- Introduction to Asset Management

- Institutional vs Retail Asset Management

- Asset Management Companies (AMCs)

- Portfolio Management Services (PMS)

- Asset Classes: Equity, Debt, Real Estate

- Fund Management Strategies

- NAV Calculation and Benchmarking

- Performance Evaluation and Ratios

- Regulatory Oversight (SEBI, AMFI)

- Trends in Global Asset Management

- Conclusion

Introduction to Asset Management

Asset management involves the professional management of investment portfolios such as equities, bonds, real estate, and alternatives on behalf of clients, aiming to meet their specified investment objectives through tailored strategies. Asset managers analyze markets, construct portfolios, execute trades, monitor performance, and report to stakeholders. Asset managers are vital to the financial system. They offer investment solutions to a variety of clients. They set asset allocations, create new investment products, and carefully assess risks and opportunities. Using advanced tools and platforms, these professionals make precise investment decisions that match their clients’ goals. They also provide important reports on performance, compliance, and valuation, serving many stakeholders, including individual investors, institutional clients such as pension funds and endowments, and government entities. This diverse approach helps asset managers improve investment strategies, reduce risks, and achieve steady financial results for their clients.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

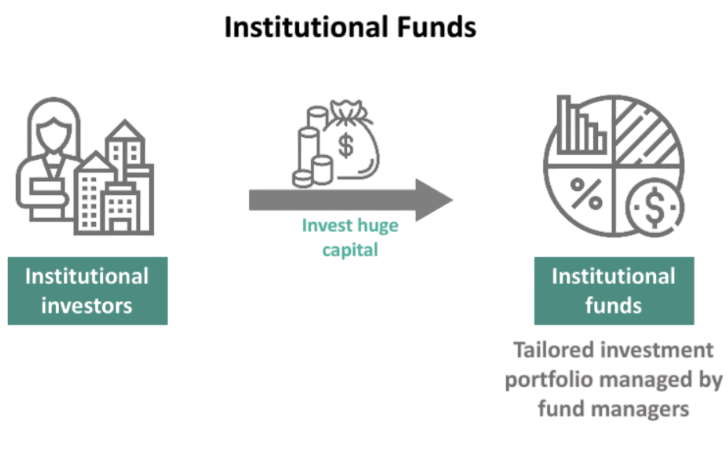

Institutional vs Retail Asset Management

Institutional asset managers and retail asset management use two different but connected approaches to investment strategies. They tailor solutions to meet specific client needs. Large institutional clients, such as pension funds, sovereign wealth funds, insurers, and endowments, focus on custom mandates and liability-driven strategies. These strategies use advanced asset allocation techniques, including private markets and complex overlays. Sophisticated approaches support these strategies through economies of scale and detailed institutional-grade reporting.

In contrast, retail asset managers assist individual investors with accessible options like mutual funds, ETFs, and portfolio management services. They prioritize affordability, ease of use, and standardized products available to a wide audience. While both groups share basic investment goals, they differ greatly in scale, complexity, and personalization. Institutional management offers highly customized solutions, while retail management provides more standardized, regulatory-compliant retail asset management options that aim to meet the varied needs of individual investors.

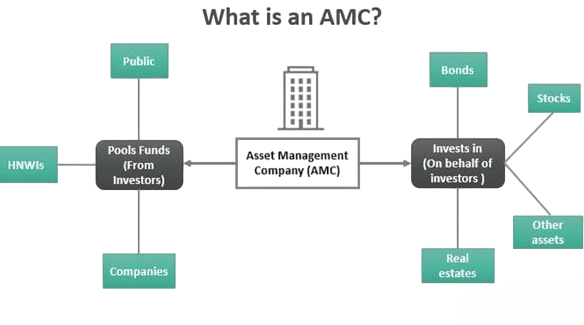

Asset Management Companies (AMCs)

“AMC” denotes both global giants (e.g., BlackRock, Vanguard) and regional players. In India, prominent AMCs include ICICI Prudential, UTI Asset Management, and SBI MF.

AMC Roles:

- Product creation and offering (equity, debt, hybrid funds)

- Portfolio governance and manager selection

- Distribution via brokers, platforms, and digital channels

- Investor communications, education, and service

Indian AMCs are organized under AMFI, which enforces ethics, disclosure norms, industry advocacy, and the “Mutual Funds Sahi Hai” awareness campaign.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Portfolio Management Services (PMS)

Portfolio management services are customized discretionary accounts offering tailor-made portfolios (e.g., concentrated equity, real estate, alternatives), typically designed for high-net-worth clients.

