- Bulge Bracket Banks

- Middle Market Banks

- Boutique Investment Banks

- Regional Banks

- Industry-Specific Banks

- Mergers & Acquisitions (M&A)

- Capital Markets Advisory

- Restructuring and Turnaround Services

- Leveraged Finance

- Conclusion

Bulge Bracket Banks

Investment banking is a multifaceted field with various types of firms and specialized services catering to different market segments and client needs. Understanding the types of investment banking and their roles is essential for anyone looking to enter the industry or work with these institutions. This article delves into the major types of investment banks, their specialties, and how they operate in the financial ecosystem.Bulge Bracket Banks are the largest and most prestigious investment banks in the world, known for offering a full range of financial services on a global scale. These firms typically work with major corporations, governments, and institutional investors, providing services such as mergers and acquisitions (M&A) advisory, equity and debt underwriting, sales and trading, asset management, and research. Bulge Bracket Banks are often involved in high-profile deals and play a central role in global capital markets. Some of the most well-known names in this category include Goldman Sachs, JPMorgan Chase, Morgan Stanley, Bank of America Merrill Lynch, Citigroup, Barclays, Credit Suisse, UBS, and Deutsche Bank. These institutions are known for their rigorous recruitment processes, competitive work environments, and influential role in shaping the global economy. Working at a Bulge Bracket Bank is often seen as a significant milestone in the careers of finance professionals due to the exposure, training, and opportunities these firms provide. However, they are also associated with demanding work hours and high performance expectations. Overall, Bulge Bracket Banks represent the top tier of investment banking and are key players in major financial transactions around the world.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Middle Market Banks

- Size & Focus: Serve mid-sized companies, typically with revenues between $10 million and $1 billion.

- Services Offered: Provide M&A advisory, capital raising (debt/equity), and restructuring services, similar to bulge bracket banks but on a smaller scale.

- Clientele: Focus on regional or sector-specific clients rather than global corporations.

- Deal Size: Usually handle deals valued between $50 million and $500 million.

Examples of Middle Market Banks:

- Houlihan Lokey

- Piper Sandler

- William Blair

- Raymond James

- Lincoln International

- Harris Williams

- Rothschild & Co (in certain markets)

- Geographic Reach: Operate regionally or nationally, though some have an international presence.

- Work Environment: More client-facing roles, faster deal exposure, and often a better work-life balance compared to bulge bracket banks.

- Career Opportunities: Strong learning environment for analysts and associates; more hands-on experience early in the career.

Boutique Investment Banks

Boutique investment banks are smaller, specialized firms that focus on specific areas of types of investment banking, such as mergers and acquisitions (M&A), restructuring, or capital advisory services. Unlike bulge bracket or middle market banks, boutiques typically do not offer a full range of services like sales and trading or large-scale underwriting. They often concentrate on a particular industry or client type and provide highly personalized, relationship-driven advisory services. Boutique banks are known for their deep expertise in niche sectors and for handling smaller deal sizes, although some elite boutiques advise on multi-billion-dollar transactions. Examples of boutique investment banks include Evercore, Lazard, Moelis & Company, and Centerview Partners. These firms tend to have flatter organizational structures, allowing junior employees to gain hands-on experience and exposure to clients earlier in their careers. While they may lack the global reach of larger banks, boutiques often provide a more focused, entrepreneurial work environment. For professionals interested in advisory work without the intense scale and structure of bulge bracket institutions, boutique investment banks offer a compelling and rewarding career path.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Regional Banks

- Geographic Focus: Primarily operate within a specific country, region, or state rather than on a global scale.

- Client Base: Serve small to mid-sized local businesses, municipalities, and regional corporations.

- Services Offered: Provide investment banking services such as M&A advisory, debt/equity issuance, and financial consulting typically at a smaller scale than bulge bracket or middle market banks.

- Deal Size: Handle relatively smaller transactions, often under $100 million.

- Industry Focus: May specialize in industries that are strong within their region (e.g., energy in Texas, tech in California).

- Work Culture: Often offer more work-life balance and localized client relationships compared to larger banks.

- Career Opportunities: Good entry point for finance professionals looking for hands-on experience with clients and deals in a less high-pressure environment.

Industry-Specific Banks

Industry-specific banks are investment banks that specialize in serving clients within particular industries or sectors, such as healthcare, technology, energy, real estate, or telecommunications. These banks leverage deep industry knowledge and expertise to provide tailored financial advisory services, including mergers and acquisitions, capital raising, restructuring, and strategic consulting. By focusing on a niche, industry-specific banks can better understand the unique challenges, regulatory environments, and market dynamics affecting their clients, which allows them to offer highly customized solutions. This specialization often helps build strong, long-term relationships with clients who value sector-focused insights. Examples of industry-specific banks include healthcare-focused firms like Leerink Partners or energy-focused banks such as Tudor, Pickering, Holt & Co. For professionals, working at an industry-specific bank can provide valuable domain expertise and the opportunity to become a trusted advisor in a particular field, making it an attractive career path for those passionate about a specific industry.

