- What is Investment Banking?

- Roles: Analyst, Associate, VP, MD

- Core Responsibilities

- Equity and Debt Offerings

- Mergers and Acquisitions Support

- Financial Modeling and Valuation

- Pitch Books and Presentations

- Regulatory Compliance

- Conclusion

What is Investment Banking?

Investment banking job description is a specialized division of banking that assists individuals, corporations, and governments in raising financial capital , financial markets and offering advisory services for mergers, acquisitions, and other types of financial transactions. Unlike commercial banking, which deals with deposits and loans, investment banking is focused on facilitating large, complex financial transactions, underwriting new securities, strategic financial decisions and providing financial advisory,Financial Modeling services. Investment banks serve as intermediaries between security issuers and investors and play a key role in financial markets by ensuring capital flows efficiently. Prominent investment banks include Goldman Sachs, pitch books, Morgan Stanley, JPMorgan Chase, and Barclays.Investment banking is a specialized segment of the financial industry that helps companies, governments, and other institutions raise capital and execute complex financial transactions. Investment banks assist in issuing stocks and bonds, facilitating mergers and acquisitions (M&A), providing financial advisory services, and underwriting new securities. They act as intermediaries between issuers of securities and investors, helping to structure deals, evaluate financial risks, and ensure regulatory compliance. Unlike commercial banks, investment banks do not take deposits instead, they focus on large-scale financial services that support corporate growth and capital markets activity.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

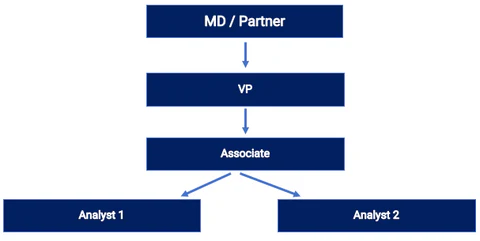

Roles: Analyst, Associate, VP, MD

Investment banking job descriptions have a hierarchical structure, and the roles typically include:

- Analyst: Entry-level position, responsible for financial modeling, research, and preparing presentations.

- Associate: More experienced than analysts, associates supervise analysts and begin interacting with clients.

- Vice President (VP): Focuses on managing client relationships, financial markets, overseeing project execution, and mentoring juniors.

- Director/Executive Director: Leads deal negotiations and client strategies; bridges the gap between VP and MD.

- Managing Director (MD): Responsible for sourcing business, maintaining client relationships, and finalizing deals.

Progression through these roles typically takes years of experience, excellent performance, strategic financial decisions and strong leadership skills.

Core Responsibilities

Investment bankers perform a wide array of functions, including:

- Financial analysis and valuation

- Structuring and executing mergers and acquisitions

- Underwriting equity and debt offerings

- Creating pitch books and marketing materials

- Conducting due diligence

- Negotiating terms of deals

- Advising clients on strategic financial decisions

These responsibilities vary depending on the department M&A, capital markets, sales & trading, or asset management.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Equity and Debt Offerings

Investment banks assist companies in raising capital through:

- Equity Offerings: Includes Initial Public Offerings (IPOs), Follow-on Public Offerings (FPOs), and private placements. The bank underwrites the shares and helps determine the price.

- Debt Offerings: Includes issuing bonds or syndicated loans. The bank helps with structuring, pricing, and marketing debt instruments.

Banks manage the entire issuance process and ensure compliance with legal and regulatory norms.

