- Introduction: Real Estate Meets Data Revolution

- Understanding Big Data in Real Estate

- Smarter Property Valuations and Price Predictions

- Hyper-Personalized Marketing and Buyer Targeting

- Optimized Investment and Portfolio Decisions

- Enhancing Urban Planning and Infrastructure Development

- Predictive Maintenance and Smart Property Management

- Risk Assessment and Fraud Detection

- Conclusion

Introduction: Real Estate Meets Data Revolution

Traditionally, real estate has been regarded as a slow-moving industry built on legacy systems, subjective decision-making, and limited visibility into consumer behavior. But in the last decade, things have begun to change dramatically. Big Data is redefining how properties are bought, sold, rented, managed, and developed. From how agents market homes to how developers plan infrastructure, the influence of data is everywhere. With the ability to collect, analyze, and act upon massive volumes of structured and unstructured data, the real estate sector is becoming smarter, Big Data Training more efficient, and more profitable. In this blog, we’ll explore how Big Data is transforming the real estate landscape, enabling innovation and driving intelligent decisions across the board. The real estate industry is undergoing a profound transformation thanks to the data revolution. With the explosion of digital data from property listings, market trends, consumer behavior, and smart devices, real estate professionals now have unprecedented access to insights that can drive smarter decisions. Big data analytics allows investors, agents, and developers to predict market fluctuations, optimize pricing strategies, and identify emerging opportunities faster than ever before. Advanced technologies like machine learning and artificial intelligence analyze vast datasets to uncover patterns that traditional Career in Big Data Analytics methods might miss, improving accuracy in property valuations and risk assessments.

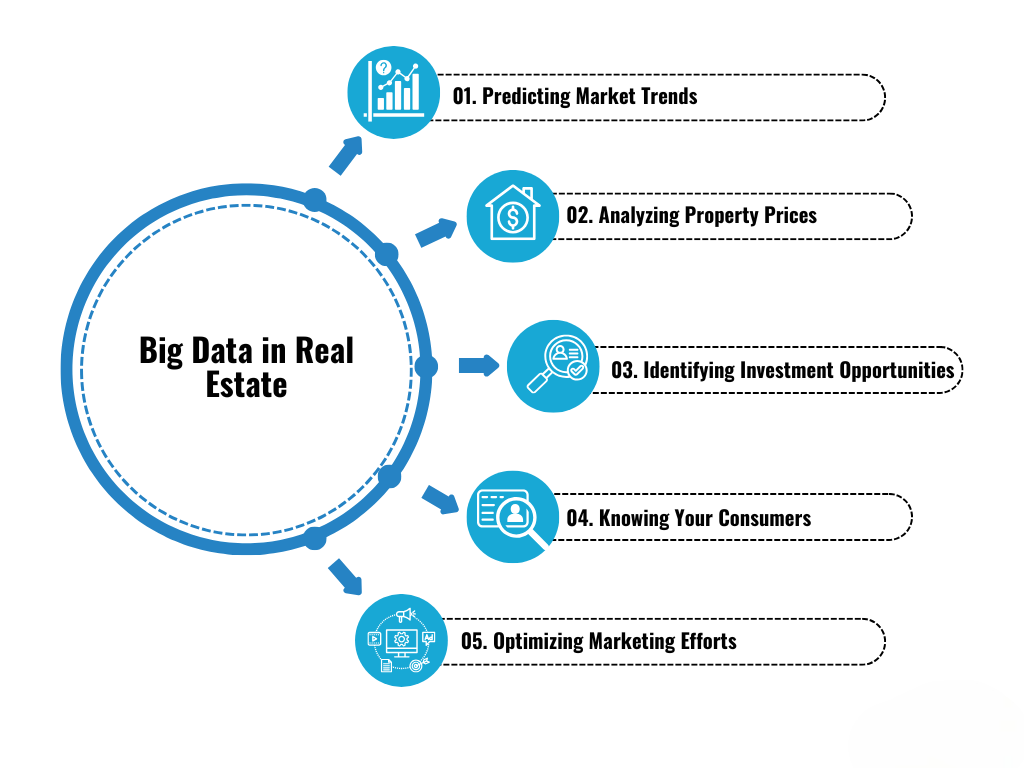

Understanding Big Data in Real Estate

At its core, Big Data in real estate refers to the vast and diverse sets of information gathered from multiple sources public records, GPS data, market trends, property listings, user behavior, social media activity, and IoT-enabled devices. This data, when analyzed using advanced analytics, machine learning, and AI, offers actionable insights that were previously unimaginable. Whether it’s tracking neighborhood desirability, estimating home values, Big Data Analytics or understanding buyer intent, Big Data gives real estate professionals the power to make informed, data-backed decisions instead of relying on hunches or outdated reports.

