- Introduction to Both Fields

- Roles and Responsibilities

- Required Skills and Qualifications

- Work-Life Balance

- Typical Career Path

- Client Engagement Styles

- Compensation Comparison

- Project Types and Deliverables

- Which Career is Right for You?

- Conclusion

Introduction to Both Fields

Management Consulting

Management consulting and investment banking are two of the most prestigious and sought-after career paths in the business and finance sectors. Both fields attract top talent, offer lucrative pay, and provide challenging, high-profile work. However, the nature of the work, skill requirements, lifestyle, and career trajectories are quite different. This detailed comparison covers the major aspects of these two professions to help students, graduates, and professionals make an informed career choice. Management consulting involves advising organizations to improve their performance, solve complex problems, and implement strategic initiatives. Consultants work closely with clients to analyze business challenges, develop strategies, and guide execution across various functional areas such as operations, marketing, finance, and technology.

Investment Banking

corporations, governments, and institutions in raising capital, executing mergers and acquisitions (M&A), and providing advisory services related to financial transactions. Investment bankers help clients with IPOs, bond issuance, debt financing, and deal structuring.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Roles and Responsibilities

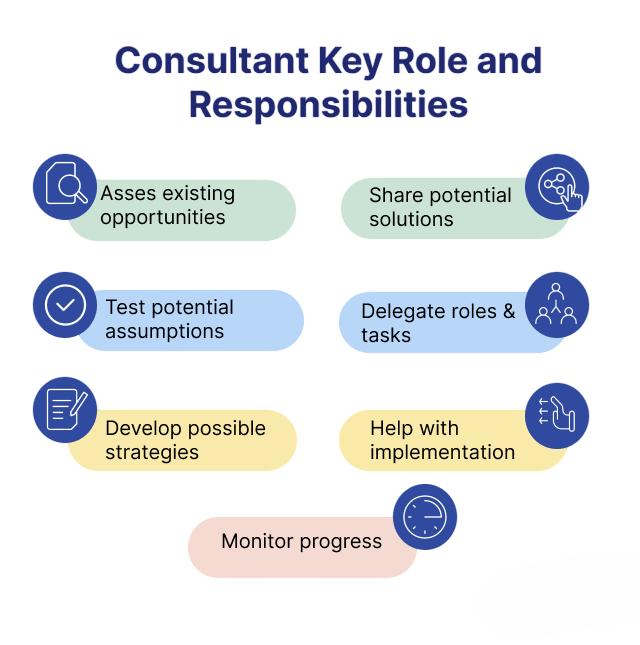

Management Consulting Roles

In management consulting roles, professionals use thorough research and data analysis to understand and tackle complex client challenges. By creating strategic recommendations, consultants work closely with organizations to improve business processes and drive transformation. This includes running collaborative workshops, conducting in-depth stakeholder interviews, and designing focused organizational change programs. Consultants play an important role in supporting digital innovation strategies, helping clients deal with technological changes and market competition. Throughout their work, they carefully prepare detailed reports, engaging presentations, and solid business cases that share insights and suggested solutions. Working effectively with various teams and senior executives ensures a complete approach, while regularly tracking performance metrics helps measure the real impact and value provided to clients.

Investment Banking Roles

Investment banking professionals play a key role in managing complex financial transactions through detailed strategic services. These experts use advanced financial modeling and valuation techniques to study market trends and industry data. This allows them to create engaging pitch books that attract potential clients. By carefully structuring and negotiating mergers, acquisitions, and divestitures, investment bankers offer essential advice for raising capital through both equity and debt instruments. Their responsibilities go beyond just deal creation. They involve thorough due diligence, smooth coordination with legal and accounting teams, and careful management of the deal process from the initial idea to final closure. This approach ensures clients receive solid guidance and effective financial solutions that improve their transaction results and support their long-term business goals. Both Management Consulting vs Investment Banking should be taken into account.

Required Skills and Qualifications

Management Consulting Skills

- Analytical and Problem-Solving Abilities: Strong capacity to assess complex situations and recommend actionable solutions.

- Communication and Interpersonal Skills: Ability to convey ideas clearly and collaborate effectively across teams.

- Ambiguity Management: Comfortable working with incomplete information and shifting project demands.

- Strategic Thinking and Business Acumen: Competent in shaping long-term strategies and understanding market forces.

- Data Analysis Tools and Frameworks: Proficient in using structured methodologies and software for decision support.