Features:

- Minimum AUM threshold (₹50 lakh+ in India)

- Personalized investment objectives

- Higher fees but bespoke advice

Portfolio management services complement standardized retail products and offer greater flexibility to affluent investors.

Asset Classes: Equity, Debt, Real Estate

In today’s changing investment landscape, savvy investors need a smart approach to asset allocation. Equity investments offer strong growth potential, but they come with higher market volatility. On the other hand, debt instruments provide stable returns and important diversification for portfolios. Real estate stands out as a solid asset, delivering consistent cash flows and acting as a strong shield against inflation. More and more, savvy investors are looking beyond the norm by adding alternative investments like private equity, hedge funds, credit instruments, and new digital assets like cryptocurrency. These alternatives are gaining popularity as investors aim for better returns and more refined diversification strategies beyond traditional markets. By carefully balancing these different asset classes, investors can build strong portfolios that are ready to handle complex market conditions.

Fund Management Strategies

In the fast-changing world of investment management, strategies differ between active and passive approaches, each with its own benefits. Active managers pick securities, position sectors, and time markets to do better than benchmarks. In contrast, passive managers track indices efficiently and at a low cost, especially using exchange-traded funds (ETFs). Investors use various methods, including value, growth, and income investing. They also apply advanced techniques like beta alignment, thematic investments in new areas such as AI and ESG, and multi-asset absolute return strategies. Decision-makers carefully consider investment goals, current market conditions, and competition. This helps them navigate complex financial environments effectively.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

NAV Calculation and Benchmarking

NAV (Net Asset Value) per unit = (Total portfolio value − liabilities) ÷ outstanding units. NAV reflects fund valuation daily/weekly depending on product type. Benchmarking measures performance relative to relevant indices. Institutional investors also compare against economic measures and peer groups to evaluate alpha generation.

Performance Evaluation and Ratios

Key Metrics:

- Absolute & Relative Return: Measures total return and performance versus benchmark

- Sharpe Ratio: Assesses risk-adjusted return by comparing excess return to volatility

- Alpha & Beta: Indicates excess return and sensitivity to market movements

- Sortino Ratio: Highlights return per unit of downside risk

- Tracking Error: Quantifies deviation from benchmark returns

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Regulatory Oversight (SEBI, AMFI)

India:

- SEBI: Regulates fund structure, disclosures, investor rights, cybersecurity, valuation standards

- AMFI: Promotes ethics, standardized practices, and retail investor awareness

- RegTech: Facilitates compliance with GDPR, DORA, cybersecurity, and digital asset rules

- ESG Frameworks: Standards like UNPRI and EU SFDR reduce greenwashing and embed sustainability mandates

Global:

Trends in Global Asset Management

- Digital & AI Integration: AI, ML, and predictive analytics are scaling portfolio optimization, risk modeling, and operations (60–70% adoption expected by 2025)

- ESG & Sustainable Investing: ESG assets exceeded 783,698.61 (2021); global ESG AUM projected to reach 383,702.12 by 2025, signaling institutional realignment

- Alternative & Private Markets: Private equity, credit, and real assets set to grow from 383,698.61 to 1,752.09 by 2030; tokenization and private indices expanding access

- Digital Distribution & Customization: Robo-advisors, direct-to-consumer channels, and app-based delivery enhance personalization and scale

- Talent & Cyber Risk: 20% growth in demand for quant finance talent; cybersecurity and DORA compliance remain top priorities

- Geopolitical Shifts & Allocation: Rising non-U.S. equity exposure, $167 bn crypto fund inflows (May 2025), and increased central bank gold reserves reflect portfolio realignment

Conclusion

Asset managers have changed the field into a complex and ever-changing environment. This landscape features professional oversight, strategic allocation, and careful performance evaluation across various market segments. Professionals are increasingly distinguishing between institutional and retail investment approaches, highlighting key differences in customization and operational size. Strategists are updating asset management strategies through important factors such as active versus passive investment models, greater ESG integration, the use of artificial intelligence, and alternative investment options. Global trends and regulatory demands are reshaping the industry, leading to structural and technological changes.