- Overview of PayPal’s Business

- Data Challenges Faced

- Big Data Infrastructure Used

- Tools and Technologies Implemented

- Fraud Detection Systems

- Customer Behavior Analytics

- Real-Time Decision Making

- Personalization and Recommendation Engines

- Conclusion

Overview of PayPal’s Business

PayPal, founded in 1998, is one of the world’s leading digital payment platforms. With over 400 million active user accounts globally, it facilitates online money transfers, supports e-commerce transactions, and offers financial services to both individuals and businesses. Operating across multiple countries and currencies, PayPal handles billions of transactions each year, generating massive volumes of data. The company’s ability to securely process payments while providing a seamless user experience hinges significantly on how well it Data Science Training utilizes big data analytics. From fraud detection to customer personalization, big data plays a central role in shaping PayPal’s operations and innovation strategies. PayPal is a global financial technology company that enables digital and mobile payments for consumers and businesses. Founded in 1998, it provides a secure platform for online transactions, allowing users to send, receive, and hold funds in multiple currencies. PayPal’s business solutions include payment processing, invoicing, and point-of-sale systems for merchants of all sizes. It supports e-commerce integration, subscription services,What is Data Pipelining and fraud prevention tools. With a presence in over 200 markets, PayPal operates through brands like Venmo, Braintree, and Xoom. The company continues to innovate in digital finance, aiming to make money movement faster, safer, and more accessible worldwide.

Data Challenges Faced

Handling massive volumes of transactions daily, PayPal faces several data-related challenges. To overcome these hurdles, PayPal has invested heavily in big data infrastructure and tools, making data central to their strategy.

- Data Security & Privacy: Ensuring compliance with global regulations (e.g., GDPR, CCPA) while protecting sensitive customer information from breaches.

- Fraud Detection: Continuously evolving fraud tactics require advanced analytics and real-time monitoring to detect and prevent fraudulent transactions What is Splunk Rex .

- Data Integration: Managing and integrating massive volumes of structured and unstructured data from various sources across platforms and subsidiaries.

- Scalability: Handling exponential data growth while maintaining performance and speed in data processing and analytics.

- Real-Time Processing: Need for instant data insights and decision-making, especially for transactions and fraud detection.

- Data Quality & Accuracy: Ensuring consistency, completeness, and reliability of data for analytics and reporting.

- Regulatory Compliance: Adapting to changing financial regulations in multiple jurisdictions, requiring precise data tracking What is Azure Data Lake and reporting.

- Customer Insights: Transforming large datasets into actionable insights to enhance customer experience and personalize services.

Do You Want to Learn More About Data Science? Get Info From Our Data Science Course Training Today!

Big Data Infrastructure Used

PayPal’s big data infrastructure is built to handle real-time processing, storage, and analytics. This hybrid data architecture ensures performance, redundancy, and scalability while maintaining data integrity. Some of the key components include:

- Apache Hadoop: For distributed data storage and batch processing.

- Apache Spark: For fast, in-memory data processing, machine learning, and streaming analytics.

- Kafka: To handle high-throughput real-time data streaming Elasticsearch Nested Mapping .

- Elasticsearch: For fast search and real-time analytics.

- NoSQL Databases (Cassandra, MongoDB): For scalable and flexible data storage.

- Relational Databases: For structured financial and transaction data.

- Data Ingestion: Kafka, Flume, and Logstash.

- Data Processing: Apache Spark, Flink, and Hadoop MapReduce.

- Data Storage: Hadoop HDFS, Amazon S3, and on-premise data lakes.

- Data Analysis: SQL, Python, R, Hive.

- Machine Learning: TensorFlow, H2O.ai, Spark MLlib.

- Visualization: Tableau, Power BI, and internal dashboarding tools.

- Approve or Deny Transactions: Instant risk assessments using machine learning.

- Monitor System Health: Real-time alerts on system performance and errors.

- Dynamic Pricing: Adjust fees or offers based on demand and usage.

- Customer Support: AI chatbots assist users using up-to-date behavioral data.

- User-Centric Experience: Tailor content, offers, and services based on individual user behavior and preferences.

- Data-Driven: Leverage transaction history, browsing patterns, location, Decision Making and device usage to inform recommendations.

- Machine Learning Models: Use algorithms like collaborative filtering and content-based filtering to generate accurate suggestions.

- Real-Time Personalization: Deliver dynamic, context-aware content during user interactions.

- Increased Engagement: Improve user satisfaction and retention through relevant, personalized experiences.

- Cross-Selling & Upselling: Recommend financial products, Apache Pig merchants, or services to increase transaction volume.