- Teamwork and Leadership: Capable of leading cross-functional teams and fostering collaboration.

- Creativity and Adaptability: Innovative mindset and flexible approach to problem-solving.

- Education: Typically requires a bachelor’s degree; MBA preferred for advancement.

Investment Banking Skills

- Financial Modeling and Valuation Expertise: Skilled in building detailed models for M&A, IPOs, and debt/equity financing.

- Accounting, Finance, and Markets Knowledge: Deep understanding of financial statements, instruments, and global markets.

- Quantitative Reasoning: Exceptional analytical thinking and numerical accuracy.

- Negotiation and Persuasion: Strong influencing skills to close complex transactions.

- Attention to Detail: Accuracy in documents, models, and client communications.

- High-Pressure Performance: Ability to deliver results under demanding timelines and workloads.

- Networking and Relationship Management: Proven ability to build and maintain client and stakeholder trust.

- Education: Bachelor’s degree in finance, economics, or related field; MBA or CFA preferred.

- Travel Intensity: Frequent travel (typically 3–4 days/week), which can impact personal routines.

- Deadline Pressure: Intense work cycles around project milestones, though generally more predictable than banking.

- Work-Life Balance: Many firms promote wellness initiatives and offer growing remote work flexibility.

- Hours: Typically ranges between 50 to 70 hours/week depending on project phase.

- Remote Flexibility: Increasing opportunities to work virtually, though travel remains integral.

- Personal Impact: Travel demands may fatigue and strain work-life harmony.

- Work Hours: Extreme hours ranging from 70 to 100+ per week, especially during active deals.

- Weekend & Late-Night Work: Common during transaction closings and earnings seasons.

- Stress Levels: High, driven by market volatility, client expectations, and tight timelines.

- Personal Time: Minimal, particularly at junior levels where demands are highest.

- Flexibility: Limited due to rigid client schedules and round-the-clock responsiveness.

- Long-Term Outlook: Work-life balance improves somewhat with seniority, but challenges persist.

- Entry-Level Salaries: Typically range from $70,000 to $100,000, depending on region and firm tier.

- Mid-Level Compensation: Managers may earn $120,000 to $180,000 including bonuses.

- Partner/Principal Earnings: Senior professionals can earn from $300,000 to over $1 million annually.

- Compensation Structure: Packages often comprise base salary, performance-based bonuses, and profit-sharing components.

- Benefits: Includes travel reimbursements, professional development support, and comprehensive health insurance.

- Entry-Level Analysts: Base salary ranges from $85,000 to $125,000, plus performance bonuses.

- Associates: Total compensation typically falls between $150,000 and $250,000.

- Vice Presidents & Directors: Earnings range from $300,000 to $600,000 or more.

- Managing Directors: Can earn millions annually, largely driven by transaction-based bonus payouts.

- Compensation Structure: Highly performance-driven with significant variability across deals and market cycles.

- Benefits: Includes signing bonuses, equity-based incentives (e.g., stock options), and lifestyle perks.

- Strategy Development: Formulating market entry plans and growth initiatives to drive competitive advantage.

- Operational Efficiency: Identifying cost-saving measures and process optimizations to enhance productivity.

- Digital Transformation: Crafting IT roadmaps and digital strategies to modernize core operations.

- Organizational Restructuring: Leading change management efforts to improve agility and align structures with strategic goals.

- Market Research: Gathering and analyzing customer insights to inform go-to-market and product decisions.

- Sustainability & CSR: Advising on ESG strategies and initiatives that align with corporate responsibility goals.

- IPO Underwriting & Equity Issuance: Facilitating initial public offerings and secondary equity offerings for corporate clients.

- Debt Issuance & Syndicated Loans: Structuring and placing debt instruments, including high-yield bonds and syndicated loan packages.

- M&A Advisory: Guiding clients through mergers, acquisitions, divestitures, and strategic alliances.

- Leveraged Buyouts & Restructuring: Supporting complex financial transactions involving debt leverage and turnaround strategies.

- Valuation & Fairness Opinions: Delivering independent assessments of enterprise value and deal fairness in transactions.

- Project & Infrastructure Capital Raising: Coordinating financing solutions for large-scale projects and infrastructure developments.

- Enjoy solving diverse business challenges across industries and functions.

- Prefer collaborative, client-facing environments with strategic engagement.

- Like making a broad impact on business direction and operational decisions.

- Are comfortable with frequent travel, but seek a relatively better work-life balance.

