- Cyber Insurance: What Is It?

- Types of Cybersecurity insurance policies

- The Significance of cyber insurance

- Who Requires Insurance Against Cybersecurity?

- Procedure for Cybersecurity Insurance Policies

- Hazards Covered and Not Covered by Cyber Insurance Policies

- Conclusion

The ever-progressing digital world creates a range of cyber risks to organizations, no matter their size while having devastating financial and operational consequences along with reputation damage. Cybersecurity has emerged as a critical tool in risk management in this regard, protecting businesses’ finances against the occurrence of cyber incidents. This paper attempts to discuss the very basics of cyber insurance, Cyber Media , meaning purpose, types, coverage, benefits, challenges, and even some future trends.

To become a certified cyber security, have a look at our Cyber Security Online Training right now.

Cyber Insurance: What Is It?

Cyber liability insurance shields people and companies against the monetary risks and losses resulting from cyber crime-related incidents. To put it simply, it’s similar to holding a digital life cyber insurance policy. As customers, we use the Internet extensively for a variety of purposes, including banking, communication, and shopping. This benefit, meanwhile, also makes us vulnerable to the dangers offered by hackers who try to take advantage of weaknesses in our digital systems, such as malware, DoS attacks, etc.

Cybersecurity Training Courses acts as a safety net, providing financial support for recovery efforts after a cyber incident, including costs related to data security insurance breaches, legal fees, and even business interruption losses. By transferring some of the financial risks associated with cyber threats to an cyber liability insurance provider, individuals, and businesses can better manage the potential fallout from an attack. Additionally, many cyber insurance policies come with risk management resources and guidance to help policyholders strengthen their cybersecurity posture before an incident occurs. This proactive approach not only helps mitigate risks but also fosters a more resilient digital environment for everyone involved.

Types of Cybersecurity Insurance Policies

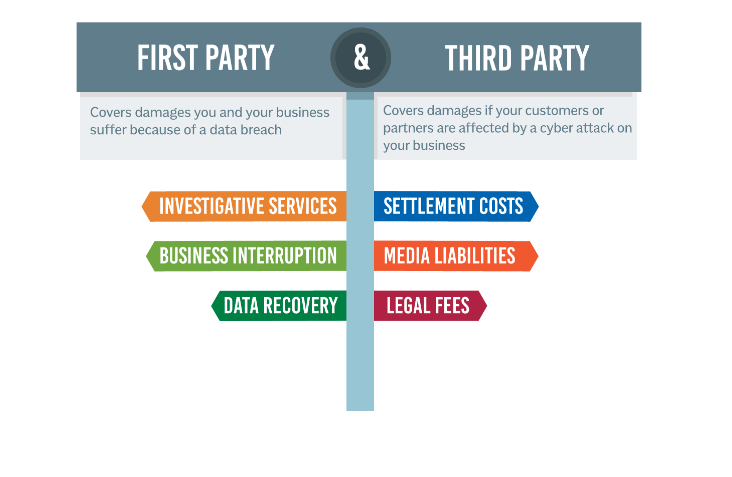

First-Party Coverage- First-party coverage protects the interest of the policyholder in case of an incident relating to cyber liability coverage.

- Those related to an investigation into the breach, notification parties, and credit monitoring services.

- Losses resulting from downtime caused by a cyber risk event, including lost revenue and operating expenses.

- Costs involved in recovering lost or destroyed data and systems.

To become a certified cyber security, have a look at our Cyber Security Online Training right now.

Third-Party Liability- Third-party cyber liability insurance protects the insured against third-party claims arising as a consequence of a cyber event.

- Cost of litigation over allegations of data breaches or other cyber events.

- Payout to aggrieved parties for injuries suffered as a result of a violation of the law or regulation, including fines imposed under regulatory laws.

- Expenses incurred in managing public relations and repairing a company’s reputation after the breach.

The Significance of Cyber Insurance

- Protecting Your Money: Cyber risk may have detrimental financial effects. Costs associated with data breaches, hacks, and even inadvertent data security insurance loss can be high. Cybersecurity offers financial security by paying for costs associated with looking into the event, alerting parties, restoring systems, and even making up for missed wages in a Web Application Security

- Legal Repercussions: Should there be a cyber incident, legal repercussions can happen right away. If you fail to protect your clients’ or customers’ data, you can be held liable, which could result in costly lawsuits. These expenses, which may include settlements, awards, and legal defence, can be partially covered by cybersecurity insurance.

- Reaction to Events and Recuperation: Resolving a cyber problem calls for prompt and efficient action. Accessibility to a network of specialists is frequently offered by cyber insurance. Public relations experts, lawyers, and cyber security experts are some of these specialties

- Standards for Compliance: Resolving a cyber problem calls for prompt and efficient action. Accessibility to a network security of specialists is frequently offered by cyber insurance. Public relations experts, lawyers, and cyber security experts are some of these specialties

- Standards for Compliance: There are particular industry-specific regulations about cyber security and data security insurance protection. Penalties or fines may be imposed for breaking these rules. cyber crime can assist in defraying the costs of adhering to these compliance standards, guaranteeing that you maintain legal compliance while protecting confidential data.

Who Requires Insurance Against Cyber Security?

