- What is Equity Investment?

- Benefits of Equity in Portfolio

- Types of Equity Securities

- Market Capitalization Categories

- Growth vs Value Stocks

- Equity Risk Premium

- Diversifying Equity Holdings

- Role of Dividends

- Evaluating Stock Performance

- Conclusion

What is Equity Investment?

Equity investment entails buying shares of a company, granting investors part ownership and a residual claim on earnings. These investments typically take the form of Equity investment, Shareholders the practice of purchasing shares in publicly or privately held companies, and is a foundational pillar of personal and institutional investment strategies. This form of investment enables individuals to participate in a company’s growth and profitability, offering potential returns through both capital appreciation and dividends. Equity investments can provide significant long-term gains, but they come with risks that require careful analysis, diversification, and portfolio management. This guide will delve into every aspect of equity investment, covering key concepts, Evaluating stock performance, Benefits of equity in portfolio methodologies, and best practices to equip both novice and experienced investors with a solid understanding of the equity lands

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Benefits of Equity in a Portfolio

Adding equity investments to a portfolio provides numerous advantages:

- Higher Potential Returns: Historically, equities outperform bonds and cash over long periods.

- Diversification: Equities offer exposure to different industries and geographic markets.

- Dividend Income: Some stocks provide a steady income stream.

- Liquidity: Most public stocks are easily tradable.

- Partial Ownership: Investors have voting rights and influence on corporate governance (common stocks).

- Common Stock: Offers voting rights and variable dividends. Shareholders are last in line during liquidation.

- Preferred Stock: Fixed dividend, no voting rights, and higher claim on assets than common stock.

- Convertible Securities: Bonds or preferred shares convertible into common stock.

- Equity Mutual Funds and ETFs: Pooled investments that hold a basket of stocks across sectors or strategies.

- Private Equity: Direct investments in startups or private firms with high growth potential.

- Large-Cap (> $10B): Established, stable firms like Apple or Johnson & Johnson.

- Mid-Cap ($2B–$10B): Companies with growth potential and some market stability.

- Small-Cap (< $2B): High-risk, high-reward companies with strong growth prospects.

- Micro-Cap (< $300M): Emerging businesses with limited market presence, high volatility.

- Significance: Guides asset allocation and valuation models like CAPM.

- Influencing Factors: Market sentiment, GDP growth, inflation, central bank policies.

- Sector Diversification: Spread investments across industries (e.g., tech, healthcare, utilities).

- Geographic Diversification: International stocks reduce exposure to domestic risks.

- Style Diversification: Blend growth, value, and dividend-focused stocks.

- Capitalization Diversification: Mix large-cap stability with small-cap growth.

- Income Stream: Provides regular income for income-focused investors.

- Reinvestment Opportunity: DRIPs (Dividend Reinvestment Plans) compound returns over time.

- Stability Signal: Reliable dividends often reflect solid company fundamentals.

- Tax Consideration: Qualified dividends may be taxed at favorable rates.

- Fundamentals: Revenue, earnings, cash flow, and debt ratios.

- P/E Ratio

- Price-to-Book (P/B)

- Dividend Yield

- PEG Ratio (P/E to Growth)

- Return on Equity (ROE)

- Return on Assets (ROA)

- Beta

- Standard Deviation

- Management Quality: Vision, ethics, and leadership track record.

Despite short-term volatility, equities generally offer superior wealth-building opportunities compared to fixed-income investments.

Types of Equity Securities

Equity securities come in several forms, each with unique characteristics:

Choosing the appropriate type depends on your risk tolerance, return expectations, and investment horizon.

