- Overview of Analyst Role

- Base Salary and Bonus Structure

- Salary Progression by Experience

- Compensation Across Firms (IB, Boutique, Big 4)

- Regional Salary Differences

- Comparison with Other Finance Roles

- Lifestyle and Work Hours

- Pay During Training and Internships

- Exit Opportunities

- Real Analyst Salary Breakdowns

- Conclusion

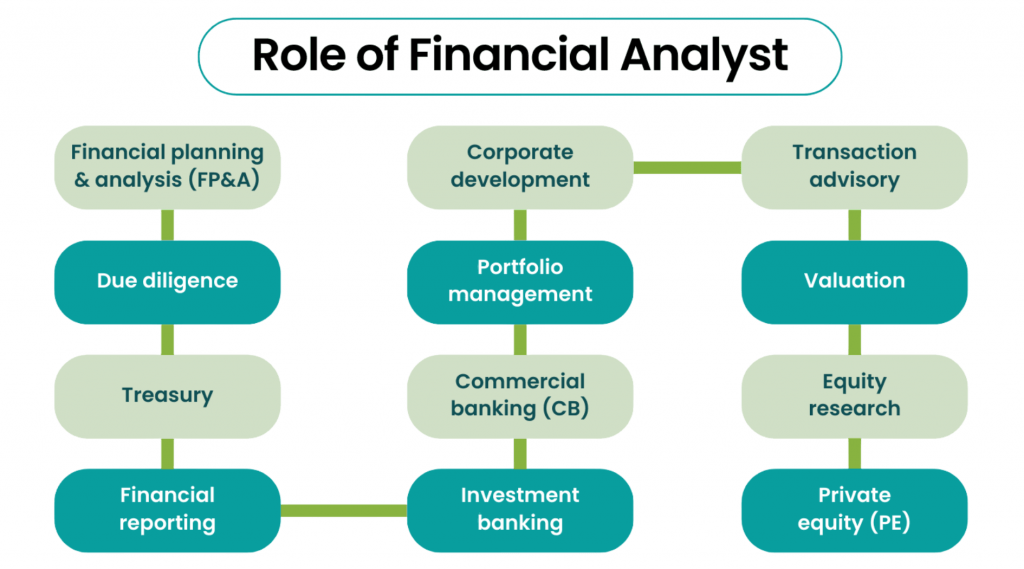

Overview of Analyst Role

An analyst in the finance industry is typically responsible for gathering, interpreting, and analyzing financial data to support strategic decisions. Analysts exist across various financial sectors such as investment banking (IB), corporate finance, asset management, consulting, and auditing. Entry-level analysts are usually recent graduates who work under associates or managers, assisting with financial modeling, preparing presentations, conducting market research, and analyzing industry trends. Depending on the firm, analysts may be in client-facing roles, support internal business decisions, or help execute large-scale transactions. While the core skills of analytical thinking, Excel proficiency, and financial knowledge remain consistent, the responsibilities differ by firm and industry.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Base Salary and Bonus Structure

In the competitive world of financial investment banking analyst salary, firms and sectors show a wide range in analyst base salaries. Entry-level professionals can expect pay between ₹4,990,800 and ₹9,149,800. Investment banking and private equity jobs usually provide the best starting packages, averaging from ₹7,070,300 to ₹8,318,000.

Consulting firms like Big 4 and MBB offer base salaries around ₹5,822,600 to ₹7,486,200, while corporate finance and boutique firms provide slightly lower ranges of ₹4,990,800 to ₹6,654,400. Performance-based bonuses can significantly boost total compensation, with percentages differing greatly across industries. Investment banking analysts might earn bonuses of 50% to 100% of their base salary, but corporate finance roles often have smaller bonuses, typically ranging from 5% to 20%. Firms influence these pay packages through individual performance, team success, and overall financial health, highlighting the competitive and merit-driven environment of financial jobs.

