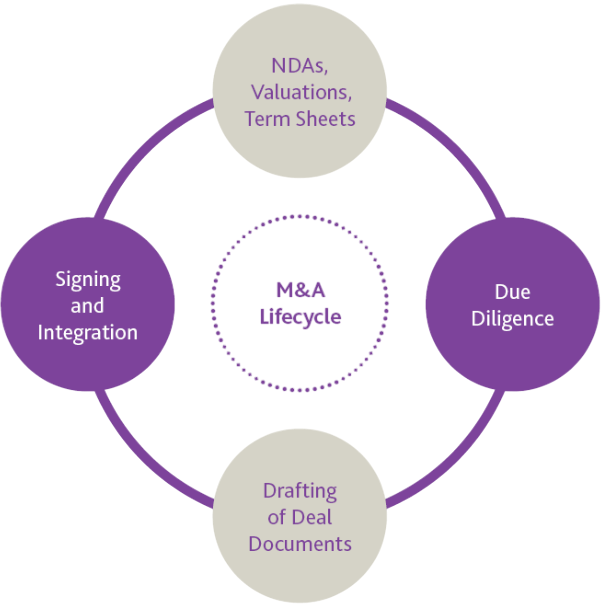

- The M&A Lifecycle

- Deal Structuring

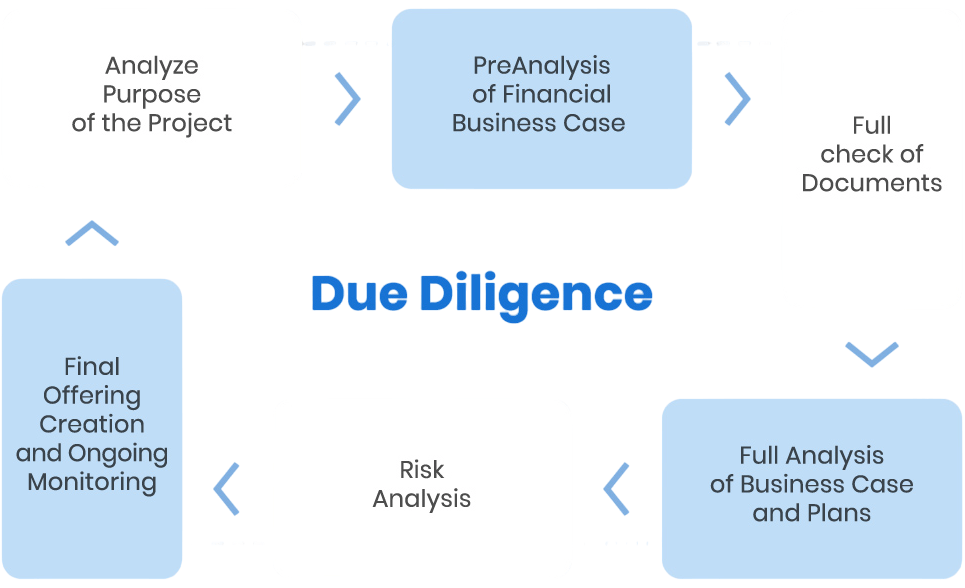

- Due Diligence Process

- Valuation Methods in M&A

- Financing the Deal

- Legal and Regulatory Aspects

- Post-Merger Integration

- Conclusion

M&A Overview and Terminologies

Mergers and acquisitions (M&A) represent key strategies for business growth, diversification, and competitive positioning. While the terms are often used together, they describe different types of corporate transactions: In the fast-changing world of corporate strategy, mergers and acquisitions (M&A) involve complex transactions that reshape business environments. These strategic actions can combine two companies, where one may survive while the other ceases to exist, or result in the outright purchase of a target company by an acquirer. The process is detailed, covering important stages like due diligence, which is a careful investigation of the target’s business, financial health, legal status, and operations. Companies engage in these strategies to find potential synergies, such as cost savings and revenue growth, while structuring deal terms that specify payment methods, governance, and how the organizations will work together after the merger. The M&A landscape varies, from friendly partnerships to hostile takeovers, with options like tender offers allowing public share purchases. Ultimately, these transactions are smart corporate moves aimed at driving growth, improving market position, and creating value for stakeholders through well-planned changes.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

The M&A Lifecycle

The mergers and acquisitions M&A Lifecycle is a complex journey that unfolds through organized phases aimed at maximizing corporate growth and value. It starts with developing a strategy, where organizations clearly define their expansion goals and identify potential targets that match their vision. Using industry databases, professional networks, and expert advisors, companies screen and shortlist potential acquisition candidates based on strict financial and strategic criteria.

After initial confidentiality agreements and preliminary talks, the process moves into due diligence, which includes a thorough review of financial records, legal contracts, intellectual property, and operational capabilities. Deal structuring is vital at this point, requiring careful consideration of payment methods, governance structures, and transaction terms. Navigating regulatory approvals from antitrust and securities authorities is another important step before finalizing the transaction. The end of this complex process involves not just closing the deal but also implementing a careful post-merger integration strategy. M&A Lifecycle strategy aligns operational systems, corporate cultures, and management approaches to unlock expected synergies and strategic potential.

Types of Mergers and Acquisitions

Types of Mergers:

- Horizontal Merger: Between companies operating in the same industry at the same production stage, aiming to increase market share (e.g., two car manufacturers merging).

