- Overview of the Profession

- Career Prospects and Growth

- Salary and Compensation

- Prestige and Networking

- Skill Development

- Work-Life Balance

- Exit Opportunities (PE, VC, Corporate)

- Job Security and Market Volatility

- Conclusion

Overview of the Profession

Investment banking primarily involves advising companies, governments, and institutions on raising capital, mergers and acquisitions (M&A), and other strategic financial decisions. Banks act as intermediaries, helping clients issue securities, evaluate investments, and execute complex financial transactions.Investment banking is often seen as one of the most prestigious and lucrative careers in finance. It attracts some of the brightest minds due to its promise of high compensation, intense learning, and influential deal-making roles. However, it also comes with significant challenges, demanding work hours, and high stress. This article explores whether investment banking is a good career choice by examining various dimensions such as career prospects, compensation, skill development, and personal fit.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Career Prospects and Growth

- High Earning Potential: Investment banking offers some of the highest salaries and bonuses in the finance industry.

- Fast Career Progression: Clear promotion path from Analyst → Associate → VP → Director → Managing Director.

- Diverse Exit Opportunities: Opens doors to private equity, hedge funds, corporate finance, venture capital, and consulting.

- Global Opportunities: Work with international clients and deals, often leading to overseas placements or transfers.

- Prestige & Recognition: Roles at top banks (bulge bracket or elite boutiques) carry significant industry prestige.

- Strong Skill Development: Builds expertise in financial modeling, valuation, negotiation, and deal execution.

- Networking Powerhouse: Extensive exposure to high-level clients, executives, and industry leaders.

- Demanding Work Environment: Long hours and high pressure, but offers fast learning and steep professional growth.

- Highly Competitive Entry: Requires strong academic background, internships, and technical/soft skills.

- Long-Term Stability: Despite market cycles, mergers and acquisitions skilled bankers remain in demand for strategic financial roles.

Salary and Compensation

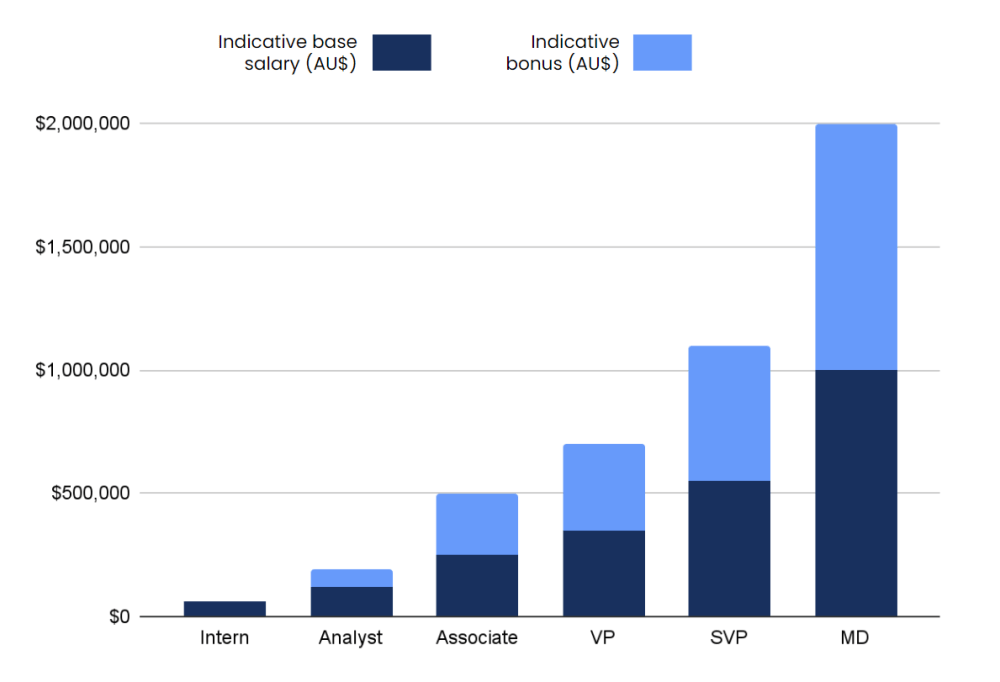

Salary and compensation in investment banking are among the most competitive in the financial services industry. Entry-level analysts at top investment banks typically earn a base salary ranging from $85,000 to $120,000 annually, with performance bonuses that can significantly increase total compensation often bringing the total to $140,000–$200,000 or more in the first year.

