- Financial Analysis

- Valuation Techniques

- Excel and PowerPoint Proficiency

- Industry Research

- Financial Modeling

- M&A Process Knowledge

- Communication and Presentation Skills

- Negotiation and Deal Structuring

- Networking and Relationship Building

- Time and Stress Management

- Understanding Regulatory Environment

- Conclusion

Financial Analysis

Investment Banking Skills is one of the most challenging and rewarding careers in the finance world. To succeed, professionals must develop a multifaceted skill set that ranges from technical financial abilities to interpersonal and strategic competencies. Below, we explore the critical skills every investment banker should master. Financial analysis is the cornerstone of Investment Banking Skills. It involves evaluating a company’s financial statements, income statement, balance sheet, and cash flow statement to assess its performance and stability. Its a complex field that helps professionals understand a company’s financial health through careful evaluation. By examining key elements such as revenue, costs, profit margins, and important financial ratios, analysts can get a complete view of an organization’s performance. They use tools like Return on Equity (ROE), Debt-to-Equity ratios, and EBITDA margins to compare companies with others in the industry, allowing for precise assessments. By analyzing trends and reviewing historical data, financial experts can forecast future performance, spot potential risks, and discover new opportunities. Due diligence is essential, especially in mergers and acquisitions, where thorough financial analysis verifies data accuracy and uncovers hidden liabilities. Ultimately, mastering these analysis techniques enables financial professionals to offer strategic advice on important business decisions, such as raising capital, acquiring companies, and restructuring, with great confidence and accuracy.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Valuation Techniques

Valuation is an important process that determines the worth of businesses and assets. It plays a key role in making decisions in finance and investment. Several methods help assess value, including Discounted Cash Flow (DCF). This method forecasts future cash flows and discounts them to present value using the cost of capital. Other approaches, like Comparable Company Analysis, use valuation multiples from industry peers. Precedent Transactions look at recent market deals to set benchmarks. Specialized techniques, such as Leveraged Buyout (LBO) Models and Sum-of-the-Parts (SOTP) analysis, offer detailed insights by evaluating financing structures, potential exit strategies, and individual segment valuations. These complex valuation methods require strong analytical skills and careful attention to key assumptions, as small changes can significantly impact financial results and strategic views.

Excel and PowerPoint Proficiency

Excel and PowerPoint are fundamental for analysts in Investment Banking Skills.

- Excel Mastery: Includes modeling, advanced formulas (VLOOKUP, INDEX-MATCH), pivot tables, macros, and VBA programming for fast data analysis and automation

- Financial Model Building: Creation of dynamic, linked models with embedded error checks and sensitivity testing to support presentation narratives

- PowerPoint Expertise: Design of clean, persuasive decks that simplify complex financial insights and strategic arguments

- Presentation Design Skills: Visual fluency in charts, tables, and structured layouts to maximize clarity and client engagement

- Automation & Efficiency: Utilization of templates, shortcuts, and formatting presets to maintain speed and consistency under pressure

Fluency in excel and powerpoint tools ensures precision, speed, and professionalism across all analyst deliverables.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Industry Research

A deep understanding of industry dynamics is essential for contextualizing financial data and projecting future market movements.

- Sector Knowledge: Mastery of industry drivers, competitive forces, regulatory conditions, and long-term growth outlook

- Intelligence Sources: Informed use of Bloomberg, Capital IQ, sector research, trade publications, and real-time news analytics

- Macro and Micro Analysis: Integrated evaluation of macroeconomic indicators and company-level performance metrics

- Market Position Evaluation: Dissection of client strengths, strategic differentiators, and placement within peer landscapes

- Trendspotting: Early identification of technological shifts, evolving regulations, and emerging sector dynamics

Robust research capabilities empower bankers to develop customized strategies and anticipate client needs with precision.