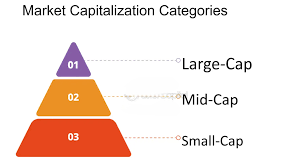

Market Capitalization Categories

Market capitalization categories play a crucial role in equity investment and portfolio construction by grouping companies based on their total market value, which is calculated by multiplying the current share price by the total number of outstanding shares. These categories typically include large-cap, mid-cap, and small-cap stocks. Large-cap companies are well-established, financially stable, and often leaders in their industries, Shareholders providing investors with relative safety and steady dividends, making them suitable for conservative portfolios. Mid-cap stocks represent companies in a growth phase, offering a balance between growth potential and risk, appealing to investors seeking moderate growth. Small-cap stocks belong to smaller, often younger companies with higher growth prospects but also greater volatility and risk, Benefits of equity in portfolio which can add diversification and potential high returns to a portfolio. Understanding these market capitalization categories helps investors tailor their portfolios according to risk tolerance, Equity securities ,investment goals, and market conditions.

Market capitalization (market cap) categorizes companies based on total market value:

Investing across different market caps allows better risk diversification and potential for enhanced returns.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Growth vs. Value Stocks

Growth Stocks: Growth stocks are shares of companies expected to grow their earnings and revenue at a faster rate than the overall market or their industry peers. These companies typically reinvest most of their profits back into the business to fuel expansion, innovation, and market share gains rather than paying high dividends. Growth Stock Performance is often found in sectors like technology, healthcare, Equity securities and consumer services, where innovation and rapid development drive growth. While they offer the potential for significant capital appreciation, Benefits of equity in portfolio growth stocks tend to be more volatile and carry higher risk compared to more established, dividend-paying stocks. Investors interested in growth stocks usually focus on long-term capital gains rather than immediate income.

Value Stocks: Value stocks are shares of companies that are considered undervalued relative to their intrinsic worth. These stocks typically have lower price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) ratios compared to the broader market or their industry peers. Value stocks are often associated with established, stable businesses that generate consistent earnings and pay regular dividends. They may be temporarily overlooked or out of favor due to market conditions, company-specific issues, or economic cycles. Investors in Evaluating stock performance aim to capitalize on the opportunity to buy quality companies at a discount, with the expectation that the market will eventually correct the mispricing, leading to capital appreciation and potential income through dividends. This strategy is generally suited for long-term investors seeking steady returns with moderate risk.

Equity Risk Premium

The Equity Risk Premium (ERP) represents the extra return investors expect from equities over risk-free assets (e.g., government bonds).

Formula :

Understanding ERP helps in estimating expected portfolio returns and evaluating equity attractiveness in different market conditions.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Diversifying Equity Holdings

Diversifying equity holdings is a key investment strategy used to reduce risk by spreading investments across a variety of Stock Performance and sectors. Instead of concentrating funds in a single company,Shareholders industry, or region, diversification involves holding shares in multiple companies with different market capitalizations, business models, and geographic exposures. This approach helps protect a portfolio from sharp losses if one particular stock or sector underperforms. By including a mix of large-cap, mid-cap, and small-cap stocks, as well as exposure to different sectors (like technology, healthcare, energy) and international markets, investors can enhance the potential for stable returns while minimizing the impact of volatility from any single investment.

Key diversification techniques include:

Balanced diversification enhances resilience and reduces volatility in portfolios.

Role of Dividends

Dividends play a crucial role in total equity returns.

High-dividend stocks are popular in defensive sectors like consumer staples and utilities.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Evaluating Stock Performance

Comprehensive stock evaluation considers both quantitative and qualitative factors:

Conclusion

Equity investment is a cornerstone of wealth accumulation and financial independence. By understanding various types of equities, diversification strategies, valuation methods, and market behavior, investors can craft resilient and growth-oriented portfolios. While equities involve risk, their historical performance and long-term growth potential make them indispensable in modern financial planning. Careful analysis, Benefits of equity in portfolio Evaluating stock performance Performance consistent evaluation, and disciplined rebalancing form the backbone of a successful equity investment strategy. Whether you’re saving for retirement, Shareholders a home, or long-term financial goals, equity investment can play a pivotal role in your journey to prosperity.