As professionals move up the ranks to associate, vice president, and managing director roles,Prestige and Networking both base pay and bonuses increase substantially. Managing directors at major banks can earn well into the seven figures, especially when involved in high-value deals. Bonuses in investment banking are usually tied to individual performance, group success, prestigious ,mergers and acquisitions and overall firm profitability, creating a highly results-driven environment. In addition to financial rewards, compensation packages often include benefits such as healthcare, retirement plans, Career Prospects and, at senior levels, stock options or profit-sharing. While the pay is attractive, it comes with long hours, high pressure, and demanding work loads especially for junior bankers. Nonetheless, for those who can manage the lifestyle, investment banking offers financial rewards that are difficult to match in most other industries.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Prestige and Networking

Prestige

- Investment banking holds a prestigious reputation due to.

- Association with major corporate deals.

- Influence over capital markets and economies.

- Strong brand recognition of top global banks.

Networking

- Exposure to senior corporate executives, entrepreneurs, investors, and government officials.

- Opportunities to build a powerful professional network.

- Alumni connections that facilitate future career moves.

Skill Development

Technical Skills

- Financial modeling and valuation.

- Understanding of capital markets and instruments.

- M&A structuring and due diligence.

Soft Skills

- Negotiation and communication.

- Presentation and client management.

- Time and project management.

The skills gained are highly transferable to other finance roles like private equity, venture capital, corporate development, and entrepreneurship.

Work-Life Balance

Work-life balance is one of the most commonly cited challenges in investment banking, especially at the analyst and associate levels. Professionals in the industry often work extremely long hours routinely 70 to 100 hours per week depending on deal flow and deadlines. Late nights, weekend work, and unpredictable schedules are common, particularly during live transactions or intense client demands. This demanding environment can take a toll on physical and mental health, relationships, and personal time. While some banks have recently introduced policies to promote better work-life balance such as protected weekends or caps on working hours these are not always consistently enforced.

The culture of “always being available” remains prevalent, Career Prospects, Prestige and networking especially at top-tier firms. That said, many professionals accept these trade-offs early in their careers in exchange for high compensation, fast career growth, and strong exit opportunities. For those who can manage the pressure, prestigious , investment banking can be incredibly rewarding but it requires strong time management, discipline, and a clear understanding of personal limits.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Exit Opportunities (Private Equity, Venture Capital, Corporate)

- Private Equity (PE): Many bankers transition to PE firms, leveraging deal experience and financial skills.

- Venture Capital (VC): B experience provides a strong foundation for evaluating startups and growth investments.

- Corporate Finance / Development: Corporations value former bankers for strategic planning, M&A, and capital raising roles.

- Entrepreneurship and Consulting: Some bankers use skills and networks to launch startups or move to consulting roles.

Job Security and Market Volatility

Job security in investment banking is closely tied to market conditions and deal activity, making it more volatile than in many other industries. When markets are strong, deal flow increases, and banks actively hire to support mergers, acquisitions, IPOs, and capital raises. However, during economic downturns or financial crises, firms may implement hiring freezes, cut bonuses, or lay off employees particularly at the junior and mid-levels. Roles tied to market-dependent activities, such as mergers and acquisitions and capital markets, tend to be more sensitive to volatility. While top performers and professionals in essential functions often retain their positions, private equity even experienced bankers are not immune to cyclical headwinds. That said, investment banking is still considered a strong long-term career path due to its high earning potential, transferable skills, and access to prestigious exit opportunities. Professionals who build broad expertise, strong client relationships, and adaptability are better positioned to weather market fluctuations and maintain job security over time.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

Investment banking can be an excellent career for driven, ambitious individuals seeking challenging work, rapid financial rewards, and extensive networking opportunities. However, it demands sacrifices in personal time and mental well-being. Understanding your personal goals and tolerance for pressure is essential to determine if investment banking is the right career for you.In conclusion, a career in investment banking offers immense opportunities for financial growth, skill development, prestige and networking and professional prestige. From the analyst level to senior leadership, individuals gain hands-on experience in high-stakes transactions, financial modeling, and strategic advisory work. However, this path comes with significant challenges: long hours, high pressure, mergers and acquisitions and sensitivity to market cycles. Success in this field requires not only technical expertise but also resilience, adaptability, and strong interpersonal skills. For those who are ambitious, driven, and ready to commit to a demanding yet rewarding environment, investment banking can be an excellent career choice with a wide range of future opportunities, both within and beyond the industry.