Big data in real estate refers to the vast amount of information generated from various sources such as property listings, market trends, social media, and IoT devices. Analyzing this data helps stakeholders make informed decisions about pricing, investments, and market forecasts. By leveraging big data analytics, real estate professionals can identify patterns, predict demand, and optimize property management Big Data Career Path . This data-driven approach enhances transparency and efficiency in buying, selling, and leasing properties. As the industry increasingly relies on data insights, understanding big data becomes essential for staying competitive and meeting the evolving needs of buyers and sellers.

Do You Want to Learn More About Big Data Analytics? Get Info From Our Big Data Course Training Today!

Smarter Property Valuations and Price Predictions

- Leverages big data analytics to analyze historical sales, market trends, and economic indicators.

- Uses machine learning algorithms to identify patterns and predict future property values.

- Incorporates various data sources such as neighborhood demographics, school ratings, and crime statistics.

- Enhances accuracy compared to traditional appraisal methods by reducing human bias Data Governance .

- Enables dynamic pricing strategies that adapt to real-time market conditions.

- Assists investors and buyers in making informed decisions with reliable price forecasts.

- Supports risk assessment by forecasting potential market downturns or price fluctuations.

- Improves transparency and trust in the valuation process for all stakeholders.

- Utilizes big data from sensors, satellites, and IoT devices to gather real-time information on traffic, pollution, and population density.

- Analyzes demographic and economic data to forecast urban growth and infrastructure needs.

- Supports data-driven decision-making for zoning, transportation, and public services planning.

- Helps optimize resource allocation and improve sustainability efforts in cities.

- Enables simulation and modeling of urban development Data-Driven Culture scenarios to predict outcomes and impacts.

- Facilitates smart city initiatives by integrating data across multiple sectors for coordinated planning.

- Improves disaster preparedness and emergency response through predictive analytics.

- Enhances citizen engagement by providing transparent data and feedback mechanisms for urban projects.

Would You Like to Know More About Big Data? Sign Up For Our Big Data Analytics Course Training Now!

Hyper-Personalized Marketing and Buyer Targeting

Big Data allows real estate marketers and agents to move beyond blanket promotions and embrace targeted, personalized marketing strategies. By analyzing online behavior, search preferences, demographics, and past inquiries, marketers can tailor campaigns that resonate deeply with specific buyer personas. In today’s competitive real estate market, hyper-personalized marketing has become a game-changer for reaching potential buyers effectively. By leveraging big data and advanced analytics, real estate professionals can create tailored marketing campaigns that address individual preferences, Data Integration , behaviors, and needs. Data collected from online searches, social media activity, past purchases, and demographic information enables agents to segment audiences with precision. This allows for delivering customized property recommendations, targeted ads, and personalized communication that resonate more deeply with buyers. Moreover, machine learning algorithms continuously refine targeting strategies by analyzing engagement patterns and feedback, ensuring higher conversion rates. Hyper-personalized marketing not only improves customer experience by offering relevant options but also increases efficiency by focusing resources on qualified leads. As a result, real estate firms gain a competitive advantage by attracting motivated buyers, shortening sales cycles, and maximizing return on investment in their marketing efforts.

Optimized Investment and Portfolio Decisions

Real estate investors, especially institutional players like REITs and private equity firms are leveraging Big Data to identify investment opportunities, manage risks, and optimize returns across their portfolios. Big data analytics has revolutionized investment strategies and portfolio management in the real estate sector. By analyzing vast amounts of data from market trends and property performance to economic indicators and demographic shifts investors can make more informed and strategic decisions. Advanced predictive models assess potential risks and returns,Big Data Training helping to identify high-value opportunities and avoid pitfalls. Real-time data enables dynamic portfolio adjustments based on changing market conditions, ensuring optimal asset allocation. Furthermore, data-driven insights support diversification strategies, balancing risk across various property types and locations. This analytical approach reduces reliance on intuition and guesswork, increasing accuracy and confidence in investment choices. Ultimately, leveraging big data empowers investors and portfolio managers to maximize returns, minimize risks, Revolutionizing Real Estate and build resilient real estate portfolios that adapt to evolving market demands and economic cycles.