Mergers & Acquisitions (M&A)

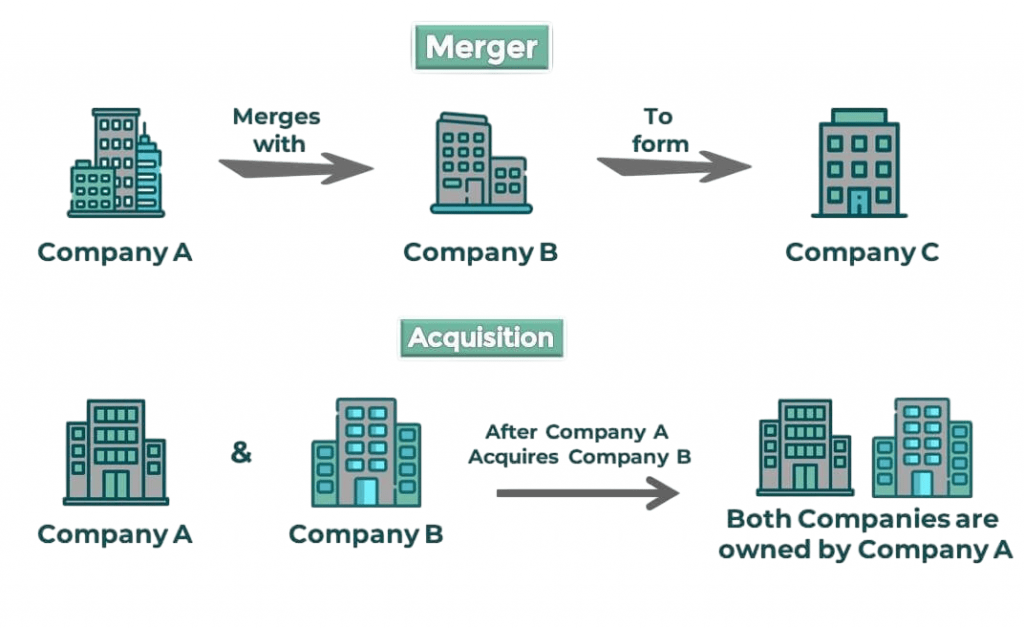

- Definition: M&A involves the consolidation of companies through mergers (combining two companies) or acquisitions (one company purchasing another).

- Purpose: Companies pursue M&A to achieve growth, diversify product lines, enter new markets, increase market share, or gain competitive advantages.

- Horizontal: Between companies in the same industry

- Vertical: Between companies at different stages of the supply chain

- Conglomerate: Between unrelated businesses

- Key Players: Investment bankers, legal advisors, consultants, and corporate executives drive the M&A process.

- Process Steps: Target identification, due diligence, valuation, negotiation, deal structuring, and integration.

- Valuation Techniques: Comparable company analysis, precedent transactions, discounted cash flow (DCF) models.

- Regulatory Considerations: M&A deals often require approval from regulatory bodies to prevent monopolies and protect competition.

- Benefits: Synergies, cost savings, increased revenue potential, and improved market positioning.

- Risks: Integration challenges, cultural clashes, overvaluation, and regulatory hurdles.

Types of M&A:

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Capital Markets Advisory

Capital Markets Advisory refers to the specialized financial services provided by investment banks and advisory firms to help companies raise capital through equity and debt markets. Advisors assist clients in determining the optimal financing structure, timing, and pricing for issuing stocks, bonds, or other securities. This includes guidance on initial public offerings (IPOs), follow-on equity offerings, bond issuances, and private placements. Capital markets advisors conduct market analysis, assess investor demand, and coordinate with underwriters, legal teams, and regulatory bodies to ensure a smooth transaction process. Their expertise helps companies access funding to support growth initiatives, acquisitions, or debt refinancing while managing costs and risks associated with capital raising. Effective capital markets advisory can enhance a company’s credibility with investors and improve its long-term financial flexibility. Overall, this service is critical for businesses seeking strategic financial solutions in dynamic market environments.

Restructuring and Turnaround Services

- Purpose: Help financially distressed companies stabilize operations, improve liquidity, and return to profitability.

Types of Restructuring:

- Financial restructuring (debt renegotiation, refinancing)

- Operational restructuring (cost reduction, process improvement)

- Strategic restructuring (business model changes, asset sales)

- Turnaround Focus: Identifying root causes of decline and implementing corrective actions to reverse negative trends.

- Key Players: Restructuring advisors, consultants, investment bankers, legal experts, and management teams.

- Services Offered: Debt advisory, creditor negotiations, bankruptcy planning, cash flow management, and stakeholder communication.

- Process Steps: Assessment of financial health, development of turnaround plan, stakeholder engagement, and implementation of changes.

- Benefits: Preserves company value, protects jobs, maximizes recovery for creditors, and often avoids bankruptcy.

- Challenges: Managing conflicting stakeholder interests, tight timelines, and uncertainty in outcomes.

- Industries Impacted: Common in sectors facing economic downturns, technological disruption, or competitive pressures.

- Key Players: Restructuring advisors, consultants, investment bankers, legal experts, and management teams.

- Services Offered: Debt advisory, creditor negotiations, bankruptcy planning, cash flow management, and stakeholder communication.

- Process Steps: Assessment of financial health, development of turnaround plan, stakeholder engagement, and implementation of changes.

- Benefits: Preserves company value, protects jobs, maximizes recovery for creditors, and often avoids bankruptcy.

- Challenges: Managing conflicting stakeholder interests, tight timelines, and uncertainty in outcomes.

- Industries Impacted: Common in sectors facing economic downturns, technological disruption, or competitive pressures.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

The types of investment banking industry is diverse, with various types of banks catering to different clients and transaction 7 types. Whether you aspire to work in a global bulge bracket bank,Capital Markets Advisory a specialized boutique, or a regional bank, understanding these categories helps you identify the right fit and career path. Each type of investment banking offers unique challenges and rewards, shaping the careers of professionals who thrive in this dynamic industry.