Financial Modeling

Financial modeling is an analytical method that turns complex data and assumptions into useful tools for valuation and decision-making. Professionals use different model types, including 3-statement integrated models, discounted cash flow (DCF), leveraged buyout (LBO), and merger models, to provide clear financial insights. By following best practices like maintaining transparency, simplicity, consistent formatting, and clear documentation, financial experts create strong analytical frameworks. Key techniques such as scenario analysis allow professionals to examine best-case, base-case, and worst-case financial outcomes. Sensitivity testing shows how changes in important variables affect valuation and potential returns. Regular audits help ensure the models are accurate and reliable. In the end, mastering financial modeling enables bankers and financial professionals to offer precise financial advice, negotiate complex deal terms effectively, and make strategic business decisions confidently.

M&A Process Knowledge

Investment bankers play a key role in mergers and acquisitions (M&A). They navigate a complex six-stage process that requires precision and skill. It all begins with deal origination, where they identify and pitch potential opportunities. Next, they conduct thorough due diligence, coordinating in-depth legal, financial, and operational reviews. During deal structuring, bankers negotiate important details like price, terms, and financing arrangements. They work closely with legal teams to draft the final agreements. At the same time, they handle regulatory approvals, making sure to follow antitrust and securities laws. In the final stages, they manage the closing procedures and the plans for integration or divestiture after the deal. By understanding each phase of the transaction, investment bankers effectively manage client expectations and keep the transaction timeline on track. This ultimately provides strategic value and helps achieve successful corporate transformations.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

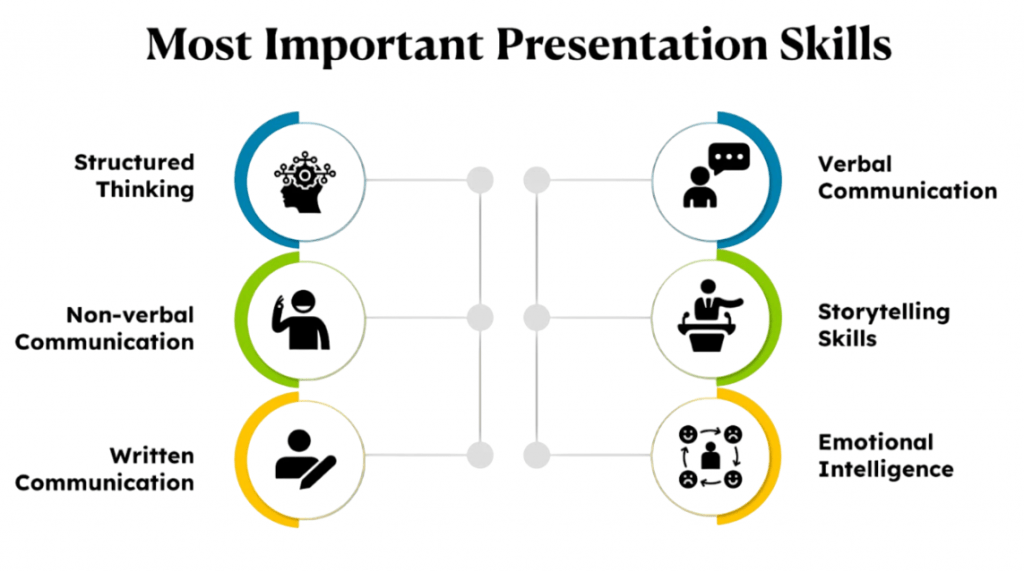

Communication and Presentation Skills

Clear and persuasive communication is a critical soft skill that underpins every aspect of deal execution and client interaction.

- Written Communication: Crafting concise emails, internal memos, and client reports that convey accuracy and professionalism

- Verbal Communication: Articulating complex financial concepts in accessible language for diverse audiences

- Presentation Delivery: Commanding presence and clarity during client pitches, stakeholder briefings, and internal reviews

- Negotiation: Representing client interests effectively while navigating deal dynamics with confidence

- Storytelling: Transforming data into compelling narratives that highlight strategic impact and investment rationale

Strong communication fosters trust, drives alignment, and is instrumental in securing successful outcomes.

Negotiation and Deal Structuring

Negotiation skills empower bankers to unlock optimal value for clients and navigate complex deal environments with precision.