Gain Your Master’s Certification in Big Data Analytics Training by Enrolling in Our Big Data Analytics Master Program Training Course Now!

Enhancing Urban Planning and Infrastructure Development

Preparing for Big Data Analytics Job? Have a Look at Our Blog on Big Data Analytics Interview Questions & Answer To Ace Your Interview!

Predictive Maintenance and Smart Property Management

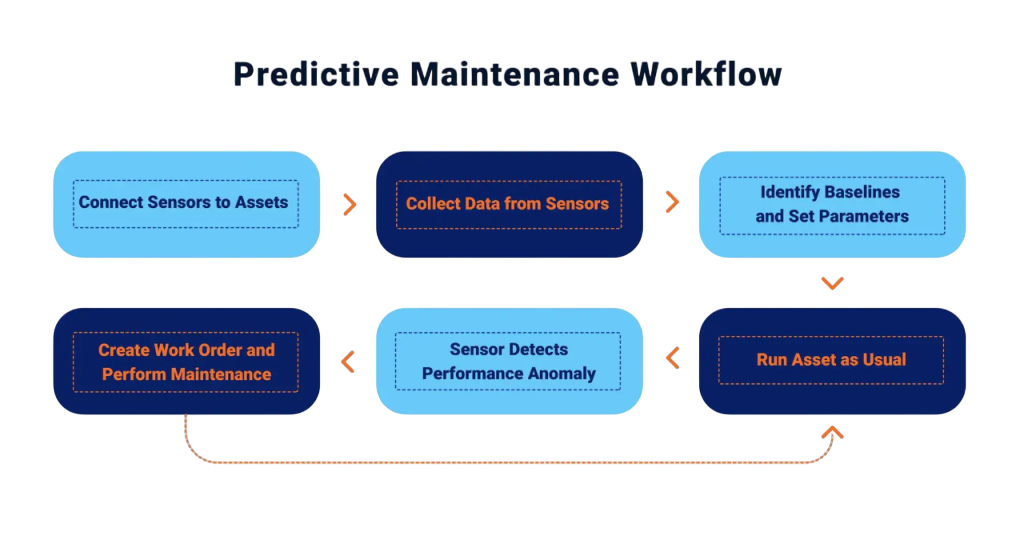

Predictive maintenance powered by big data and IoT technology is transforming property management by enabling proactive care and reducing operational costs. Sensors embedded in building systems continuously monitor equipment health, energy consumption, and environmental conditions. This real-time data is analyzed using predictive algorithms to identify potential failures before they occur, Big Data Analysis allowing maintenance teams to address issues early and avoid costly breakdowns.

Smart property management also leverages data analytics to optimize energy use, enhance security, and improve tenant comfort through automated systems and personalized services. By shifting from reactive to predictive maintenance, property managers can extend the lifespan of assets, reduce downtime, and increase overall efficiency. This data-driven approach not only lowers expenses but also improves tenant satisfaction and property value, making it an essential strategy for modern real estate management in today’s technology-driven market.

Risk Assessment and Fraud Detection

Big data analytics plays a crucial role in enhancing risk assessment and fraud detection within the real estate industry. By analyzing vast datasets including transaction histories, ownership records, financial backgrounds, and market trends professionals can identify irregularities and potential risks early on. Advanced machine learning algorithms detect patterns and anomalies that may indicate fraudulent activities such as identity theft, property flipping schemes, or falsified documentation. Additionally, predictive analytics help assess creditworthiness and market volatility, enabling lenders and investors to make informed decisions Big Data Career Path . Real-time monitoring and automated alerts further strengthen security measures, reducing the chances of financial loss and legal complications. Integrating data from multiple sources increases transparency and trust across transactions, safeguarding both buyers and sellers. As fraud schemes become more sophisticated, leveraging big data for risk management is essential to protect the integrity and stability of real estate markets.

Conclusion

From smarter pricing and hyper-targeted marketing to urban planning and predictive maintenance, Big Data is rewriting the rules of real estate. The sector is no longer driven solely by intuition or past trends; it’s powered by live data, intelligent algorithms, and predictive foresight Big Data Training. For real estate professionals, developers, investors, and even end-users, embracing Big Data is no longer optional; it’s a strategic necessity. Those who adapt will find themselves at the forefront of an industry that is becoming faster, smarter, and more consumer-centric than ever before.