- Introduction to Financial Securities

- Equity Securities

- Debt Securities

- Derivatives Options Futures

- Structured Products

- Hybrid Instruments

- Legal and Regulatory Environment

- Issuance and Trading

- Valuation of Securities

- Role in Portfolio Management

- Risks Associated with Securities

- Conclusion

Introduction to Financial Securities

Financial securities are tradable financial instruments that represent an ownership position, a creditor relationship, or rights to ownership. They are the backbone of financial markets and come in many forms, including stocks, bonds, options, futures, and more. Securities provide a way for entities such as companies and governments to raise capital, and for investors to deploy their funds in various assets for potential returns. Securities can be broadly classified into two categories: equity and debt. Derivatives, hybrids, and structured products also fall under the securities umbrella, each serving specific functions in the financial ecosystem. Understanding financial securities is fundamental for anyone involved in investing, portfolio management, or corporate finance.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Equity Securities

Equity securities represent ownership in a corporation. They give shareholders a stake in the company’s success, allowing them to benefit from capital appreciation, dividends, and voting rights. The most common form is common stock, which many people hold. It offers voting rights and the possibility of dividends. Preferred stock, on the other hand, provides fixed dividends and a higher claim on assets, but it does not come with voting rights. The price of these securities is influenced by company performance, current market trends, and investor sentiment. This creates a risk-reward situation where the potential for higher returns comes with greater risk compared to debt securities. Because of this, equity securities are crucial for portfolios focused on growth and long-term investment strategies. They attract investors who want to take advantage of a company’s potential.

Debt Securities

Debt securities represent a loan made by an investor to an issuer (typically a corporation or government). These securities obligate the issuer to pay back the principal along with interest.

Types of Debt Securities

- Bonds: Long-term instruments with fixed or variable interest payments.

- Treasury Securities: Government-issued instruments including Treasury bills, notes, and bonds.

- Municipal Bonds: Issued by states or local governments to finance public projects.

- Corporate Bonds: Issued by companies to raise working capital or fund expansion.

Key Concepts

- Face Value: The principal amount to be repaid at maturity.

- Coupon Rate: Interest rate paid periodically to investors.

- Maturity Date: Date when the principal is repaid by the issuer.

Debt securities are ideal for income-focused investors seeking predictable returns.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Derivatives Options Futures

Derivatives Options Futures are financial instruments whose value is derived from an underlying asset, such as stocks, bonds, commodities, or interest rates.

Common Derivatives

- Options: Provide the right, but not the obligation, to buy/sell an asset at a specific price.

- Futures: Obligatory contracts to buy/sell at a future date and price.

- Swaps: Agreements to exchange cash flows or financial instruments.

Uses of Derivatives

- Hedging: Protecting against price movements.

- Speculation: Profiting from price movements.

- Arbitrage: Exploiting price differences in markets.

Derivatives Options Futures are complex but useful tools for managing financial risk.

Structured Products

Structured products offer an interesting option for investors looking for customized investment solutions that fit their risk-return needs. These pre-packaged investments often include derivatives. While they can provide unique opportunities like Equity-Linked Notes (ELNs), Principal-Protected Notes (PPNs), and Credit-Linked Notes (CLNs), they also have complexities that may challenge some investors. These instruments are designed for people with different risk tolerances or specific market views. They may provide conditional returns or strong capital protection features. However, potential investors should be aware of the trade-offs, including the complexities and lower liquidity that often come with these financial products.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

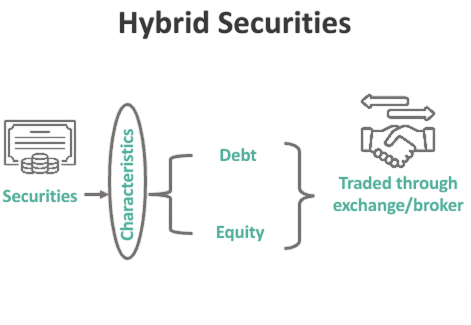

Hybrid Instruments

Hybrid financial instruments offer an interesting investment solution that connects traditional debt and equity options.

These versatile securities give investors remarkable flexibility, making them attractive for those who want a balanced approach to managing their portfolios. By combining elements of both debt and equity, these instruments provide a unique chance to improve financial strategies, especially through potential tax benefits that can increase overall returns. Furthermore, investors who want to generate income while also seeking growth are particularly drawn to these options. They make a smart choice for diversifying investment portfolios with one strategic financial product.

Legal and Regulatory Environment

The trading of financial securities is governed by regulatory bodies to ensure transparency, fairness, and investor protection.

Key Regulatory Agencies

- SEC (U.S.): Oversees securities transactions and protects investors.

- SEBI (India): Regulates the Indian securities market.

- FCA (UK): Financial Conduct Authority monitors financial conduct.

Laws and Guidelines

- Securities Act of 1933 (U.S.): Governs new issues.

