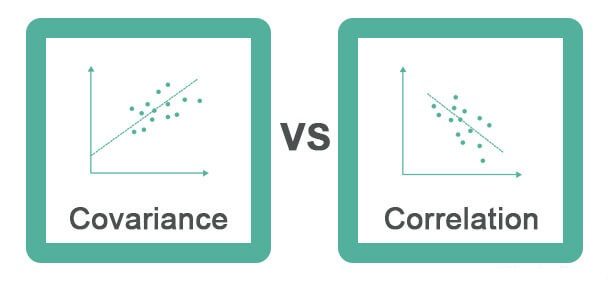

Covariance indicates the direction of the linear relationship between variables while correlation measures both the strength and direction of the linear relationship between two variables.

- What is Covariance?

- What is the Correlation?

- The formulation for variance and Correlation

- Difference Between Covariance and Correlation

- Correlation vs variance

- How is square measure variance and correlation relevant to statistics analytics?

- Key Differences

- Conclusion

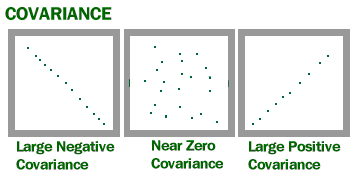

- Covariance measures however the two variables flow into. It will take any fee from -∞ to +∞.

- The better this fee, the larger established the association is. A fine large choice indicates fine variance and denotes that there is an immediate entreaty. Effectively which implies associate degree growth in a very single variable may to boot cause a corresponding growth withinside {the totally different|the various} variable well-appointed different things keep steady.

- On the choice hand, a poor large choice indicates poor variance, that denotes associate degree inverse entreaty among the two variables. tho’ variance is right for outlining the type of entreaty, it’s miles horrific for deciphering its magnitude.

What is Covariance?

What is the Correlation?

Correlation could be a step prior to of variance as a result of it quantifies the association among random variables. In simple phrases, it’s miles a unit degree of the manner those variables trade with appreciate to each totally different (normalized variance fee).

Unlike variance, the correlation has associate degree higher and reduce cap on a spread. It will simplest take values among +1 and -1. A correlation of +1 shows that random variables have an immediate and sturdy entreaty.

On the choice hand, the correlation of -1 shows that there is a sturdy inverse entreaty, associate degreed associate degree growth in a very single variable can cause an same and contrary lower withinside the various variable. zero manner that the two numbers square measure freelance.

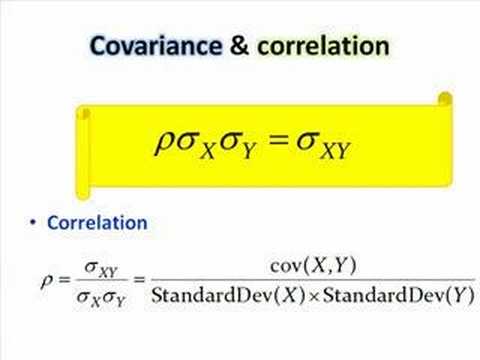

The formulation for Covariance and Correlation :-

Let’s specific those standards, mathematically. For random variables A and B with implying values as Ua and Ub and well-liked deviation as reserves and Sb respectively:

Effectively the association among the two could also be represented as:

Both correlations and variance find software system in fields of applied mathematics and financial analysis. Since correlation standardizes the association, it’s miles helpful in analysis of any variables. This assist analyst in developing with techniques like try exchange and hedging. for currently now not simplest inexperienced returns at the portfolio but to boot safeguarding those returns in phrases of unfavorable moves withinside the inventory market.

Difference Between Covariance and Correlation :-

Covariance and Correlation square measure phrases which might be exactly contrary to each totally different, they every square measure used in facts and regression analysis, variance indicates America however the two variables vary from each totally different whereas correlation indicates America the association among the two variables and also the manner square measure they associated.

Correlation and variance square measure applied mathematics standards which might be wont to decide the association among random variables. Correlation defines however a exchange one variable can impact the choice, when variance defines however gadgets vary along. Confusing? Let’s dive in equally to apprehend the excellence among those intently associated phrases.

Correlation vs Covariance :-

Let’s see the head distinction among Correlation vs variance.

