- Who is an Investment Advisor?

- Roles and Responsibilities

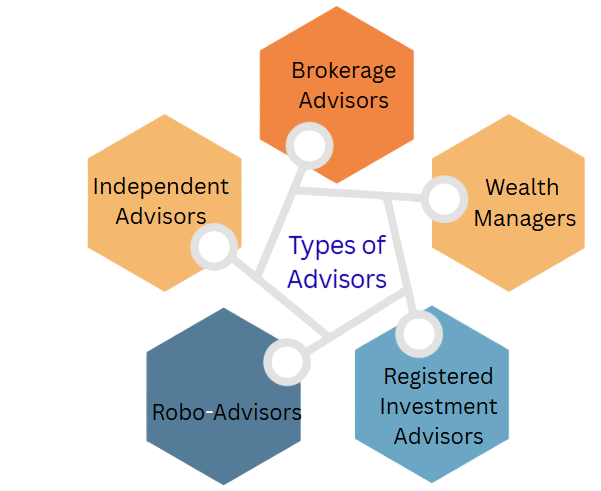

- Types of Advisors (Robo, Independent, etc.)

- Qualifications and Certifications

- Fiduciary vs Suitability Standard

- Advisor Compensation Models

- How to Choose an Advisor

- Regulatory Oversight (e.g., SEBI, SEC)

- Trends in the Advisory Industry

- Conclusion

Who is an Investment Advisor?

An investment advisor is a financial professional who provides guidance to individuals or institutions on investment strategies, financial planning, and portfolio management. Investment advisor compensation models may be individuals or part of firms, and they help clients achieve specific financial goals by analyzing market conditions, assessing individual financial situations, robo advisor, robo investing and offering tailored advice. Registered investment advisors (RIAs) must meet regulatory requirements and are typically held to a fiduciary standard, meaning they are legally obligated to act in the client’s best interest.Investment advisors work in diverse environments including wealth management firms, banks, robo advisor, brokerage firms,types of advisors , Risk management or independently. Their services range from retirement planning and estate management to managing multi-million-dollar portfolios.An investment advisor is a professional or firm that provides advice to clients about investing in securities such as stocks, bonds, mutual funds, or ETFs. They help individuals or institutions develop and manage investment portfolios based on financial goals, risk tolerance, and time horizons. Registered investment advisors (RIAs) are legally obligated to act in their clients’ best interests a standard known as fiduciary duty. Depending on their license and regulatory status, some advisors may also manage assets directly or offer financial planning services.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Roles and Responsibilities

Investment advisors wear many hats depending on the client’s financial complexity. Their core responsibilities include:

- Financial Assessment: Analyzing clients’ financial status, including income, expenses, assets, and liabilities.

- Goal Setting: Helping clients define long-term and short-term financial goals.

- Investment Planning: Recommending an appropriate mix of asset classes based on client risk profiles.

- Portfolio Construction: Selecting securities such as stocks, bonds, mutual funds, and ETFs.

- Risk Management: Implementing diversification and hedging strategies.

- Continuous Monitoring: Reviewing performance, rebalancing portfolios, and making adjustments as needed.

- Regulatory Compliance: Ensuring client portfolios adhere to all legal standards.

- Education and Communication: Keeping clients informed on financial strategies, market trends, and any potential changes in their financial outlook.

Types of Advisors (Robo, Independent, etc.)

The financial planning advisory landscape includes several types of advisors:

- Independent Advisors: Typically fee-only professionals who are not tied to specific financial products,robo investing or institutions. They offer personalized and unbiased advice.

- Robo-Advisors: Digital platforms using algorithms to build and manage investment portfolios. Best suited for individuals seeking low-cost, hands-off investment options.

- Bank and Brokerage Advisors: Often part of larger financial institutions and may recommend proprietary products. Their compensation might include commissions.

- Wealth Managers: Cater to high-net-worth individuals and provide a wide range of services, including estate planning and tax strategies.

