- Organizations invest huge sums of money on new projects. It is important for organizations to ensure that these investments are safe and will result in good returns and benefits for the organizations.

- Hence there is a need for analyse all new project opportunities to justify the decisions for making the needed monetary investments. An organization may be having multiple project opportunities to invest on and reap the benefits. But they cannot invest on all projects, they have to be selective.

- The process of analysing the new project opportunities to decide which ones will be worthwhile taking up so that the organization gets the most benefits is known as project selection methods.

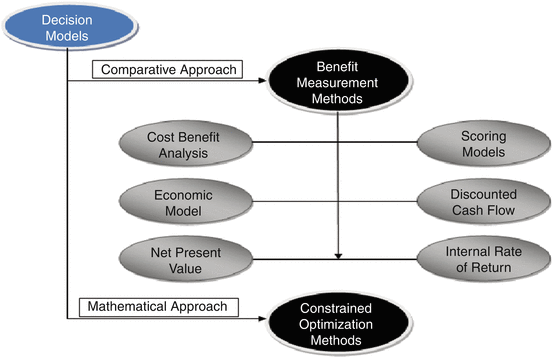

There are two major categories of project selection methods as below:

Quantitative Methods

- Benefits Measurement Methods

- Constrained Optimization Methods

Qualitative Methods

Benefits Measurement MethodsBenefits measurement methods mostly use a comparative approach by studying the possible benefits from different projects and then selecting the most beneficial ones.

Some of the most important methods under this category include the following:

- Cost Benefit Analysis – Benefits from the project should be more than the cost invested in the project for any project to be considered for selection. A ratio of benefits to cost (BCR) should be more than 1. Higher the BCR, better the opportunity.

- Payback Period – Payback period is the time in which the total investment of a project is recovered. After the payback, the organization truly will start making profits. Payback time of a project should ideally be lower. Lower the payback period, the project looks that much more attractive.

- Net Present Value – Net present value is the difference between the sum of present value of all revenue and the sum of present value of all the investment. The NPV must be more than zero for the project to be profitable. Higher the NPV, better is the choice. NPV is the most practical criteria which discount all future values of revenue and investments to their corresponding present values to calculate profit.

- Internal Rate of Return (IRR) – IRR is the maximum expected return on money from a given project. Higher the IRR, better the opportunity. IRR is the rate of interest at which the NPV becomes equal to zero.

- Scoring Model – Scoring models are used to study different project options against certain parameters by assigning scores to them for each parameter. The project option with the highest score will be the preferred one.

- Economic Value Added – EVA is to see if the project is profitable after deducting all cost of capital. Because then only there is economic value added in the project.

- Opportunity cost – Opportunity cost concept is used to study what we lose by selecting something. This can be used when we have to give up some benefits while we will be selecting some other benefits. If we have 2 projects A and B. Opportunity of selecting A is what we will be losing by not selecting B.

- These methods are mathematical models of project selection which are used for larger projects that require complex and comprehensive calculations and simulations to study the feasibility of projects by understanding the uncertainties involved clearly.

- Some of the important constrained optimization methods include the following:

- Linear programming

- Nonlinear programming

- Integer programming

- Dynamic programming

- Multiple objective programming

Qualitative Methods

Many times project selection is done based on non-financial considerations. These may include political reasons, personal biases, safety and security considerations, investor and customer requests etc.