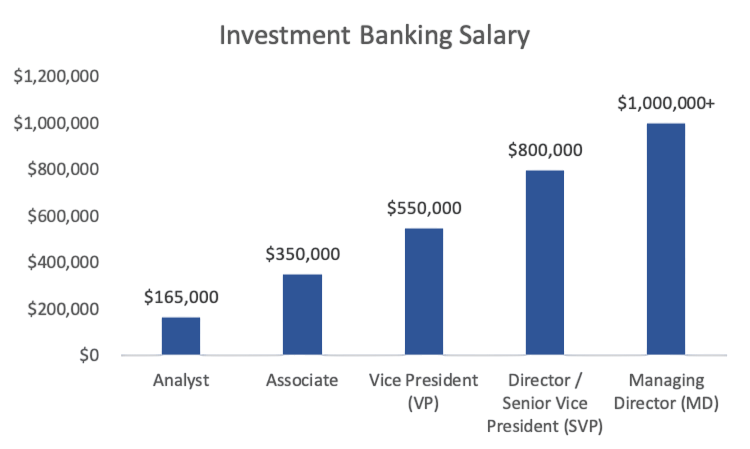

Salary Progression by Experience

The typical career path and investment banking analyst salary progression for an analyst in finance generally follows this pattern:

| Level | Years of Experience | Typical Title | Total Compensation |

|---|---|---|---|

| Entry-Level | 0–2 years | Analyst | ₹80,000–₹150,000 |

| Mid-Level | 2–4 years | Senior Analyst / Associate | ₹120,000–₹250,000 |

| Experienced | 4–7 years | VP / Manager | ₹200,000–₹400,000 |

| Senior Leadership | 7+ years | Director / MD / Partner | ₹400,000–₹1M+ |

Progression speed depends on firm size, performance, and geographic location. In investment banking, analysts are often promoted to associates after 2–3 years.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Compensation Across Firms (IB, Boutique, Big 4)

Below is a comparative overview of base salaries, bonuses, and total first-year compensation across major finance career paths:

Investment Banks (Bulge Bracket):

- Examples: Goldman Sachs, JPMorgan, Morgan Stanley

- Base Salary: ₹100,000

- Bonus: ₹70,000–₹100,000

- Total First-Year Compensation: ₹170,000–₹200,000+

Boutique Investment Banks:

- Examples: Evercore, Lazard, Houlihan Lokey

- Base Salary: ₹90,000–₹100,000

- Bonus: ₹60,000–₹100,000

- Total: ₹150,000–₹190,000

Boutiques often offer slightly higher bonuses to compete with bulge brackets, but fewer structured training programs.

Big 4 Firms (Deloitte, PwC, EY, KPMG):

- Base Salary: ₹65,000–₹85,000

- Bonus: ₹5,000–₹15,000

- Total: ₹70,000–₹100,000

These roles often involve audit, consulting, or transaction services rather than M&A deals.

Corporate Finance or Industry Roles:

- Base Salary: ₹60,000–₹80,000

- Bonus: ₹3,000–₹10,000

- Total: ₹65,000–₹90,000

Regional Salary Differences

Global financial markets show significant differences in investment banking analyst salary based on location. In the United States, cities like New York and San Francisco offer the highest pay due to higher living costs and industry presence. Other metropolitan areas see salaries that are 10% to 25% lower. In Europe, London provides competitive base salaries between ₹5,822,600 and ₹7,486,200, along with strong bonus potential. Cities like Frankfurt, Paris, and Amsterdam have similar pay structures. In Asia, financial centers such as Singapore and Hong Kong offer attractive packages from ₹4,990,800 to ₹8,318,000, often with lower taxes. In India, salaries vary greatly between local and global firms. Entry-level analysts at domestic companies earn ₹6 to ₹15 LPA, while international firms pay ₹20 to ₹40 LPA. In Dubai, the Middle East offers appealing opportunities with tax-free salaries around ₹5,822,600 to ₹7,486,200, often with generous relocation benefits. This highlights the complex and regionally varied landscape of financial analyst salaries.