- Vertical Merger: Between companies at different stages of the supply chain to improve efficiencies (e.g., a manufacturer acquiring a supplier).

- Conglomerate Merger: Between unrelated businesses to diversify risk and revenue streams.

- Market Extension Merger: Between companies selling the same products but in different markets to expand geographical reach.

- Product Extension Merger: Between companies offering different but related products targeting the same customer base.

Types of Acquisitions:

- Friendly Acquisition: Target company’s management agrees to the deal.

- Hostile Acquisition: The acquirer bypasses management and directly appeals to shareholders.

- Reverse Merger: A private company acquires a public company to become publicly traded without an IPO.

- Cross-border Acquisition: Acquisitions between companies based in different countries.

- Cash Payment: Immediate liquidity to sellers; preferred by sellers for certainty.

- Stock Payment: Payment through shares of the acquiring company; helps preserve cash and aligns interests.

- Combination: Mix of cash and stock to balance risk and reward.

- Debt Financing: Using borrowed funds to finance the deal.

- Asset Purchase: Acquirer buys specific assets, not the entire company, limiting liability exposure.

- Stock Purchase: Acquirer buys shares and assumes ownership, including liabilities.

- Earn-outs: Contingent payments based on future performance, reducing buyer risk.

- Contingent Value Rights (CVRs): Additional payments contingent on specific events.

- Cash Reserves: Using internal funds, reducing borrowing costs but limiting liquidity.

- Debt Financing: Borrowing through loans or bonds; increases leverage and interest obligations but preserves ownership.

- Equity Financing: Issuing new shares; dilutes existing shareholders but reduces financial risk.

- Hybrid Instruments: Convertible debt, mezzanine financing combining debt and equity features.

- Antitrust and Competition Laws: Authorities such as the U.S. Federal Trade Commission (FTC) and European Commission evaluate deals for potential anti-competitive effects.

- Securities Laws: Compliance with disclosure, insider trading, and shareholder approval requirements is mandatory.

- Employment Laws: Employee rights, severance, and union agreements must be respected during restructuring.

- Environmental and Industry Regulations: Specific industries (e.g., finance, healthcare) have additional regulatory hurdles.

- Cross-Border Regulations: Deals involving multiple jurisdictions must comply with international laws and tax treaties.

- Integration Planning: Starts early, even before deal closure, defining integration teams, milestones, and budgets.

- Cultural Integration: Aligning company cultures, communication styles, and values to avoid employee turnover and productivity loss.

- Systems Integration: Combining IT platforms, reporting structures, and operational processes.

- Synergy Realization: Capturing cost savings, revenue enhancements, and strategic benefits identified during due diligence.

- Change Management: Engaging stakeholders, transparent communication, and training to manage transition smoothly.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Deal Structuring

Deal structuring is critical to ensure alignment of interests, minimize risks, and optimize financial outcomes.

Other Deal Structures:

Due Diligence Process

Due diligence is an important process used to evaluate potential business investments or transactions. It involves examining various strategic areas in detail. This thorough assessment includes financial analysis, such as reviewing historical statements and cash flow. It also requires legal checks of contracts and intellectual property rights.

The operational review looks into supply chain dynamics, manufacturing abilities, and technology systems. Human resources evaluations focus on workforce potential and organizational strengths. Tax compliance and environmental risk assessments add to this complete approach. Teams of accountants, lawyers, and industry experts work together to spot risks and confirm investment values. By conducting these detailed investigations, organizations can make informed choices, reduce risks, and ensure they are on track with their long-term goals.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Valuation Methods in M&A

Valuing a business fairly is important for pricing and negotiations. Professionals use various methods to find a company’s true worth. The Discounted Cash Flow (DCF) analysis is a key approach. It projects future cash flows and discounts them to present value using the weighted average cost of capital. Alongside DCF, comparable company analysis looks at trading multiples from similar firms. Precedent transactions give further insights by referencing valuation multiples from previous mergers and acquisitions. Asset-based valuation offers another view, especially for capital-heavy businesses, by calculating net asset value. Leveraged buyout (LBO) analysis focuses on cash flow potential and the ability to pay off debt. Since no single method gives a complete picture, financial experts usually combine results from these approaches. This helps them form a clear and detailed understanding of a company’s actual value, reducing risks and aiding informed investment choices.

Financing the Deal

M&A transactions can be financed through various sources, impacting risk and cost.

Sources of Financing:

Leveraged Buyouts (LBOs):

A form of acquisition financed predominantly through debt, often used by private equity firms, relying on the target’s cash flows for debt servicing.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Legal and Regulatory Aspects

M&A deals are subject to strict legal and regulatory scrutiny to protect competition, investors, and public interests.

Post-Merger Integration

Successful integration is essential to realize the full benefits of Post-Merger Integration.

Conclusion

Mergers, acquisitions and divestitures are powerful corporate strategies with the potential to reshape industries, drive growth, and unlock value. However, their complexity requires meticulous planning, thorough due diligence, thoughtful deal structuring, and effective integration to succeed. Understanding the lifecycle, valuation methods, regulatory environment, and human impacts is essential for all stakeholders involved. Learning from past successes and failures further enhances the probability of achieving desired strategic and financial outcomes.