- Securities Exchange Act of 1934 (U.S.): Covers trading and reporting.

Regulation mitigates fraud, promotes efficiency, and sustains investor confidence.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Issuance and Trading

Issuance Process

- Equities: IPOs, follow-on public offerings (FPOs).

- Debt: Private placements, public offerings.

- Derivatives: Exchange-traded or over-the-counter.

Trading Mechanisms

- Order Types: Market, limit, stop-loss.

- Platforms: Exchanges, electronic trading systems.

Efficient issuance and trading systems are essential for market liquidity and investor participation.

Valuation of Securities

In the complex world of investment strategy, investors rely on accurate valuation as the foundation for making informed financial decisions. Experienced investors use various methods across different financial instruments to determine true value. These methods include discounted cash flow (DCF) and price multiples for equity, present value calculations for debt, and models like Black-Scholes for derivatives. Macroeconomic factors, such as interest rates, company performance metrics, and overall investor sentiment, influence these valuation methods. By carefully examining these factors, financial professionals gain insights that lead to better investment strategies and risk management, ultimately resulting in a more effective process in present value calculations and financial outcomes.

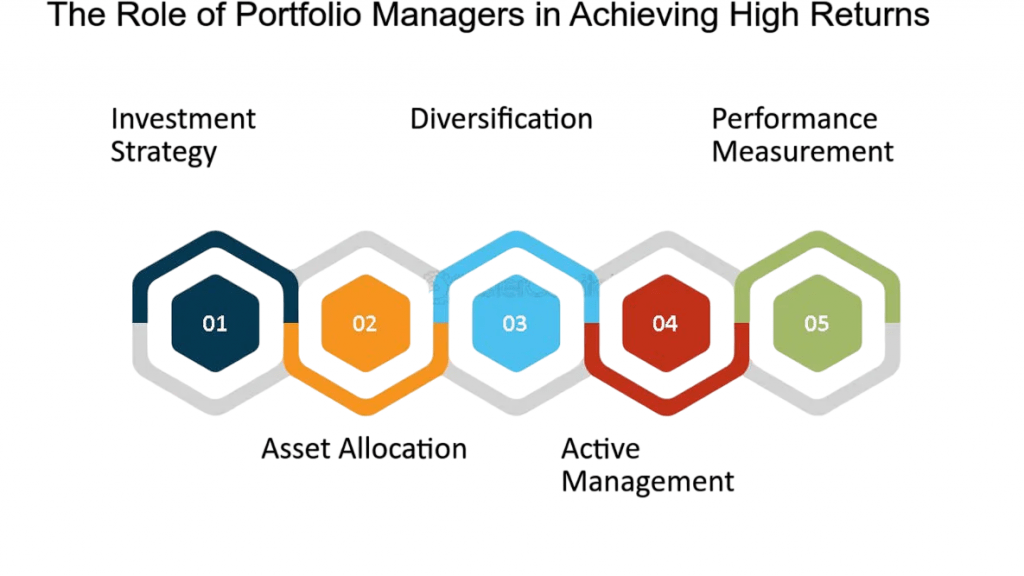

Role in Portfolio Management

Securities are core building blocks of investment portfolios.

- Asset Allocation: Diversifying among equities, debt, and alternatives.

- Risk Management: Using securities with different risk-return profiles.

- Liquidity Management: Ensuring access to cash when needed.

Effective portfolio management balances risk, return, and time horizon based on investor objectives.

Risks Associated with Securities

Every type of security carries inherent risks:

- Equity Risks: Market volatility, business performance.

- Debt Risks: Credit risk, interest rate risk, inflation.

- Derivative Risks: Counterparty risk, leverage, complexity.

- Liquidity Risk: Difficulty in buying or selling without price impact.

- Regulatory Risk: Changes in rules affecting returns.

Risk assessment and diversification are key to managing securities-related exposure.

Conclusion

Financial securities form the foundation of modern capital markets. Whether it is equity for ownership, debt for income, or derivatives for hedging, understanding their functions and risks is crucial for investors and financial professionals alike. From issuance and valuation to trading and regulation, securities offer the tools needed for wealth creation and risk management. With proper knowledge and strategy, investors can leverage these instruments to build robust and diversified portfolios tailored to their financial goals. Many factors can influence these valuation models. Broad economic conditions play a significant role. For example, changes in interest rates can greatly affect present value calculations. A company’s financial health is also crucial. Investors closely examine financial performance metrics. Key ratios like profit margins and debt levels provide important insights. The overall mood of the market matters as well. Investor sentiment, whether positive or negative, can impact asset prices. By breaking down these elements, financial experts gain a deeper understanding. They can identify mispriced assets or possible risks. This knowledge allows them to develop better investment strategies. It also helps them improve risk management methods. Ultimately, this careful approach to valuation leads to better financial outcomes. It helps investors navigate the investment landscape with increased confidence and success.