- Introduction to BFSI Sector

- Risk Management and Fraud Detection

- Customer Segmentation and Personalization

- Credit Scoring and Loan Underwriting

- Regulatory Compliance

- Operational Efficiency

- Predictive Forecasting

- Customer Experience Enhancement

- Data Monetization Opportunities

- Conclusion

Introduction to BFSI Sector

The BFSI Sector is Banking, Financial Services, and Insurance (BFSI) sector plays a pivotal role in global economic development. As the world becomes increasingly digitized, the BFSI industry is generating massive volumes of data from every transaction, interaction, and operation. With the rise of fintech innovations, mobile banking, and online payments, institutions are recognizing that data is more than just a byproduct it is a strategic asset. Data Analytics Training enables professionals to capitalize on this asset leveraging machine learning, AI, and predictive models to accelerate decision-making, mitigate risks, and deliver hyper-personalized financial services. In this context, let’s explore eight core reasons why the BFSI sector is aggressively investing in data analytics.

Risk Management and Fraud Detection

Managing risk has always been at the heart of financial institutions, and data analytics significantly enhances this capability. With complex financial instruments and cross-border transactions, institutions need robust systems to assess and mitigate risks proactively. Advanced analytics enables banks and insurers to identify abnormal patterns, detect early signs of market volatility, and flag suspicious activities in real time. What is Apache Zookeeper became increasingly relevant offering a centralized service for maintaining configuration information, naming, synchronization, and group services critical to fraud detection workflows and distributed financial systems. Machine learning algorithms can analyze thousands of transactions per second, identifying anomalies based on location, amount, frequency, and user behavior.

Interested in Obtaining Your Data Analyst Certificate? View The Data Analytics Online Training Offered By ACTE Right Now!

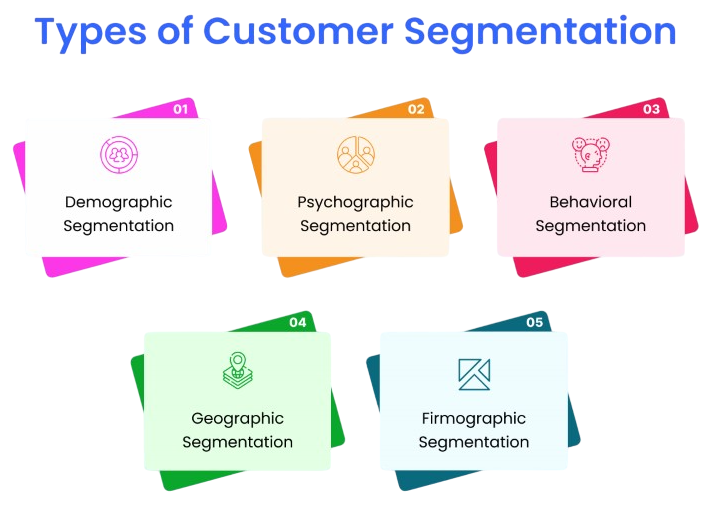

Customer Segmentation and Personalization

- No two customers are alike, and modern BFSI institutions understand this. Data analytics allows for hyper-segmentation of customers based on behavior, transaction history, demographics, and digital interactions. This information helps banks and insurers offer tailored products and services, improving both customer satisfaction and profitability.

- For example, analytics can identify a group of young professionals who are more likely to be interested in investment products or loans for new businesses. By targeting this segment with personalized offers and communication, institutions increase conversion rates and build long-term relationships. Personalization also extends to service delivery chatbots, mobile apps, and customer support systems can adapt in real time based on customer profiles.

To Explore Data Analyst in Depth, Check Out Our Comprehensive Data Analytics Online Training To Gain Insights From Our Experts!

Credit Scoring and Loan Underwriting

Traditional credit scoring models rely on a narrow set of financial indicators, often missing out on other valuable data points. With data analytics, BFSI companies can enhance credit scoring models by incorporating alternative data such as mobile usage, social behavior, utility payments, and even online activity. This holistic view of a borrower’s profile helps in more accurate and fair loan underwriting, especially for people with limited or no credit history (commonly referred to as “thin-file” customers). Who Is a Data Architect becomes a central question in this context highlighting the role of professionals who design and manage the data infrastructure that powers such advanced analytics and ensures data integrity, accessibility, and security across financial systems.