- Value flexibility to pivot into corporate strategy, entrepreneurship, or public sector roles later.

- Thrive in fast-paced, high-pressure environments tied to financial markets and transactions.

- Enjoy deal-making, capital markets, and structuring complex financial solutions.

- Possess strong quantitative skills and financial modeling expertise.

- Are prepared for demanding hours and intense deadline pressure.

- Aim to transition into private equity, hedge funds, or senior roles in corporate finance.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Work-Life Balance

Management Consulting: Lifestyle & Workload

Investment Banking: Lifestyle & Workload

Typical Career Path

Management Consulting Career Path

In the fast-changing field of management consulting, professionals can expect a clear and steady career path. Starting as an Analyst or Associate in the first 0-3 years, individuals build essential skills and gain industry knowledge. As they move up to Consultant or Senior Consultant roles between 3-6 years, they acquire deeper expertise and take on more complex client engagements. The career progression continues to Manager or Engagement Manager positions from 6-9 years, where leadership and managing client relationships become important. At the senior leadership level, after 10+ years, professionals can become Principal, Director, or Partner, which marks the highest achievement in consulting. Many consultants use their broad experience to shift into industry roles, corporate strategy jobs, or start their own businesses, showing the flexibility and transferable skills gained throughout their consulting careers.

Investment Banking Career Path

A career in investment banking provides a clear and progressive path. It starts at the Analyst level, where individuals usually spend 2-3 years building basic skills. As they grow, they move to the Associate role for 3-4 years, taking on more responsibilities and gaining strategic insights. The progression continues with the Vice President position, lasting 3-5 years, where bankers show strong leadership and manage complex deals. Next are the Director or Executive Director roles, which enhance strategic skills over another 3-5 years. The top of this career ladder is the Managing Director level, typically reached after 7 or more years of hard work and significant contributions. Many investment banking professionals later use their experience to explore roles in private equity, hedge funds, corporate development, or senior finance positions, making for a dynamic and rewarding career path with great potential for growth and impact.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Client Engagement Styles

Management Consulting

In the fast-paced world of management consulting, client-facing roles require strong interpersonal skills and strategic thinking. Consultants act as trusted advisors, working directly with senior executives. They use a collaborative approach that focuses on building agreement and communicating diplomatically. These professional relationships develop through intensive, long-term projects that can last weeks, months, or even years. Typically, these involve detailed methods like workshops, in-depth interviews, and ongoing feedback. Successful consulting depends on balancing soft skills. Professionals must navigate complex organizations with careful communication and strategic insight. Ultimately, they deliver solutions that lead to significant business results.

Investment Banking Career Path

In the fast-paced world of management consulting, client-facing roles require strong interpersonal skills and strategic thinking. Consultants act as trusted advisors, working directly with senior executives. They use a collaborative approach that focuses on building agreement and communicating diplomatically. These professional relationships develop through intensive, long-term projects that can last weeks, months, or even years. Typically, these involve detailed methods like workshops, in-depth interviews, and ongoing feedback. Successful consulting depends on balancing soft skills. Professionals must navigate complex organizations with careful communication and strategic insight. Ultimately, they deliver solutions that lead to significant business results.

Compensation Comparison

Management Consulting Compensation

Investment Banking Compensation

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

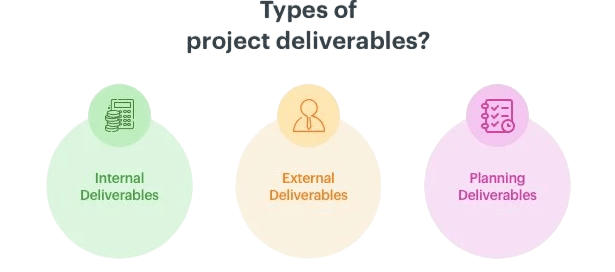

Project Types and Deliverables

Management Consulting Projects

Investment Banking Projects

Which Career is Right for You?

Career Path Decision Criteria

Choosing between management consulting and investment banking depends on your interests, skills, and lifestyle preferences.

Consider Investment Banking if you:

Conclusion

Both management consulting and investment banking offer rewarding careers with excellent compensation and growth opportunities. Your choice should align with your strengths, career ambitions, and lifestyle preferences. While consulting offers variety, strategic breadth, and somewhat more balanced work-life rhythms, investment banking delivers specialization, financial expertise, and significant earning potential albeit with greater demands on time and resilience. Understanding the nuances of each will empower you to make a confident and informed career decision.