- Why ought we use Data Science in finance?

- Application of data science in the finance industry

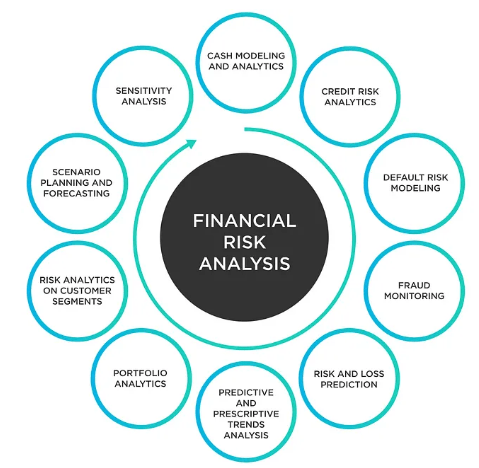

- Risk Analytics

- Financial Fraud Detection

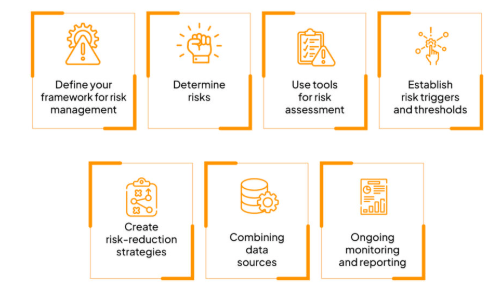

- Automation of Risk Management

- Personalized Services

- Credit Allocation

- Conclusion

Data science is transforming the finance industry by enabling smarter, faster, and more accurate decision-making. Through advanced analytics, machine learning, and big data technologies, financial institutions can detect fraud, assess risk, automate trading, and personalize financial products and Data Science Course Training . By leveraging massive volumes of structured and unstructured data, organizations can gain deeper insights into customer behavior, market trends, and operational efficiency. As the financial landscape becomes increasingly data-driven, data science continues to play a crucial role in shaping the future of finance.

Why ought we use Data Science in finance?

With the boom in digitization and online transactions, the dangers of online fraud have accelerated rapidly. This is because of patron records leakage, as online transactions probably have system faults. As patron records are a valuable, useful resource in this virtual era, we want to guard them from fraudsters. Data Mining and Data Warehousing is in which Machine Learning and Data Management in finance assist, stopping clients in addition to agencies from economic losses. Let us apprehend the use of data science techniques in finance with the assistance of a use case.

- Let us assume that a patron has an account at Citibank. The financial institution collects patron records comprising transactions, loans, debits, credits, online shopping, and more. The software program utilized by the financial institution maintains the music of each hobby of the patron’s account.

- After amassing the records, it analyzes the transaction history, transaction amounts, transaction frequency, and many different factors. Also, the safety software program utilized by the financial institution explains the time and vicinity of the transactions through data science techniques. The Data Management in Organizations a transaction if any uncommon hobby is located along with transactions crafted from one-of-a-kind places anxiously.

- Moreover, the financial institution evaluates its ability to clients through their account balances. If a large amount is credited or debited from an account, the gadget marks the transaction as suspicious and tests its validation. Further, based on patron records analysis, the financial institution provides clients with loans, offers, and other advantages. This facilitates making cordial family members with capable clients and additionally complements its sales generation.

- All that is simplest feasible with the involvement of data science techniques in the finance industry. Now, we can undergo several Data Science programs in the finance industry.

Become a Data Science expert by enrolling in this Data Science Online Course today.

Application of Data Science in the Finance Industry

Data science allows for things such as handling dangers, catching fraud, using ML algorithms to trade, and optimizing portfolios. By using unique strategies like device mastering and studying massive quantities of statistics. This results in higher predictions and more excellent money-making opportunities. It additionally saves money and time by automating repetitive tasks. Overall, statistics technology is converting finance for the higher and supporting companies to make smarter decisions. Let’s check the main Data Management programs inside the Classification in Data Mining. Customer Data Management As mentioned, statistics is one of the primary sources of information in the enterprise area. Nowadays, most agencies make use of patron statistics to beautify their productivity. The statistics of clients allow monetary establishments to maintain music in their transactions. In advance days, agencies saved statistics on the usage of conventional methods. However, the upward thrust of numerous technologies has given a brand new path to the finance enterprise. Nowadays, the technology utilized by the finance enterprise are Big Data equipment, Data Science, Artificial Intelligence, and Machine Learning. With the assistance of this technology, statistics control has emerged as much less complicated than in the past. data science techniques monetary establishments is used to control and save their clients` statistics efficiently. The statistics saved through those establishments may be dependent or unstructured. However, the equipment of Data Science can process, store, and segment can process, store, and segment all varieties of statistics. The saved statistics may be processed to prepare the monetary reviews of those agencies.

Advance your Data Science career by joining this Data Science Online Course now.

Risk Analytics

For any company, there are dangers of security, competitors, monetary loss, dropping clients, or enterprise failure because of a few reasons. Especially for financial establishments, like banks and coverage companies, chance analytics becomes a critical enterprise approach. Risk analytics allows for the growth of unique enterprise techniques that preserve the performance of the enterprise. Also, it will enable growing trustworthiness within the marketplace and amongst clients. Nowadays, the approaches for AI Tools for Coding use Data Science and Machine Learning. Data Science in finance analyzes marketplace tendencies and patron statistics. Then, it attempts to locate capacity threats with the assistance of Machine Learning equipment. The software program for chance analytics allows you to use techniques to save you from enterprise failure. Moreover, through studying the dangers, agencies can anticipate the ups and downs of an enterprise because of numerous worldwide marketplace activities.