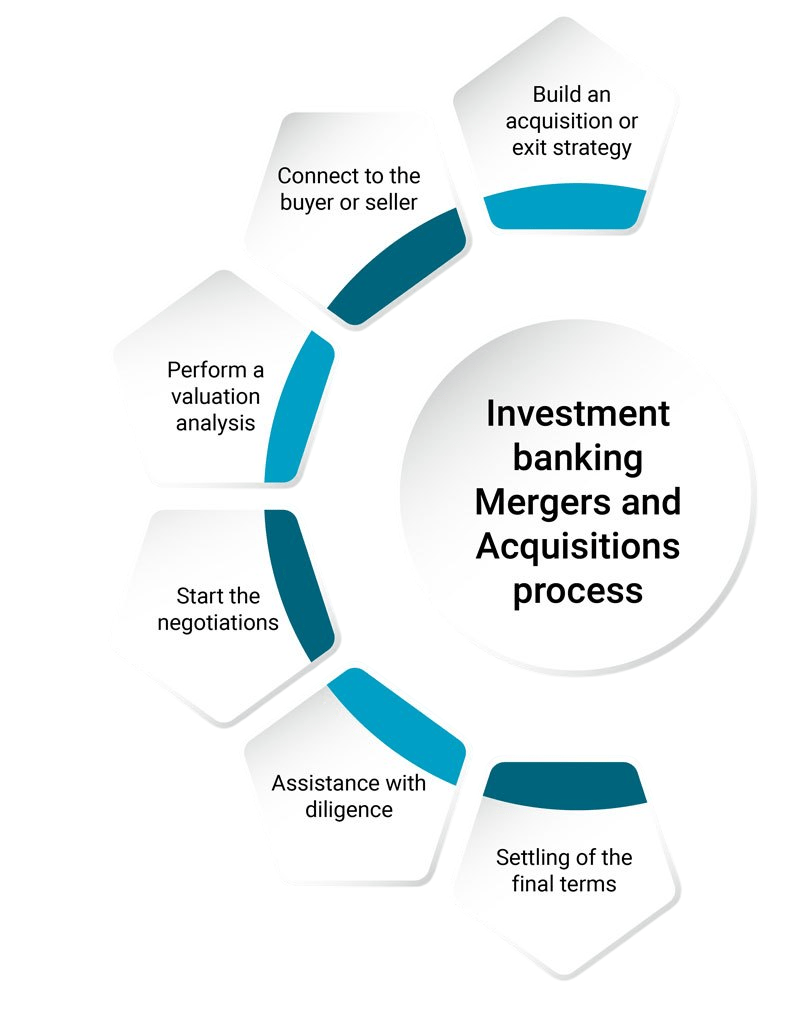

Mergers and Acquisitions Support

Investment banks play a critical role in M&A by:

- Identifying acquisition or merger opportunities

- Performing valuation and due diligence

- Structuring deals and negotiating terms

- Assisting with financing

- Managing post-merger integration

They work on both the buy-side and sell-side, representing either acquirers or target companies.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Financial Modeling and Valuation

Financial modeling is central to investment banking. Common valuation techniques include:

- Discounted Cash Flow (DCF) analysis

- Comparable Company Analysis (Comps)

- Precedent Transactions Analysis

- Leveraged Buyout (LBO) modeling

Analysts and associates develop Excel models to assess company performance and determine intrinsic value, mergers,financial markets,strategic financial decisions which support decision-making during deals.

Pitch Books and Presentations

Pitch books are crucial client-facing documents. They include:

- Company and market analysis

- Valuation summaries

- Deal structures and benefits

- Strategic rationale

Analysts and associates spend a significant amount of time preparing pitch books and customizing them for client presentations to win mandates.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Regulatory Compliance

Given their influence on capital markets, investment banking job description acquisitions, investment banks operate under strict regulatory environments. Key regulations include:

- U.S. Regulations: Securities Act of 1933, Securities Exchange Act of 1934, Dodd-Frank Act

- Global Bodies: SEC (U.S.), FCA (UK), SEBI (India), ESMA (EU)

Compliance involves:

- Insider trading rules

- Know Your Customer (KYC) and Anti-Money Laundering (AML)

- Disclosure requirements

- Adherence to fiduciary duties

Failure to comply can lead to severe penalties and reputational damage.

Conclusion

Investment banking is a prestigious and lucrative career path that combines financial acumen, strategic thinking, and client engagement. While the journey demands resilience and long hours, it offers unmatched exposure to the world of high finance and corporate strategy. From underwriting billion-dollar IPOs to orchestrating landmark M&A deals, mergers and acquisitions , strategic financial decisions, investment banking job descriptions shape the global financial landscape. Understanding the job roles, financial markets, required skills, pitch books and growth trajectory is essential for aspiring professionals considering this exciting field.