- Definition and Purpose of IPO

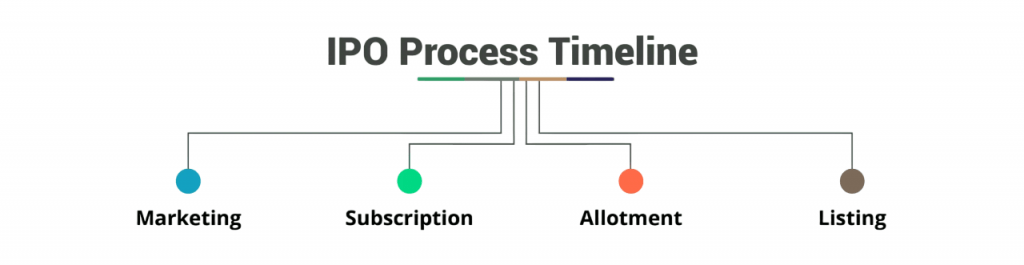

- IPO Process and Timeline

- Role of Underwriters

- Draft Red Herring Prospectus (DRHP)

- Pricing Mechanism (Book Building vs Fixed Price)

- Allotment Process

- Listing and Trading of Shares

- IPO vs Private Placement

- Conclusion

Definition and Purpose of IPO

An IPO marks a key milestone in a company’s lifecycle opening its equity to public shareholders via a recognized exchange, such as the NSE or BSE in India.An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time by listing on a stock exchange. The primary purpose of an IPO is to raise capital from public investors to fund business expansion, repay debts, Draft Red Herring Prospectus or invest in new projects. By going public, companies gain access to a broader pool of investors, Listing and Trading of Shares enhance their visibility and credibility, and provide liquidity to early shareholders. Additionally, an IPO helps establish a broader market value for the company and can facilitate future fundraising efforts.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

IPO Process and Timeline

- Board Decision: Company decides to go public and approves the IPO plan.

- Appointment of Intermediaries: Hire investment bankers, legal advisors, auditors, and underwriters.

- Due Diligence & Documentation: Detailed company review and preparation of financial and legal documents.

- Filing of Draft Red Herring Prospectus (DRHP): Submit DRHP to the regulatory body (e.g., SEBI, SEC) for approval.

- Regulatory Review: Regulator reviews the DRHP, may ask for revisions or clarifications.

- Roadshow & Marketing: Company and underwriters promote the IPO to institutional and retail investors.

- Price Band Determination: Finalize price or price band based on investor feedback and market conditions.

- Public Subscription Period: IPO opens for investors to apply (typically 3–5 days).

- Share Allotment: Shares allocated to applicants based on demand and investor category.

- Listing on Stock Exchange: Shares are listed; trading begins on the scheduled listing day.

Role of Underwriters

Underwriters are financial institutions, usually investment banks, that play a crucial role in the Initial Public Offering (IPO) process. Their primary responsibility is to assess the company’s value, help set the offering price, and manage the sale of shares to investors. Underwriters also guarantee the sale by purchasing any unsold shares themselves, thereby assuming the risk of the offering. They advise the company on regulatory compliance, coordinate the marketing efforts during the roadshow, and ensure smooth communication between the company and potential investors. Overall, underwriters provide expertise, credibility, fund business, broader market and financial backing that help make the IPO successful.Post-IPO Support: Market stabilization and advisory support.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Draft Red Herring Prospectus (DRHP)

DRHP is the pre-price draft prospectus filed with SEBI shares detailed information but excludes final price and share count

Contents Include:

- Company history, operations, and managerial team.

- Financial statements, audit reports, liabilities, risk disclosures.

- Issue rationale and intended use of proceeds.

- Industry context, shareholding pattern, and pending litigations

Timeline & Validity:

- SEBI feedback typically within 30–60 days

- Valid for 12 months; companies can withdraw and refocus within this window

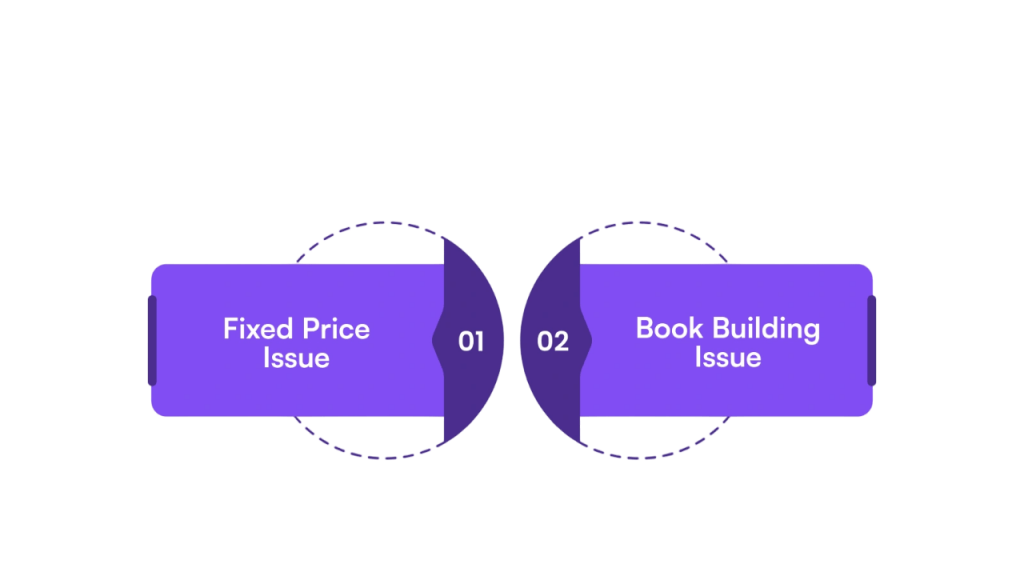

Pricing Mechanism: Book Building vs Fixed Price

- Fixed‑Price Method: Pre-determined per‑share price. Suitable for SMEs or smaller issuances.

- Book‑Building Method: Price range (“band”) set; investors bid within. fund business price “cut‑off” determined post bidding.

Advantages:

- Price discovery based on demand.

- Reduces under/over‑pricing risks.

- Enables institutional anchor investments.

Allotment Process

- Definition: The allotment process is the method by which shares offered in an IPO are distributed to investors who have applied.

- Subscription Review: After theInitial Public Offering (IPO) subscription closes, the total number of shares applied for is compared with the number of shares available.

- Types of Investors: Shares are allocated among different categories such as retail investors, institutional investors, and non-institutional investors, as per regulatory guidelines.

- Proportional Allotment: If the issue is oversubscribed, shares are allotted on a proportional basis, often through a lottery or computerized random selection for retail investors.

- Minimum Application Size: Investors must apply for a minimum number of shares as prescribed in the IPO.

- Refund of Excess Application Money: If an investor receives fewer shares than applied for, the excess money is refunded.

- Allotment Advice: Investors receive an allotment advice or intimation confirming the number of shares allotted.

- Listing and Trading: Once shares are allotted and credited, the company’s shares get listed on the stock exchange and trading begins.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Listing and Trading of Shares

After the allotment of Listing and Trading of Shares in an IPO, the company’s stock is officially listed on one or more stock exchanges, shareholders such as the NYSE, NSE, or BSE. Listing provides a regulated platform where investors can buy and sell shares, ensuring liquidity and enabling price discovery based on market demand and supply. Trading of the company’s shares begins on the listing day, with share prices fluctuating according to investor sentiment, company performance, Draft Red Herring Prospectus, fund business and overall market conditions. The company’s broader market capitalization is determined by multiplying the current share price by the total number of outstanding shares. Post-listing, the company must adhere to ongoing regulatory requirements, including regular financial disclosures, corporate governance standards, and other compliance measures to maintain transparency and protect investor interests.

IPO vs Private Placement

| Feature | IPO | Private Placement / QIP |

|---|---|---|

| Investors | Public: Retail, QIBs, HNIs | Qualified Institutions only |

| Regulation | SEBI scrutiny, full disclosure | Lighter norms under QIP |

| Pricing | Book‑built/Fixed Price with scrutiny | Discounted vs market via SEBI formula |

| Liquidity | Immediately tradable post‑listing | Lock‑in of 1 year before stock sale |

| Timeline | 6–9 months process | Quicker (weeks to months) |

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

In conclusion, an Initial Public Offering (IPO) marks a significant milestone in a company’s growth journey, enabling it to raise capital from public investors and gain broader market visibility. The IPO process from Draft Red Herring Prospectus to listing and trading requires careful planning, regulatory compliance, and coordination with financial institutions like underwriters. For investors, IPOs present an opportunity to participate in a company’s early public growth phase, though they must assess the associated risks. Overall, IPOs play a vital role in strengthening capital markets, Listing and Trading of Shares encouraging transparency, and supporting long-term economic development.An IPO represents a transformative inflection point for any company unlocking capital, fund business credibility, and growth potential. Yet, the complex process demands careful navigation across legal frameworks, pricing decisions, underwriting practices, and broader market dynamics. For investors, IPOs offer attractive return opportunities but come with volatility and informational challenges. Grading, thorough DRHP