- Understanding Interests: Decoding the motivations of buyers, sellers, and stakeholders to align proposals strategically

- Terms and Conditions: Structuring favorable deal components including price points, warranties, and indemnity protections

- Financial Structuring: Crafting flexible payment frameworks such as cash, stock swaps, and earnout mechanisms

- Conflict Resolution: Mediating valuation gaps and addressing disputes to preserve deal integrity

- Strategic Thinking: Balancing immediate deal metrics with long-term client relationship objectives

Effective negotiation hinges on rigorous preparation, emotional acuity, and adaptability throughout the deal lifecycle.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Networking and Relationship Building

In the fast-paced world of investment banking, success depends on effective networking and building relationships. Professionals in this field understand that forming strong connections is crucial. These connections can range from interactions with high-level executives to engaging with the broader industry. By establishing a solid rapport with CFOs, investors, and other key players, bankers build a foundation of trust and understanding. This strategy goes beyond managing clients directly. It includes collaborating across departments, using alumni networks, and keeping extensive contacts in legal, accounting, and consulting fields. Being active in social events, conferences, and professional gatherings further supports these networking efforts. In the end, these carefully nurtured networks act as vital pathways. They open doors to new business opportunities, potential partnerships, and career-changing chances that can shape long-term success in the competitive investment banking environment.

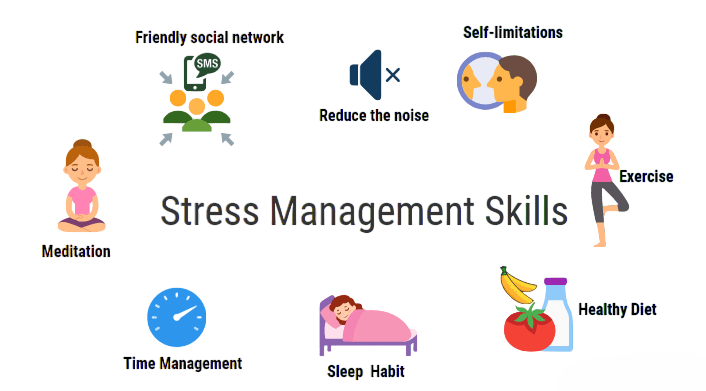

Time and Stress Management

Given the demanding nature of the job, effective time and stress management is essential.

- Prioritization: Navigating multiple deal flows and deadline pressures with structured task planning

- Delegation: Utilizing junior talent and support functions to optimize workload distribution

- Work-Life Balance: Adopting routines and habits that maintain mental, physical, and emotional wellness

- Stress Reduction: Incorporating mindfulness, exercise, and time-blocking techniques to manage pressure proactively

- Crisis Handling: Maintaining composure and decision clarity during high-stakes and time-sensitive deal events

Resilience is a foundational trait that enables long-term success in Investment Banking Skills by mitigating Time and Stress Management.

Understanding Regulatory Environment

Investment banking operates within tightly controlled regulatory environments, demanding rigorous understanding and adherence.

- Securities Laws: Deep familiarity with insider trading rules, disclosure obligations, and ethical safeguards

- Market Regulations: Knowledge of major regulatory bodies like SEBI (India), SEC (US), and FCA (UK), including jurisdictional mandates

- Anti-Money Laundering (AML): Execution of compliance protocols and thorough client due diligence to prevent financial crime

- Data Privacy: Strict adherence to confidentiality policies and data protection standards (e.g., GDPR, IT Act)

- Reporting Requirements: Timely and accurate financial disclosures in line with regulatory expectations and audit standards

Strong regulatory acumen minimizes legal exposure, ensures compliance, and builds institutional trust with clients and stakeholders.

Conclusion

The analyst role serves as an investment banking analyst salary high-paying entry point into the finance industry with excellent long-term career potential. Compensation depends heavily on the firm, region, role type, and individual performance. While some roles offer higher pay and fast-track promotions, they come at the cost of long hours and a demanding lifestyle. Understanding how salary scales with experience, industry, and geography can help aspiring analysts make informed career choices. While the base salary is attractive, it’s often the bonuses, perks, and exit opportunities that make this career path one of the most sought-after in the world of finance.