As outlined antecedently, variance illustrates the credential to that variables vary with appreciate to each totally different, when correlation determines the energy and course of this entreaty. variance and correlation square measure interlinked with each totally different. In simple phrases, correlation refers back to the scaled model of variance. this way that correlation could be a distinctive case of variance which can be finished while the statistics is in standardized kind.

The key variations among variance and correlation could also be summarized as follows:

What do they degree? variance measures whether or not or not a version in a very single variable consequences in a very version in the other variable; for instance, looking at whether or not or not associate degree growth {in a|during a|in associate degree exceedingly|in a very} single variable consequences in an growth, lower, or no trade withinside the various variable. Correlation measures the course additionally to the energy of the association among variables (i.e. however powerfully those variables square measure related to each different).

Relationship constraints: variance offers with the linear entreaty of simplest variables withinside the dataset, whereas correlation will contain or some of variables or statistics units and their linear relationships.

Value variety: though every coefficient of correlation and variance square measure measures of linear association, correlation coefficients square measure standardized, consequently showing associate degree absolute fee within a certain selection from -1 to one. On the choice hand, variance values are not standardized associate degreed use an indefinite selection from -∞ to +∞ , that makes the interpretation of variance a bit difficult.

Measurement units: Correlation is dimensionless, i.e. it’s miles a unit-unfastened degree of the association among variables. In distinction, variance is in units, that’s designed via manner of suggests that of multiplying the unit of one variable via manner of suggests that of the unit of the other variable.

Change in scale: variance is full of the exchange scale, i.e. if all of the values of one variable square measure improved via manner of suggests that of a gradual and every one of the values of the other variable square measure improved via manner of suggests that of a comparable or one-of-a-kind steady, then the variance is modified. Conversely, correlation isn’t full of the exchange scale.

- Comparing samples from or larger one-of-a-kind populations. this can be useful because it facilitates in reading not unusualplace developments and designs in one-of-a-kind samples.

- In statistics-pushed industries, variance and correlation assist in working out variable statistics as how to technique statistics and expeditiously perform analytical operations.

- Correlation could be a key technique for investigation members of the family among variables sooner than imposing applied mathematics modeling.

- PCA (primary issue evaluation) is applied the use of covariance and correlation so that it will reduce dimensions of big datasets to beautify interpretability. Data scientists use PCA to perform predictive evaluation and exploratory statistics evaluation.

- Analytical methods along with multivariate evaluation and function choice are performed via way of means of using covariance and correlation methods.

How is square measure variance and correlation relevant to statistics analytics?

Statistics work the muse of the many statistics analysis techniques and techniques. Some not unusualplace use instances of variance and correlation withinside the topic of statistics analytics include:

Key Differences :-

1. Covariance is a hallmark of the diploma to which random variables extrude with admiration to every other. Correlation, on the alternative hand, measures the electricity of this relationship. The price of correlation is sure at the higher via way of means of +1 and at the decrease facet via way of means of -1. Thus, it’s miles a precise variety. However, the variety of covariance is indefinite. It can take any superb price or any terrible price (theoretically, the variety is -∞ to +∞).

2. You can relax confident that a correlation of .five is more than .3, and the primary set of numbers (with correlation as .five) are extra depending on every apart from the second one set (with correlation as .3). Interpreting this kind of end result might be difficult from covariance calculations.

3. Change of scale impacts covariance. For example, if the price of variables is extended via way of means of comparable or extraordinary constants, then this impacts the calculated covariance of those numbers. However, making use of the equal mechanism for correlation, multiplication via way of means of constants does now no longer extrade the preceding end result. This is due to the fact a extrade of scale does now no longer have an effect on correlation.

4. Unlike covariance, correlation is a unit-loose degree of the inter-dependency of variables. This makes it smooth for calculated correlation values to be in comparison throughout any variables no matter their devices and dimensions.

Conclusion :-

Correlation and covariance are very intently associated with every other, and but they fluctuate a lot. Covariance defines the kind of interaction, however correlation defines now no longer best the sort however additionally the electricity of this relationship. Due to this reason, correlation is frequently termed because the unique case of covariance. However, if one ought to pick out among the , maximum analysts select correlation because it stays unaffected via way of means of the modifications in dimensions, locations, and scale. Also, considering that it’s miles constrained to a variety of -1 to +1, it’s miles beneficial to attract comparisons among variables throughout domains. However, an crucial drawback is that each those ideas degree the best linear relationship.