- Introduction to Artificial Intelligence in Banking

- Role of AI in Financial Services

- AI-Powered Fraud Detection in Banking

- Credit Scoring and Risk Assessment with AI

- AI-Based Automated Loan Processing

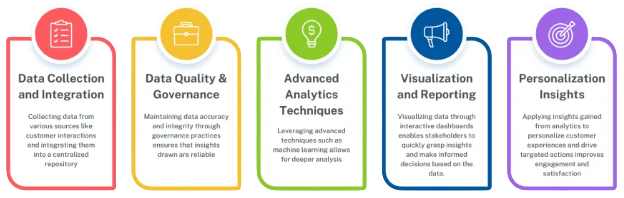

- Predictive Analytics for Customer Insights

- Regulatory and Ethical Challenges in AI Banking

- Future of AI in the Banking Industry

Introduction to Artificial Intelligence in Banking

Artificial Intelligence (AI) is transforming the banking industry by automating processes, enhancing customer experiences, and improving security measures. AI enables banks to analyze vast amounts of data, detect fraud, personalize customer interactions, and streamline operations. With advancements in machine learning and natural language processing, AI is revolutionizing financial services, making banking more efficient and secure. AI is no longer just a futuristic concept; Data Science Course Training is actively reshaping how financial institutions operate, making them more data-driven and customer-centric. The evolution of AI in banking has been gradual, starting from rule-based automation to advanced machine learning algorithms capable of deep learning and self-improvement. Today, banks leverage AI to automate back-office operations, enhance decision-making, and provide seamless digital experiences. AI helps reduce costs, eliminate errors, and enhance regulatory compliance, ensuring financial stability and growth.

Role of AI in Financial Services

AI plays a crucial role in modern financial services, including risk management, customer service, fraud detection, and regulatory compliance. AI-powered solutions help banks reduce operational costs, improve decision-making, and enhance customer satisfaction. By leveraging AI, financial institutions can provide personalized recommendations, automate routine tasks, and offer seamless digital banking experiences. Financial institutions are also using AI for Top AI Newsletters data analytics, allowing them to make better strategic decisions. AI-powered predictive modeling enables banks to anticipate customer needs and offer tailored financial products. This results in higher engagement, better customer retention, and increased profitability. Furthermore, AI helps in portfolio management by identifying investment opportunities based on historical trends and real-time market data.

Learn the fundamentals of Data Science with this Data Science Online Course .

AI-Powered Fraud Detection in Banking

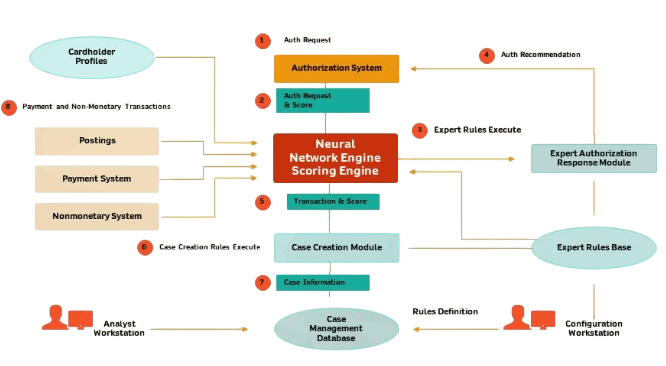

- Fraud detection is a critical area where AI significantly enhances security. Traditional fraud detection methods often fail to identify sophisticated cyber threats. AI-driven systems use machine learning algorithms to analyze transaction patterns, detect anomalies, and flag suspicious activities in real-time. AI-powered fraud detection minimizes false positives and enables banks to take proactive measures against financial crimes.

- Banks are deploying AI-driven fraud prevention tools that utilize real-time data analysis to detect irregularities. AI systems can analyze thousands of transactions within seconds, identifying patterns that might indicate fraudulent activity.

- These AI solutions can prevent identity theft, account takeovers, and fraudulent transactions, ensuring the security of both Chatgpt vs Googlebard and financial institutions.AI-powered chatbots and virtual assistants improve customer service by providing instant responses to inquiries.

- These intelligent systems handle account queries, fund transfers, and transaction details, reducing the need for human intervention. AI chatbots, such as those implemented by banks like HDFC and ICICI, offer 24/7 customer support, helping clients manage their finances efficiently.

- Additionally, AI-powered voice assistants like Google Assistant and Siri are being integrated into banking applications, allowing customers to conduct transactions using voice commands. These advancements improve accessibility, especially for differently-abled individuals, and provide seamless banking experiences.

- AI-driven personal finance management tools help individuals track expenses, set budgets, and manage savings. AI-powered apps like Cleo and Mint analyze financial habits and provide insights on spending patterns. These intelligent financial assistants help users make informed financial ecosystem decisions, automate savings, and plan for future expenses effectively.

- Moreover, AI-based financial planning tools offer predictive insights into future expenses, allowing users to set realistic financial goals. These tools help individuals optimize their financial health and ensure better long-term financial stability.

