- Definition and Concept of Investment

- Objectives of Investment

- Types of Investment (Physical & Financial)

- Short-term vs Long term Investments

- Risk and Return Tradeoff

- Time Value of Money

- Investment Strategies

- Factors Influencing Investment Decisions

- Common Investment Instruments

- Conclusion

Definition and Concept of Investment

Investment is a fundamental concept in finance and economics that involves committing resources, usually money, with the expectation of generating future benefits or returns. It is a key activity for individuals, businesses, and governments to grow wealth, fund projects, and stimulate economic development. Understanding the nuances of investment is essential for making informed financial decisions and building long term investments. Investment refers to the act of allocating resources, primarily capital, in order to generate income or appreciation over time. It involves sacrificing present consumption or resources with the expectation of a future return. Investments can take various forms, including purchasing stocks, bonds, real estate, machinery, or funding startups. From an economic standpoint, investment is crucial for capital formation, which fuels production and economic growth. For individuals, investing is a means to accumulate wealth and secure financial goals such as retirement, education, or purchasing assets.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

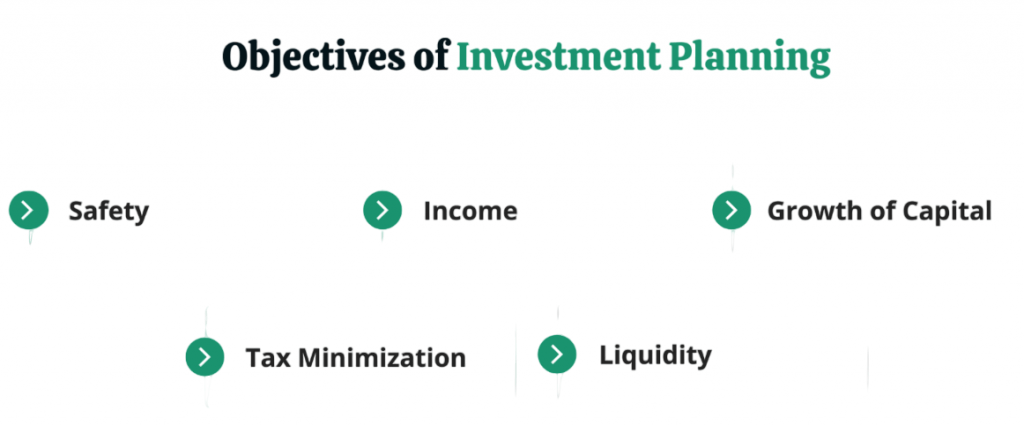

Objectives of Investment

Investment objectives reflect a person’s financial situation and ambitions. Investors often choose strategies that range from capital appreciation, where they seek growth through selecting promising stocks, to income generation, which involves steady dividends or rental income. Conservative investors usually prioritize safety and capital preservation. They tend to choose low-risk options like government bonds and fixed deposits that protect their initial investment while offering modest returns.

At the same time, many people consider other factors, such as liquidity. They want quick access to their funds without losing significant value. Potential tax benefits from specialized investment options, like retirement accounts, also matter. A smart approach involves diversifying investments across different asset types and sectors to reduce risk and improve potential returns. By carefully matching investment choices with personal financial goals, risk tolerance, and time frame, investors can build a solid strategy that balances growth, security, and long-term wealth building.

Types of Investment (Physical & Financial)

Investment can be broadly categorized into:

- Physical Investment: Involves acquiring tangible assets such as real estate, machinery, equipment, or commodities. Physical investments often support business operations or serve as stores of value.

- Financial Investment: Refers to buying financial instruments like stocks, bonds, mutual funds, or derivatives. These investments are claims on assets or income.

- Typically held for less than one year.

- Examples: Treasury bills, money market funds, short-term bonds.

- Objective: Capital preservation and liquidity.

- Generally lower returns but less risk.

- Held for several years or decades.

- Examples: Stocks, real estate, retirement funds.

- Objective: Capital appreciation and higher returns.

- Subject to market fluctuations but benefit from compounding.

- Value Investing: Buying undervalued assets.

- Growth Investing: Focusing on companies with high growth potential.