Financial Fraud Detection

In the virtual era, there’s a speedy growth in online transactions. Along with this comes numerous unethical sports all over. For instance, there are instances of fake coverage claims that have brought about super losses inside the monetary sector. To address such vital problems, monetary establishments have begun deploying diverse technology. One of these technologies is Data Management. The equipment of Data Science Course Training is incorporated with the enterprise software program to hold songs of client transactions and their beyond records. With the assistance of Data Science in finance, monetary establishments’ safety structures have become extraordinarily secure and productive. Also, there’s a lower Credit Allocation card fraud compared to the financial records of the ultimate five years. ML algorithms of the software program are designed in this manner, and the software program attempts to research from beyond records. Then, it uses its mastering to expect the dangers that could arise inside within the future. By this, Data Science facilitates monetary agencies from degrading.

Automation of Risk Management

- Every enterprise entails some risks that could smash its profits. Virtual technology has provided a number of superior technologies that could save any enterprise from useless losses.

- One of the superior technologies utilized by most monetary companies is automation. Data science and machine learning make the automation of duties and enterprise methods feasible.

- In the finance industry, they may be used to Master Prompt Engineering for Better AI Results danger control. Risk control is an essential enterprise pastime that enables studying faults in an enterprise.

- To save you the flaws and inconsistencies inside the enterprise, the software program for safety structures analyzes records and attempts to come across uncommon styles of data science usage. Also, with the assistance of Machine Learning algorithms, the software program learns and improves itself for the higher prevention of faults inside the destiny.

- In the case of a monetary firm, if any danger is considered in a monetary pastime, then the software program notifies and blocks the pastime for safety reasons.

- With the help of Data Science software in finance, the automation of risk control has become a whole lot greener, and this has led companies to notable development in enterprise control and growth.

Ready to excel in Data Science? Enroll in ACTE’s Data Science Master Program Training Course and begin your journey today!

Personalized Services

Personalized offerings are a key function in today’s enterprise world. The involvement of the latest technology in client offerings has made it feasible to reinforce the general increase of any enterprise organization. To Build and Annotate an NLP Corpus Easily offerings use Data Science and Machine Learning to construct programs that offer a customized experience to customers. This has proved to be decisive for monetary establishments as well.

Let’s not forget the operation of a financial institution. With the assistance of Data Science, the financial institution software analyzes customers` records, including:

- Personalized Services

- Frequent transactions

- Shopping records

- Debits/credits

- Repaying of loans

- Bank balance

There may be additional hidden elements for comparing client records. With the assistance of this evaluation, the software provides a credit score rating for every client. Based on the credit score rating, the financial institution identifies its profit-producing customers. Then, it provides offers, discounts, loans, and regulations that may be useful for those customers. Also, client offerings have stepped forward with Machine Learning and AI-based totally chatbots. Mosmoste monetary enterprise’s regions, including rage agencies, mortgage providers, buying and selling agencies, banks, etc., use chatbots to offer first-rate client service. Nowadays, those corporations have additionally begun using speech popularity generation to enhance interactivity with customers. All those finance programs, such as Artificial Intelligence and Data Science, are supporting groups that generate excessive profits.

Are you getting ready for your Data Science interview? Check out our blog on Data Science Interview Questions and Answers!

Credit Allocation

Machine learning (ML) performs an essential function in credit allocation by providing banks and monetary establishments with effective equipment to make more correct and green lending decisions. ML algorithms can examine substantial quantities of records, together with credit history, income, employment status, and other applicable factors, to evaluate the creditworthiness of borrowers. ML fashions can discover styles and correlations in the records, allowing creditors to make predictions about the chance of compensation and default. These fashions may be educated on ancient records to examine from beyond mortgage consequences and broaden predictive capabilities. By leveraging ML, creditors can Agents in Artificial Intelligence and streamline the credit score allocation process. This permits quicker decision-making, decreased human bias, and improved risk assessment. ML algorithms can also adapt and replace their models in real-time, incorporating new records and adjusting lending techniques accordingly. Overall, ML in credit score allocation enables monetary establishments to make more knowledgeable and objective lending decisions, which leads to improved mortgage approval rates, decreased defaults, and more advantageous profitability.

Conclusion

In 2025, records technology will revolutionize the finance industry, using innovation, efficiency, and danger control. Financial establishments more and more leverage system learning, AI, and extensive records Risk Analytics to decorate decision-making, fraud detection, client insights, and algorithmic trading. Advanced predictive fashions assist in credit score scoring, portfolio optimization, and real-time danger assessment, ensuring extra-correct and records-pushed techniques. Additionally, combining blockchain and monetary records analytics strengthens Data Science Course Training and regulatory compliance. Despite demanding situations, which include worries about records privacy and evolving regulations, records technology remains a critical pressure shaping the destiny of finance, making operations smarter, extra secure, and client-centric. As the era advances, the function of records technology in Credit Allocation will continue to grow, unlocking new possibilities and reworking conventional monetary services.