- Predictive analytics powered by AI enables banks to understand customer behaviors and preferences. AI models analyze transaction histories, spending habits, and engagement patterns to offer personalized financial products and services.

- Banks leverage AI insights to anticipate customer needs, enhance marketing strategies, and improve overall customer satisfaction. By analyzing historical transaction data, Artificial Intelligence in What is Anova can predict which customers are likely to default on loans, enabling banks to take proactive measures to prevent financial losses.

- Predictive analytics also helps banks design better loyalty programs and promotions tailored to individual customers.Algorithmic trading, also known as high-frequency trading (HFT), relies on AI to execute large-scale transactions at optimal prices.

- AI-driven trading algorithms analyze market trends, news sentiment, and historical data to make data-driven investment decisions. Investment banks use AI to optimize portfolio management, predict market movements, and minimize financial ecosystem risks.

- AI-powered robo-advisors, such as Betterment and Wealthfront, provide automated investment recommendations to retail investors, making investment banking more accessible to the general public. These AI Banking Artificial Intelligence in Business use complex algorithms to provide personalized investment strategies based on risk tolerance and financial goals.

- AI enhances cybersecurity by detecting and preventing cyber threats in real-time. AI-driven security systems monitor network activities, identify unusual behaviors, and mitigate potential breaches. Banks use AI-powered authentication methods, such as biometric verification and behavioral analytics, to enhance security and protect sensitive customer data from cyberattacks.

- With cyber threats evolving constantly, AI-driven security solutions ensure banks remain one step ahead of hackers by continuously updating security protocols and identifying new vulnerabilities before they are exploited.

Dive into Data Science by enrolling in this Data Science Online Course today.

Credit Scoring and Risk Assessment with AI

AI enhances credit scoring and risk assessment by analyzing vast datasets beyond traditional credit history. Machine learning models assess applicants’ financial behaviors, employment history, spending patterns, and social media activity to determine creditworthiness. This AI Banking approach provides fairer, more accurate lending decisions and helps financial institutions mitigate default risks. AI-based credit assessment models reduce bias and increase financial inclusion by evaluating non-traditional data sources, such as Data Science Course Training bill payments and mobile phone usage, to assess an applicant’s creditworthiness. This is particularly beneficial for individuals with limited credit history but strong financial ecosystem responsibility.

AI-Based Automated Loan Processing

AI streamlines loan processing by automating application evaluation, documentation, and approval workflows. Traditional loan processing involves manual verification, which is time-consuming and prone to errors. AI Banking systems analyze applicant data, assess risk factors, and expedite decision-making, allowing banks to approve loans faster while ensuring compliance with regulatory requirements. Moreover, AI-powered chatbots assist applicants throughout the loan process, providing guidance on eligibility criteria, required documentation, and loan options. This enhances customer experience and speeds up loan disbursal.Additionally, AI models can predict an applicant’s creditworthiness more accurately by analyzing non-traditional data sources such as transaction history, social behavior, and Artificial Intelligence in Healthcare footprints. This enables banks to extend credit to underserved populations who may lack formal credit histories. AI also helps in fraud detection by identifying anomalies in loan applications, reducing the risk of defaults. Integration with OCR (Optical Character Recognition) technologies allows automated extraction of data from documents, minimizing manual entry errors. Real-time monitoring of loan accounts using AI ensures early identification of repayment issues. Overall, AI significantly boosts efficiency, accuracy, and inclusiveness in the loan processing lifecycle.

Take charge of your Data Science career by enrolling in ACTE’s Data Science Master Program Training Course today!

Predictive Analytics for Customer Insights

Want to ace your Data Science interview? Read our blog on Data Science Interview Questions and Answers now!

Regulatory and Ethical Challenges in AI Banking

While AI offers numerous benefits, it also presents regulatory and ethical challenges. Data privacy, algorithmic biases, and lack of transparency in AI decision-making are key concerns. Regulators are implementing guidelines to ensure AI-driven Banking Industry solutions comply with data protection laws and ethical Top Data Science Colleges in India . Banks must balance AI adoption with responsible AI practices to maintain customer trust and regulatory compliance. Additionally, ethical concerns regarding job displacement due to AI automation remain a significant issue. Banks must focus on reskilling employees and creating new job roles that complement AI-driven solutions rather than replace human expertise.

Future of AI in the Banking Industry

The future of Artificial Intelligence in Banking will be driven by continued advancements in machine learning, blockchain integration, and quantum computing. AI will further automate complex financial processes, improve fraud detection capabilities, and offer hyper-personalized banking experiences. As AI adoption increases, banks must focus on ethical AI implementation, customer-centric innovations, and regulatory compliance to maximize AI’s potential while ensuring trust and Data Science Course Training . With the rise of open banking and API-driven financial services, AI will enable seamless integration between banks and third-party financial service providers, further enhancing customer experiences and creating a more interconnected financial ecosystem.