- Registered Investment Advisors (RIAs): Fiduciaries registered with regulatory bodies such as the SEC or SEBI, offering highly personalized services.

Each type serves different client needs, levels of engagement, and portfolio sizes.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Qualifications and Certifications

Professional investment advisors often possess various educational and industry certifications to establish credibility:

- Academic Background: Bachelor’s degree in finance, economics, accounting, robo advisor or business.

- CFA (Chartered Financial Analyst) – Global standard for investment analysis and portfolio management.

- CFP (Certified Financial Planner) – Focuses on holistic financial planning.

- CPA (Certified Public Accountant) – Useful for clients with complex tax and financial needs.

- ChFC (Chartered Financial Consultant) – Offers expertise in financial planning.

- Series 65 or Series 66 (U.S.) – Required for providing investment advice.

- NISM Certification (India) – Required under SEBI for investment advisors.

- Fiduciary Standard: Advisors must act solely in the client’s best interest, disclosing conflicts of interest, robo investing and prioritizing client outcomes over personal gains. Common among RIAs and fee-only planners.

- Suitability Standard: Common among brokers, this standard requires that recommendations merely be suitable for the client, not necessarily optimal.

- Credentials and Regulatory Compliance

- Experience and Track Record

- Fiduciary Status

- Client Specialization (e.g., retirees, business owners)

- Communication Style and Availability

- Technology and Tools Offered

- Transparency in Fees

- SEC (U.S.): Requires RIAs with $100M+ AUM to register and adhere to fiduciary duties.

- FINRA: Regulates brokers and enforces suitability standards.

- SEBI (India): Mandates licensing, fee models, and disclosure norms for investment advisors.

- Registration and continuing education

- Disclosure of conflicts

- Client agreement requirements

- Maintenance of audit trails

Certifications:

Licensing Exams:

Certifications demonstrate expertise and adherence to professional standards.

Fiduciary vs Suitability Standard

Understanding the ethical standards guiding an advisor’s recommendations is vital:

Clients should inquire about the advisor’s duty of care and request a fiduciary oath when possible.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Advisor Compensation Models

In investment banking, advisor compensation models refer to the ways in which financial advisors or investment bankers are paid for their services, particularly in mergers and acquisitions (M&A), capital raising, and strategic advisory roles. The most common model is the success fee, where the advisor receives a significant payment only if the transaction is completed. This aligns the advisor’s interests with the client’s objectives but may also encourage pushing deals through. Another common structure is the retainer fee, a fixed, non-refundable payment made upfront or at regular intervals to secure the advisor’s ongoing services, regardless of the deal’s outcome. Often, compensation combines both models: a smaller retainer to cover initial work and a larger success fee upon deal closure. In some cases, tiered fee structures are used, where the advisor earns a higher percentage based on the deal’s size or performance benchmarks. Additionally, in equity or venture transactions, advisors might receive equity compensation or warrants.

These models are designed to balance risk and reward, motivate performance, and reflect the complexity and value of the advisory work involved. Ultimately, the chosen model depends on the client’s needs, the transaction type, and the advisor’s negotiating power.

How to Choose an Advisor

Selecting the right advisor involves evaluating several factors:

Clients should interview multiple advisors, Risk management review disclosures, and seek referrals before finalizing.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Regulatory Oversight (e.g., SEBI, SEC)

Regulatory bodies oversee investment advisors to protect investor interests:

Key regulations include:

Regulatory frameworks ensure transparency and reduce fraud.

Conclusion

Investment advisors play a crucial role in guiding clients through financial decisions, market complexities, robo investing and life transitions. Their value lies not just in selecting investments, but in building trust,financial planning strategically, Risk management,Common Advisor Tools and delivering consistent performance. Whether working with a robo-advisor, an independent fiduciary, or a full-service wealth manager, investors benefit from informed, disciplined, and personalized financial guidance. As the financial landscape continues to evolve, types of advisors, robo advisor Suitability choosing the right advisor remains one of the most impactful decisions a client can make for their financial future.