- Companies of All Dimensions: Whether you manage a giant corporation, a small startup, or a midsized business, cybersecurity insurance is crucial. cyber risk can affect businesses of all sizes, and the resulting financial losses can be substantial. Businesses can be shielded from ransomware attacks,network security failures, data handling expenses, and other cyber crime catastrophes by purchasing cybersecurity

- Healthcare Establishments: Sensitive patient data is handled by the healthcare sector in large quantities. For healthcare providers such as hospitals, clinics, and medical offices, cyber security insurance is especially important. In the event of adata security insurance, it offers financial protection, preserving patient privacy and lowering the possibility of legal trouble and reputational harm.

- Financial Institutions: Cyber crime frequently target banks, credit unions, cyber liability insurance firms, and other financial institutions. This is because they have access to important client data in Web Security . Financial organisations can reduce the risks of fraud and other cyber threats that could affect their business activities and reputation by getting cyber security.

- Online Retailers: Cyber risk are a major risk for organisations and online shops that handle transactions via the Internet. Cybersecurity protects online retailers against credit card fraud, supply chain interruptions, and website outages.

- Educational Institutions: Because they hold a lot of information about their students and faculty, educational institutions are prime targets for cyber crime . Cybersecurity assists academic institutions in defraying the costs of attacks by ransomware and other cyber threats that have the potential to impair operations and threaten the privacy of staff and students.

- Individuals: Although Cybersecurity Training Courses is mainly related to corporations, it is becoming more and more important for individuals as well. It can offer protection against internet fraud, identity theft, and unlawful use of one’s financial data

Transform Your Career with Cyber Security Knowledge Enroll in ACTE’s Cyber Security Expert Masters Program Training Course Today!

Procedure for Cybersecurity Insurance Policies

Step 1: Determining Your Risk Assessing the digital assets, online activity, and potential vulnerabilities of your business is the first step. This aids the insurance company in figuring out the cyber liability coverage you require and your unique risk profile. Step 2: Tailoring ProtectionThe insurance company will collaborate with you to design a policy that is tailored to your requirements based on the assessment. They will take into account things like your company’s size, the sector you work in, and the kinds of Cyber insurance you might encounter.

Step 3: Talking about PoliciesThe terms and conditions of the cyber insurance policy, including what is and is not covered, will be explained by the insurance provider. Making sure you comprehend the policy in its entirety, along with any exclusions from society, deductibles, and limits, is a crucial step in this process in Network Topology .

Step 4: Payment and PremiumThe insurance company will determine the amount of the premium after you both agree on the level of protection and terms. The price you shell out for the protection provided by insurance is known as the premium. Depending on your agreement, the payment may be done annually or in instalments.

Step 5: Putting Cybersecurity Measures Into PracticeA common requirement from insurance companies is that you take specific cybersecurity precautions before they would insure you. Regular software upgrades, data encryption, staff training, and network security measures are a few examples of these precautions. This lessens the possibility of cyberattacks and related legal issues.

Step 6: Handling IncidentsIn the event of a malware attack or other cyber incident, you should tell your insurance provider right away. They will assist you in taking the necessary actions to prevent more harm, safeguard compromised systems and data security insurance , and adhere to any applicable legal obligations as they lead you through the incident response process.

Step 7: Settlement of ClaimsYou have the option to claim with your insurance company if a covered cyber incident causes you to suffer financial losses. Evidence and documentation of the incident and the resulting damages must be provided. After reviewing the claim, the insurance company will pay out according to the cyber insurance policy conditions if it is authorised.

Hazards Covered and Not Covered by Cyber Insurance Policies

- Cyber Extortion: cyber liability coverage may protect in cases where hackers try to extract money by claiming to leak private information or interfere with regular business activities

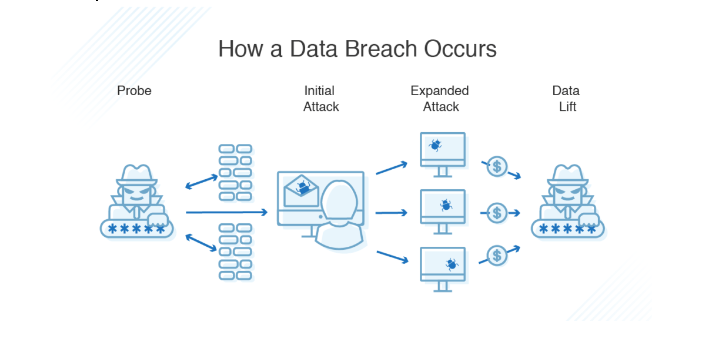

- Breach of Data: One of the most frequent dangers covered by cybersecurity is a data breach. It entails illegal access to private Database Security, including customer information and personal documents.

- Known Vulnerabilities: Losses arising from known vulnerabilities that are not fixed or patched are not covered by cybersecurity. To make sure cyber liability coverage is legitimate, it’s critical to keep up a strong cybersecurity posture and take swift action to fix any vulnerabilities that are discovered.

- War and Terrorism: Losses resulting from acts of terrorism or war are typically not covered by cybersecurity insurance coverage. Most of the time, these risks are not covered.

Preparing for Cyber Security job interviews? Check out our Cyber Security Interview Questions and Answers now!

Conclusion

Cybersecurity Training is, therefore, a very relevant aspect for organisations in an increasingly complex digital world. In light of the changing nature and increasing severity of cyber threats, a strongcyber insurance policy may be one of the most critical financial safeguards against expensive breach-of-data-related costs or ransomware incidents. network security does extend beyond the protection of mere finances however, it encourages them to take proactive steps toward cybersecurity measures. This can only be achieved through developing a culture of resilience and awareness. Nevertheless, in the case of coming towards cybersecurity insurance, organizations must do this with caution, ensuring they understand the details of their cyber liability coverage and what might potentially be their limitation.