- Starting as an Analyst

- Analyst to Associate Progression

- Associate to VP

- Vice President to Director

- Director to Managing Director

- Responsibilities at Each Level

- Timeline for Promotions

- Skills for Advancement

- Conclusion

Starting as an Analyst

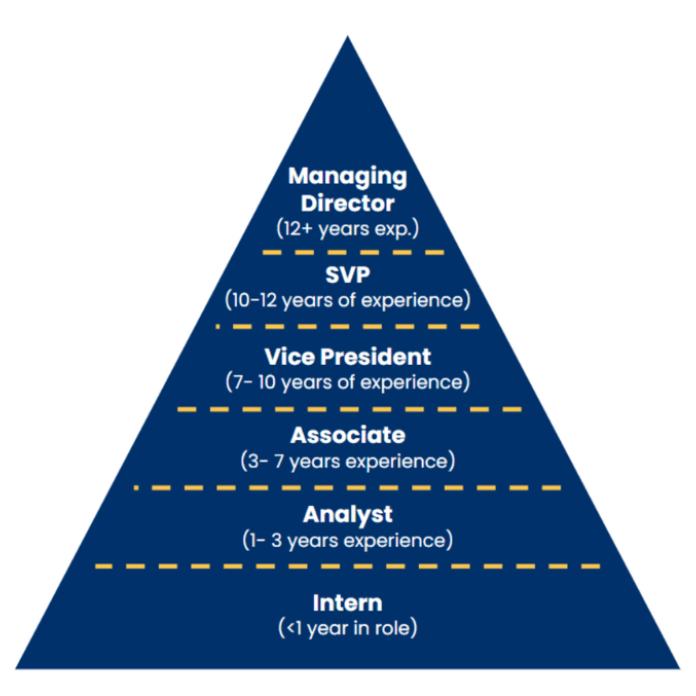

The journey in investment banking typically begins at the analyst level, the foundation on which a successful banking career is built.Investment banking is known for its lucrative pay and steep learning curve, but it is equally recognized for its demanding work environment and clear hierarchical career progression. For many finance professionals, understanding the typical investment banking career path is crucial to navigating their roles, setting expectations, and planning for long-term growth. This article offers an in-depth look into the stages of an investment banking career, from entry-level analyst to managing director, along with responsibilities, timelines, skills required, mentorship, mobility,Timeline for Promotions and global opportunities.Starting as an Analyst in investment banking marks the entry point into one of the most demanding and prestigious roles in finance. Typically recruited straight out of undergraduate programs, analysts are the backbone of deal execution, responsible for building complex financial models, preparing pitch books, conducting market research, and supporting senior bankers on mergers, acquisitions, IPOs, and other transactions. The learning curve is steep and the hours are long, often 70 to 100 per week but the role provides unparalleled exposure to high-profile deals and seasoned professionals. It’s a rigorous environment that tests attention to detail, stamina, and problem-solving under pressure. For those who excel, the Analyst role can be a powerful launchpad, leading to promotion to Associate, entry into top MBA programs, or opportunities in private equity, hedge funds, or corporate strategy.

Analyst to Associate Progression

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today! The move from associate to VP usually takes around 3-5 years and marks a significant step in responsibility. Expanded Responsibilities Skills Required Challenges Would You Like to Know More About Database? Sign Up For Our Database Online Training Now! Promotion from VP to Director or Executive Director (title varies by bank) often occurs after another 3-5 years, subject to deal success and client development. Director’s Role Compensation and Status The final step in the traditional investment banking career path hierarchy is the promotion to Managing Director (MD), often after 5-7 years as Director. Managing Director Responsibilities Influence and Leadership Selectivity and Pressure

Associate to Vice President (VP)

Vice President to Director

Director to Managing Director

- Fewer bankers make it to this level; promotion is highly selective.

- MDs face intense pressure to consistently deliver revenue and maintain client satisfaction.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Responsibilities at Each Level

Understanding the evolving responsibilities is key to preparing for career growth.

- Analyst: Financial modeling, research, pitch book preparation

- Associate: Supervision, client interaction, quality control

- Vice President: Project management, client communication, deal execution

- Director: Business origination, team leadership, mentoring

- Managing Director: Client relationship management, strategic leadership, revenue generation

Each level demands a shift from technical proficiency to leadership investment banking career path and strategic business development.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Timeline for Promotions

While Timeline for Promotions vary by bank and individual performance, a typical career progression might look like this:

- Analyst: 2-3 years

- Associate: 3-5 years

- Vice President: 3-5 years

- Director: 5-7 years

Banks often conduct annual or biannual reviews to evaluate readiness for promotion.

Skills for Advancement

Beyond technical knowledge, several skills become increasingly critical:

- Communication: Clear, persuasive communication for pitching and negotiating.

- Leadership: Managing teams, motivating juniors, and conflict resolution.

- Client Management: Building and sustaining long-term client relationships.

- Time Management: Handling multiple deals under tight deadlines.

- Strategic Thinking: Anticipating market trends and client needs.

Continuous learning and adaptability remain essential throughout the career.

Conclusion

In conclusion, starting as an Analyst in investment banking sets the foundation for a fast-paced and rewarding career in finance. While the role demands long hours, precision, Timeline for promotions and resilience, it offers exceptional training, exposure to complex transactions, and a clear pathway for advancement. Whether your goal is to rise through the ranks to Associate and beyond, pursue an MBA, or transition to the buy-side, the Analyst position is a critical first step that opens doors to a wide range of high-impact opportunities in the financial world.The investment banking career path in India is demanding but rewarding, offering a clear progression from analyst to managing director, each stage marked by increasing responsibility, skill, and compensation. Success requires technical excellence, strategic client management, leadership, and resilience under pressure. While some may plateau or choose to exit, many find global opportunities and long-term growth within the sector. Understanding this pathway helps aspiring bankers navigate their careers with realistic expectations and deliberate planning.