- Continuous Learning: Systems evolve and improve over time with more user data and feedback.

- Enhanced User Loyalty: Personal touches foster stronger customer relationships and brand loyalty.

- Business Growth: Supports strategic goals like higher conversion rates, revenue growth, and customer lifetime value.

- Fraud Detection Synergy: Behavioral insights also help detect unusual activities, adding a layer of security.

Would You Like to Know More About Data Science? Sign Up For Our Data Science Course Training Now!

Tools and Technologies Implemented

PayPal employs a suite of tools across various layers of its data analytics framework.By combining these Tools and Technologies,Data Science Training PayPal ensures seamless data flow from ingestion to insights.

Fraud Detection Systems

Fraud Detection Systems play a critical role in protecting financial platforms like PayPal from unauthorized transactions and cyber threats. These systems use a combination of machine learning, artificial intelligence (AI), and rule-based algorithms to monitor and analyze user behavior in real time. By examining transaction patterns, device usage, geolocation, and spending habits, fraud detection systems can flag unusual activities that deviate from a user’s normal behavior. PayPal, for example, leverages advanced predictive models that process vast amounts of transactional data to identify potentially fraudulent actions within milliseconds Apache Hive vs HBase Guide . The system assigns risk scores to each transaction and can automatically trigger alerts, request additional user verification, or block the transaction altogether. Machine learning models improve over time by learning from historical data and adapting to new fraud techniques. These systems must strike a balance between detecting real fraud and minimizing false positives that can negatively impact legitimate users. In addition to AI, human analysts and security teams work alongside automated systems to investigate complex cases and continuously update detection rules. As cyber threats become more sophisticated, fraud detection systems must evolve rapidly to ensure customer trust, regulatory compliance, and the integrity of digital financial services.

Gain Your Master’s Certification in Data Science Training by Enrolling in Our Big Data Analytics Master Program Training Course Now!

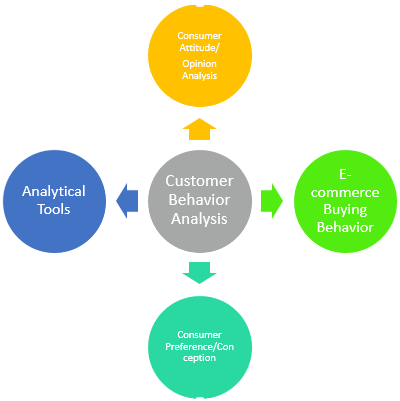

Customer Behavior Analytics

Customer Behavior Analytics refers to the process of collecting, analyzing, and interpreting data on how customers interact with a platform, product, or service. In companies like PayPal, it plays a vital role in enhancing user experience, increasing engagement, and driving business growth. This analytics approach involves tracking user activities such as transaction history, login frequency, device usage, preferred payment methods, Elasticsearch Nested Mapping and time spent on different features. Advanced tools like machine learning and AI help identify patterns, segment users, and predict future behaviors. For instance, PayPal uses customer behavior analytics to personalize offers, recommend financial products, and detect anomalies that could indicate fraud. It also helps in optimizing the user journey by identifying pain points that cause drop-offs or abandonment during payment processes.

By understanding customer needs and preferences, businesses can tailor their services, improve customer retention, and deliver more targeted marketing campaigns. Real-time behavioral data also supports proactive customer support and better risk management. Overall, customer behavior analytics transforms raw data into actionable insights, allowing companies to make data-driven decisions and build deeper, more personalized relationships with their users.

Preparing for Data Science Job? Have a Look at Our Blog on Data Science Interview Questions & Answer To Acte Your Interview!

Real-Time Decision Making

Real-time data is crucial to PayPal’s core services. These capabilities empower PayPal to deliver timely, context-aware services with minimal latency Scala Certification . The company uses streaming analytics to:

Personalization and Recommendation Engines

Conclusion

PayPal’s strategic use of big data analytics is a prime example of how digital platforms can harness data for operational excellence, enhanced security, and customer-centric innovation. By integrating advanced technologies like machine learning, real-time analytics, and cloud computing, PayPal has built a robust ecosystem that not only supports its global financial operations but also continuously evolves to Data Science Training meet changing user expectations. From fraud prevention to customer personalization and infrastructure optimization, every layer of PayPal’s services is infused with data-driven intelligence. Businesses across industries can look to PayPal’s example for inspiration in building scalable, secure, and responsive data strategies. As data continues to grow in volume and importance, mastering big data analytics will be essential to staying competitive in the digital economy.