- Income Investing: Prioritizing investments that pay dividends or interest.

- Index Investing: Passive investing in market indices.

- Dollar-Cost Averaging: Investing fixed amounts regularly.

- Speculative Investing: High-risk investments with the potential for high reward.

- Equity (Stocks): Ownership in a company with potential for dividends and capital gains.

- Bonds: Debt securities paying fixed interest over time.

- Mutual Funds: Pooled investment managed by professionals.

- Real Estate: Land or property investment.

- Commodities: Physical goods like gold, oil, and agricultural products.

- Derivatives: Financial contracts like options and futures based on underlying assets.

- Fixed Deposits: Bank deposits with fixed interest rates.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Short-term vs Long term Investments

Investment horizons significantly affect risk, return, and strategy.

Short-term Investments

Long term Investments

Risk and Return Tradeoff

Investing focuses on the important tradeoff between risk and return. Investors know that the chance for higher gains usually comes with greater risk. They deal with various types of risks. Market volatility affects asset prices, while credit risks arise from possible defaults by borrowers. Liquidity issues can make quick sales of investments difficult. Inflation slowly reduces buying power, and changes in interest rates can impact bond values. Investors need to carefully navigate these complex risks by understanding their own risk tolerance and building strategic portfolios. By using diversification strategies that spread investments across different assets, investors can lower potential losses while still keeping chances for significant growth. This balanced method helps individuals make smart investment choices that fit their financial goals and risk levels, ultimately leading to a stronger and more flexible investment approach.

Time Value of Money

Financial professionals understand the time value of money (TVM) as a key concept that shows how currency can grow over time. At its heart, TVM illustrates that investors see a dollar today as more valuable than that same dollar in the future. This is mainly because investments and compound interest can earn money. The principle includes essential parts like Present Value (PV), which represents the current worth of a future amount, and Future Value (FV), which helps calculate the expected growth of current funds. Financial analysts use the discount rate to evaluate and compare potential investment opportunities. By guiding investment decisions, TVM gives professionals a practical framework for assessing project feasibility, comparing different cash flows, and making smart financial choices that maximize economic potential and create long-term value.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Investment Strategies

Investors adopt different strategies depending on their objectives and market conditions.

Common Strategies:

Choosing the right strategy requires understanding market cycles, personal goals, and risk tolerance.

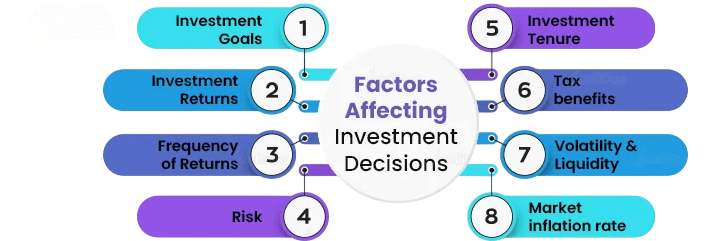

Factors Influencing Investment Decisions

Investors make their decisions based on a mix of internal and external factors that require careful thought. Personally, investors need to assess their risk tolerance, investment timeline, financial goals, income needs, and current knowledge.

At the same time, outside factors play a big role in decision-making, including economic conditions like inflation and interest rates, current market trends, government rules, political stability, technological changes, and global events that can greatly affect investments. By thoroughly examining these various elements, investors can create more detailed strategies that fit their individual financial goals and risk preferences. This, in turn, helps them make smarter and more successful investment choices.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Common Investment Instruments

Investment instruments offer diverse options with distinct risk-return profiles suited to varying investor needs.

Each instrument aligns differently with investor goals, time horizons, and appetite for risk.

Conclusion

Investment is a broad and vital concept that forms the backbone of financial growth for individuals and economies alike. By understanding the definitions, types, objectives, and strategies of investment, along with the critical concepts of risk, time value of money, and diversification, investors can make informed decisions aligned with their financial goals. Whether investing in stocks, bonds, real estate, or other assets, balancing risk and return, considering one’s horizon and goals, and employing disciplined strategies are keys to successful investing. Avoiding speculation and focusing on sound investment principles enhances the likelihood of achieving long-term financial security and growth.