Comparison with Other Finance Roles

n the competitive field of financial analyst roles, compensation and career paths can vary greatly among different specialties. Investment Banking (IB) analysts earn the highest total compensation, ranging from ₹14,140,600 to ₹16,636,000. However, they work intense schedules of 80 to 100 hours per week and experience fast career advancement.

On the buy-side, analysts also earn attractive salaries, between ₹14,972,400 and ₹20,795,000, with more manageable hours of 60 to 80 per week and good growth opportunities. Corporate finance and equity research professionals take a more balanced approach, with total compensation between ₹5,822,600 and ₹11,645,200 and more sustainable work weeks of 40 to 70 hours. While IB and private equity roles offer higher financial rewards, they require greater personal sacrifice and stress. This forces analysts to make careful career choices that consider their professional goals, pay, and personal health.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Lifestyle and Work Hours

Work Hours:

- Investment Banking: 80–100 hours/week, including weekends

- Big 4: 50–70 hours/week, with seasonal spikes

- Corporate Finance: 40–50 hours/week

- Hedge Funds / Private Equity: 60–80 hours/week

Lifestyle:

- The analyst lifestyle is intense, especially in investment banking and consulting.

- Personal time is often sacrificed for career advancement and compensation.

- Burnout is common due to long hours and high pressure.

- Work-life balance is frequently cited as a major trade-off in these roles.

Pay During Training and Internships

Training

New analysts often undergo 2–8 weeks of training on technical skills, tools, and soft skills. Training is fully paid.

Internships

| Firm Type | Monthly Stipend |

|---|---|

| IB (US) | ₹8,000–₹10,000 |

| Big 4 | ₹3,000–₹5,000 |

| PE / VC | ₹5,000–₹8,000 |

| Indian MNCs | ₹25,000–₹75,000 |

| Global Firms (India) | ₹1L–₹3L/month |

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Exit Opportunities

After 2–3 years as an analyst, professionals often move into:

- Private Equity / Hedge Funds: Most common exit route for investment banking analysts.

- Business School: Top MBA programs actively recruit candidates with analyst experience.

- Corporate Strategy / Development: Strategic roles within Fortune 500 firms.

- Startups: Especially popular in fintech, SaaS, and data analytics spaces.

- Venture Capital: Preferred by those interested in innovation and early-stage investing.

- Consulting: Strategy positions at firms like McKinsey, BCG, Bain.

Some analysts continue within the same firm, transitioning into associate or VP roles.

Real Analyst Salary Breakdowns

Case 1: Investment Banking Analyst – NYC

- Base: ₹5 LPA

- Bonus: ₹3 LPA

- 401(k) Match: ₹50 LPA

- Total Compensation: ₹58 LPA

Case 2: Big 4 Analyst – India

- Base: ₹10 LPA

- Bonus: ₹1.5 LPA

- Benefits: ₹1 LPA

- Total Compensation: ₹12.5 LPA

Case 3: Private Equity Analyst – London

- Base: ₹3 LPA

- Bonus: ₹1 LPA

- Stock Options (Deferred): ₹7 LPA

- Total Compensation: ₹11 LPA

Case 4: Corporate Finance Analyst – Bengaluru

- Base: ₹15 LPA

- Bonus: ₹2 LPA

- Total Compensation: ₹17 LPA

Conclusion

The analyst role serves as an investment banking analyst salary high-paying entry point into the finance industry with excellent long-term career potential. Compensation depends heavily on the firm, region, role type, and individual performance. While some roles offer higher pay and fast-track promotions, they come at the cost of long hours and a demanding lifestyle. Understanding how salary scales with experience, industry, and geography can help aspiring analysts make informed career choices. While the base salary is attractive, it’s often the bonuses, perks, and exit opportunities that make this career path one of the most sought-after in the world of finance.