Regulatory Compliance

BFSI firms operate in one of the most heavily regulated environments. Compliance with regulations such as KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR (General Data Protection Regulation), and others is non-negotiable. Failure to comply can result in heavy fines and reputational damage. Data analytics helps organizations automate and streamline compliance processes. It enables real-time tracking of transactions, identification of suspicious activities, and generation of comprehensive audit trails. Data Analytics Training equips professionals to build these capabilities combining regulatory knowledge with analytical tools to ensure transparency, accuracy, and proactive risk mitigation. Natural Language Processing (NLP) is used to analyze unstructured data in legal documents, contracts, and regulatory updates. Analytics dashboards provide compliance officers with clear visibility into risk exposure, compliance gaps, and reporting timelines, thereby ensuring proactive adherence to global and local regulations.

Gain Your Master’s Certification in Data Analyst Training by Enrolling in Our Data Analyst Master Program Training Course Now!

Operational Efficiency

- One of the primary goals of digital transformation in BFSI is to optimize internal operations. Data analytics plays a central role in identifying bottlenecks, automating manual processes, and reducing operational costs. By analyzing process data from across departments such as loan processing, claims management, customer service, and IT support, institutions can streamline workflows and improve turnaround time.

- Kafka vs RabbitMQ comparisons often arise when designing such data pipelineshighlighting differences in throughput, durability, and message delivery guarantees that influence how predictive analytics systems forecast demand and schedule resources effectively. Robotic Process Automation (RPA) combined with data insights automates repetitive tasks like data entry, report generation, and compliance checks.

Are You Preparing for Data Analyst Jobs? Check Out ACTE’s Data Analyst Interview Questions and Answers to Boost Your Preparation!

Predictive Analytics

- Forecasting has moved beyond spreadsheets and historical trends. With predictive analytics, BFSI firms can now anticipate market changes, customer behavior, and financial outcomes with greater accuracy. By leveraging historical data, machine learning algorithms, and real-time inputs, banks can predict loan defaults, insurance claims, interest rate trends, and investment opportunities.

- For instance, insurers can predict which policyholders are more likely to file claims based on driving behavior or lifestyle data. Banks can forecast liquidity needs based on customer withdrawal patterns or seasonal trends. Predictive models are also being used for demand forecasting in investment products, allowing firms to optimize portfolios and maximize returns.

Customer Experience Enhancement

Big Data is revolutionizing how SMEs approach marketing and sales. With access to customer data and market trends, SMEs can design targeted marketing campaigns that resonate with specific audience segments. Real-time data enables dynamic pricing strategies and personalized product recommendations. Social media analytics provide insights into customer sentiment and brand perception. Sales teams can use predictive analytics to identify promising leads and tailor pitches accordingly. What is Apache Hadoop YARN becomes especially relevant in this context offering a resource management layer that coordinates data processing tasks across distributed systems, ensuring scalability and responsiveness for real-time analytics. By analyzing campaign performance metrics, SMEs can continuously refine their marketing strategies to maximize ROI. Big Data ensures that every marketing dollar is spent effectively.

Data Monetization Opportunities

- Data is not just a tool, it’s a revenue-generating asset. Many BFSI institutions are exploring data monetization strategies, either by developing data-driven products or by offering insights as a service. Internal analytics platforms can be used to create new services, such as credit risk advisory, investment scoring, or personalized financial planning tools. How to install Apache Spark on Windows became a foundational step enabling teams to set up scalable data processing environments locally, test models efficiently, and accelerate the deployment of analytics-driven financial solutions.

- Some financial institutions also collaborate with fintechs or third-party developers through open banking APIs, enabling secure data sharing in exchange for value-added services.

- For example, anonymized transaction data can help retailers understand buying behavior, or insurers can offer discounts to health-conscious customers based on fitness tracker data. The ethical and compliant use of data in such monetization efforts is crucial, but when done responsibly, it opens up new revenue streams while enhancing customer offerings.

Conclusion

The BFSI sector has always been data-intensive, but with the advent of advanced analytics, its approach to data has fundamentally shifted. No longer passive repositories of information, banks and insurers are now active users of data leveraging it to reduce risks, personalize services, meet regulations, and drive innovation. The integration of data analytics is not just a competitive advantage but a strategic necessity. From fraud detection and risk management to customer experience and digital innovation, data analytics is transforming the core of how BFSI firms operate. Data Analytics Training equips professionals in the BFSI sector to lead this transformation building expertise in predictive modeling, anomaly detection, and customer intelligence to drive secure, data-driven growth. As technologies continue to evolve and data becomes more voluminous and diverse, the ability to extract timely, actionable insights will define the success of institutions in the BFSI space. Investing in data analytics is not just a trend, it’s the foundation for the next generation of financial services.